Question: 16abc a) In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad characterization (inaccurate) of

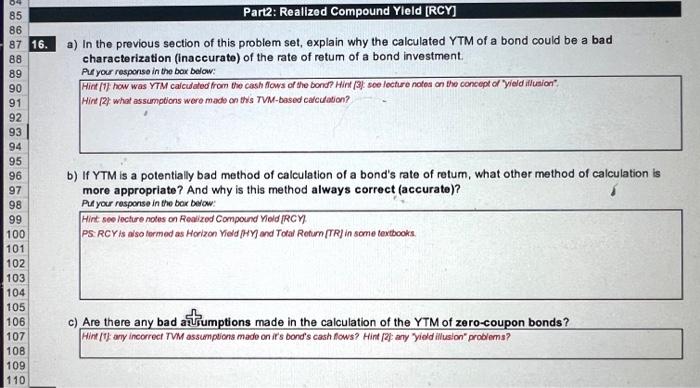

a) In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad characterization (inaccurate) of the rate of retum of a bond investment. Al your responso in the box below: Hirt [2} what assumptions wero made on th's TVM-based calcuation? b) If YTM is a potentially bad method of calculation of a bond's rate of retum, what other method of calculation is more appropriate? And why is this method always correct (accurate)? Puf you response in the bor berow: Hint see lecture notes on Realized Compound Viold [RCY PS: RCY is also tormed as Horizon Vidd [HY and Total Retum [TR] in some tercbooks. c) Are there any bad azsumptions made in the calculation of the YTM of zero-coupon bonds? Hint (T) ary incorrect TVM assumptions mado on if's bond's cash flows? Hirt [2] any "yidd illusion" problems? a) In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad characterization (inaccurate) of the rate of retum of a bond investment. Al your responso in the box below: Hirt [2} what assumptions wero made on th's TVM-based calcuation? b) If YTM is a potentially bad method of calculation of a bond's rate of retum, what other method of calculation is more appropriate? And why is this method always correct (accurate)? Puf you response in the bor berow: Hint see lecture notes on Realized Compound Viold [RCY PS: RCY is also tormed as Horizon Vidd [HY and Total Retum [TR] in some tercbooks. c) Are there any bad azsumptions made in the calculation of the YTM of zero-coupon bonds? Hint (T) ary incorrect TVM assumptions mado on if's bond's cash flows? Hirt [2] any "yidd illusion" problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts