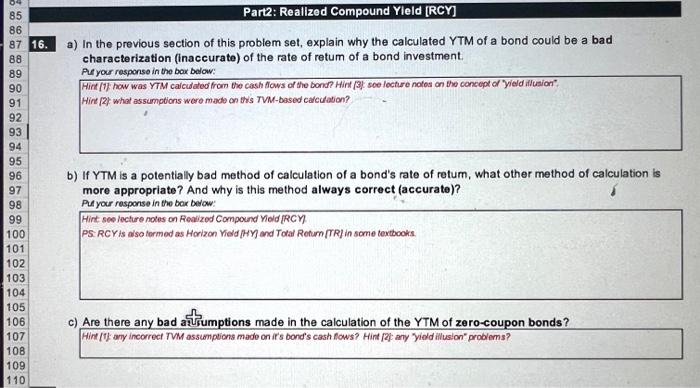

Question: In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad characterization (inaccurate) of the rate

In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad characterization (inaccurate) of the rate of return of a bond investment.

16 a,b,c please

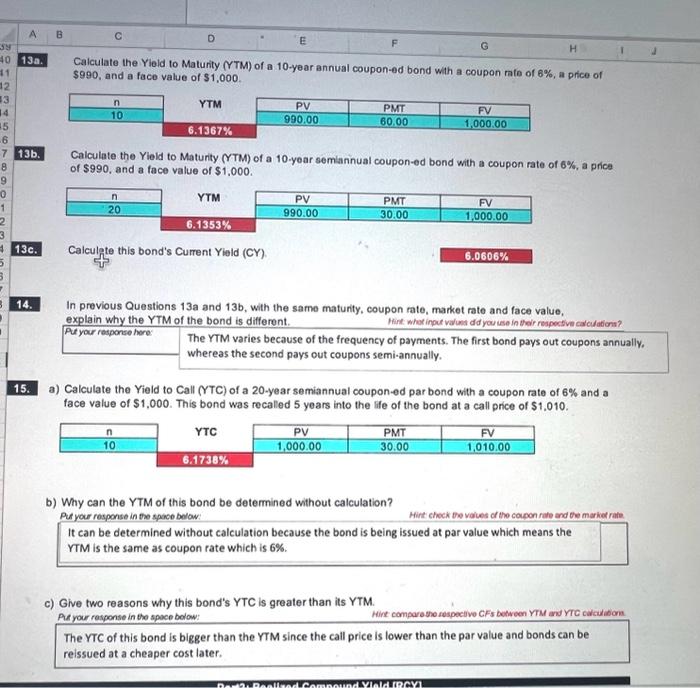

Calculate the Yield to Maturity (YTM) of a 10 -year annual coupon-ed bond with a coupon rate of 6%, a price of $990, and a face value of $1,000. Calculate the Yield to Maturity (YTM) of a 10 -year semannual coupon-ed bond with a coupon rate of 6%, a price of $990, and a face value of $1,000. Caiculate this bond's Current Yieid (CY). In previous Questions 13a and 13b, with the same maturity, coupon rate, market rate and face value, explain why the YTM of the bond is different. Hint whet inpur valuns dd you ise in their respocive calculations? whereas the second pays out coupons semi-annually. a) Calculate the Yield to Call (YTC) of a 20-year semiannual coupon-ed par bond with a coupon rate of 6% and a face value of $1,000. This bond was recalled 5 years into the life of the bond at a call price of $1,010. D) Why can the YTM of this bond be determined without calculation? Pur your rosponse in the spaco below: It can be determined without calculation because the bond is being issued at par value which means the VTM is the same as coupon rate which is 6%. Give two reasons why this bond's YTC is greater than its YTM. Aur your response in the space bolow: Hint compara the respoctive CFs between YTM and YTC cuculation The YTC of this bond is bigger than the YTM since the call price is lower than the par value and bonds can be reissued at a cheaper cost later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts