Question: 17. Tyson, Inc. issued a 20-year bond which is callable in 13 years. It has a coupon rate of 8.25% payable semiannually and has

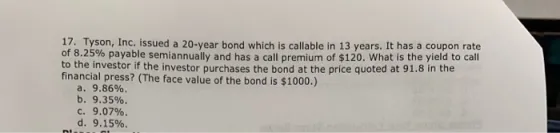

17. Tyson, Inc. issued a 20-year bond which is callable in 13 years. It has a coupon rate of 8.25% payable semiannually and has a call premium of $120. What is the yield to call to the investor if the investor purchases the bond at the price quoted at 91.8 in the financial press? (The face value of the bond is $1000.) a. 9.86%. b. 9.35%. c. 9.07%. d. 9.15%. ni.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To calculate the yield to call YTC we need to find the rate of return an investor would earn if they ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock