Question: 1.analysis Return on assets (ROA ratiosReturn on equity (ROE) ratios Earnings per share (EPS)Market-to-book ratios for 2019 and 2020 2.Compare overall performance of the firm

1.analysis Return on assets (ROA ratiosReturn on equity (ROE) ratios Earnings per share (EPS)Market-to-book ratios for 2019 and 2020

2.Compare overall performance of the firm between 2019 and 2020.

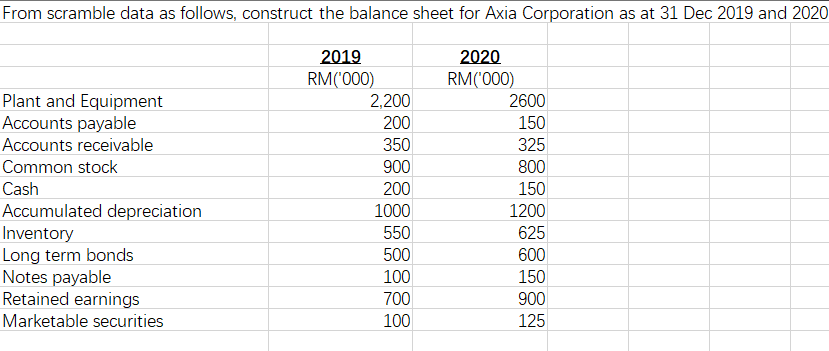

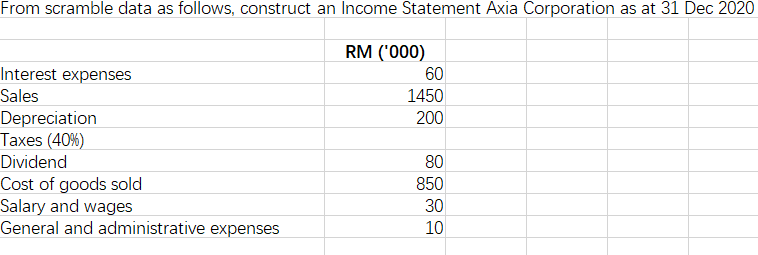

From scramble data as follows, construct the balance sheet for Axia Corporation as at 31 Dec 2019 and 2020 Plant and Equipment Accounts payable Accounts receivable Common stock Cash Accumulated depreciation Inventory Long term bonds Notes payable Retained earnings Marketable securities 2019 RM('000) 2,200 200 350 900 200 1000 550 500 100 700 100 2020 RM('000) 2600 150 325 800 150 1200 625 600 150 900 125 From scramble data as follows, construct an Income Statement Axia Corporation as at 31 Dec 2020 RM ('000) 60 1450 200 Interest expenses Sales Depreciation Taxes (40%) Dividend Cost of goods sold Salary and wages General and administrative expenses 80 850 30 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts