Question: 2. Consider the problem of forecasting the return on a portfolio comprised of two assets. The daily return on the portfolio is denoted R

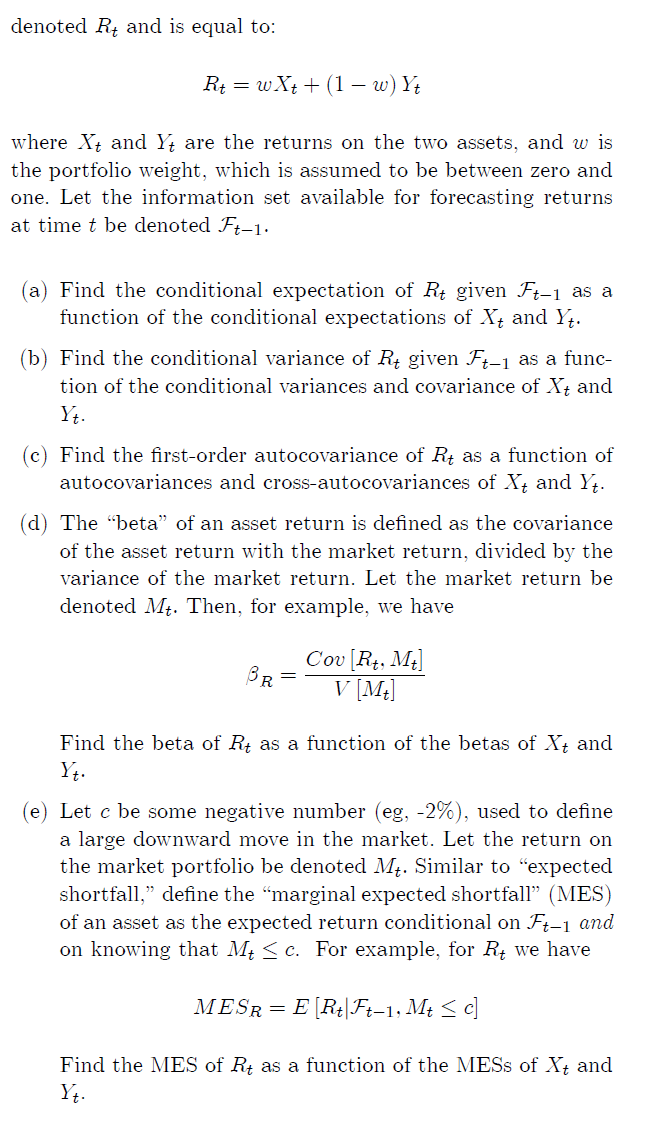

2. Consider the problem of forecasting the return on a portfolio comprised of two assets. The daily return on the portfolio is denoted R and is equal to: Rt = w Xt + (1 w) Yt where X and Y are the returns on the two assets, and wis the portfolio weight, which is assumed to be between zero and one. Let the information set available for forecasting returns at time t be denoted Ft-1. (a) Find the conditional expectation of Rt given Ft-1 as a function of the conditional expectations of X and Y. (b) Find the conditional variance of Rt given Ft-1 as a func- tion of the conditional variances and covariance of Xt and Yt. (c) Find the first-order autocovariance of Rt as a function of autocovariances and cross-autocovariances of X and Y. (d) The "beta" of an asset return is defined as the covariance of the asset return with the market return, divided by the variance of the market return. Let the market return be denoted Mt. Then, for example, we have BR = Find the beta of Rt as a function of the betas of Xt and Yt. MESR Cov [Rt, Mt] V [Mt] (e) Let c be some negative number (eg, -2%), used to define a large downward move in the market. Let the return on the market portfolio be denoted M. Similar to expected shortfall," define the "marginal expected shortfall" (MES) of an asset as the expected return conditional on Ft-1 and on knowing that M c. For example, for Rt we have = E [Rt|Ft-1, Mt c] Find the MES of Rt as a function of the MESS of Xt and Yt.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

a The conditional expectation of Rt given Ft1 can be expressed as a function of the conditional expe... View full answer

Get step-by-step solutions from verified subject matter experts