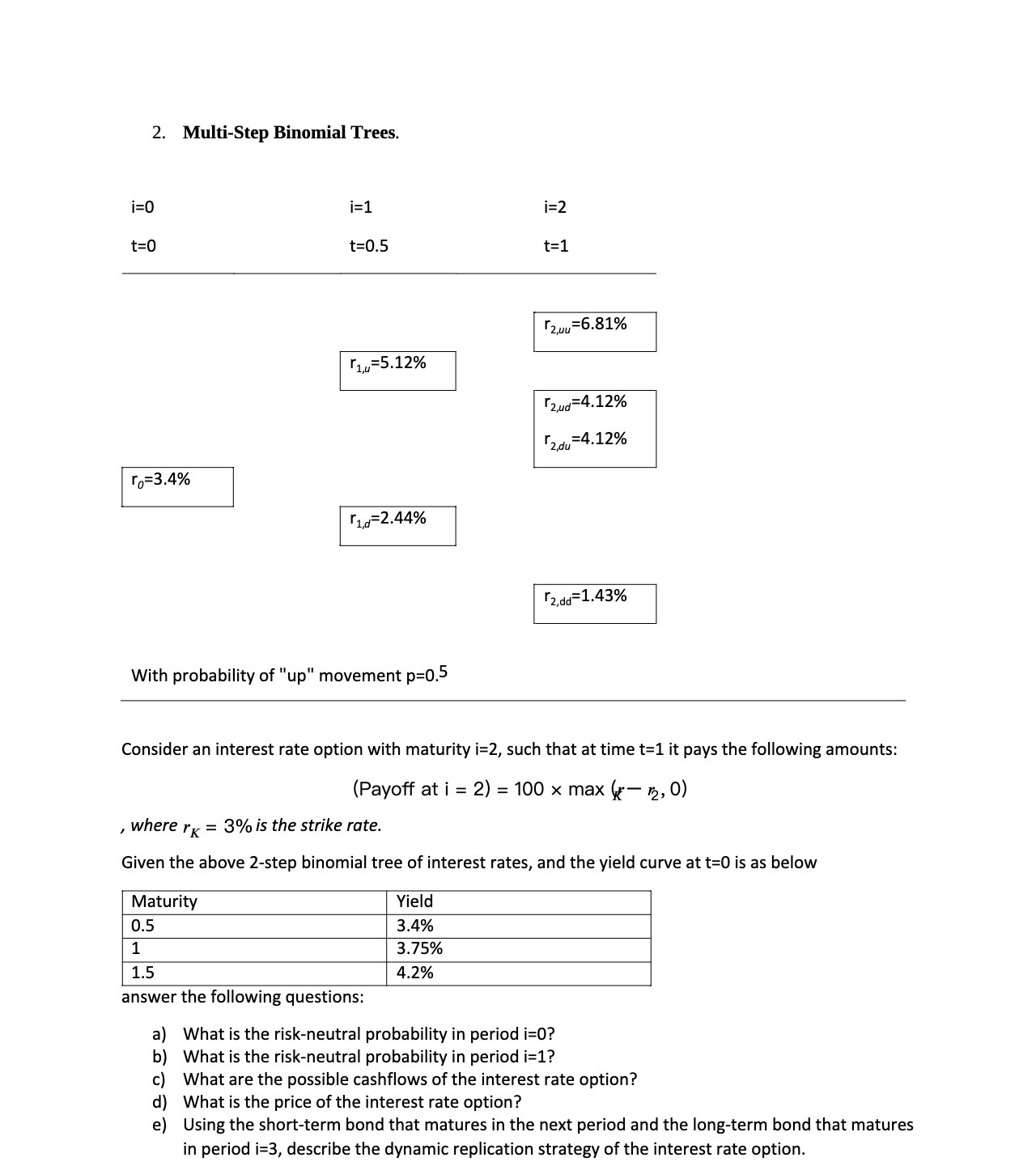

Question: 2. Multi-Step Binomial Trees. 1:: t=0.5 t=1 r1=2.44% Baud-43% With probability of up movement p=0.5 Consider an interest rate option with maturity i=2, such that

2. Multi-Step Binomial Trees. 1:: t=0.5 t=1 r1=2.44% Baud-43% With probability of "up" movement p=0.5 Consider an interest rate option with maturity i=2, such that at time t=1 it pays the following amounts: (Payoff at i = 2) = 100 x max k :2, 0) , where 1-K = 3% is the strike rate. Given the above 2-step binomial tree of interest rates, and the yield curve at t=0 is as below Maturity Yield | 0.5 | 3.4% | 1 3.75% answer the following questions: a) What is the risk-neutral probability in period i=0? b) What is the risk-neutral probability in period i=1? c) What are the possible cashflows of the interest rate option? d) What is the price of the interest rate option? e} Using the short-term bond that matures in the next period and the long-term bond that matures in period i=3, describe the dynamic replication strategy of the interest rate option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts