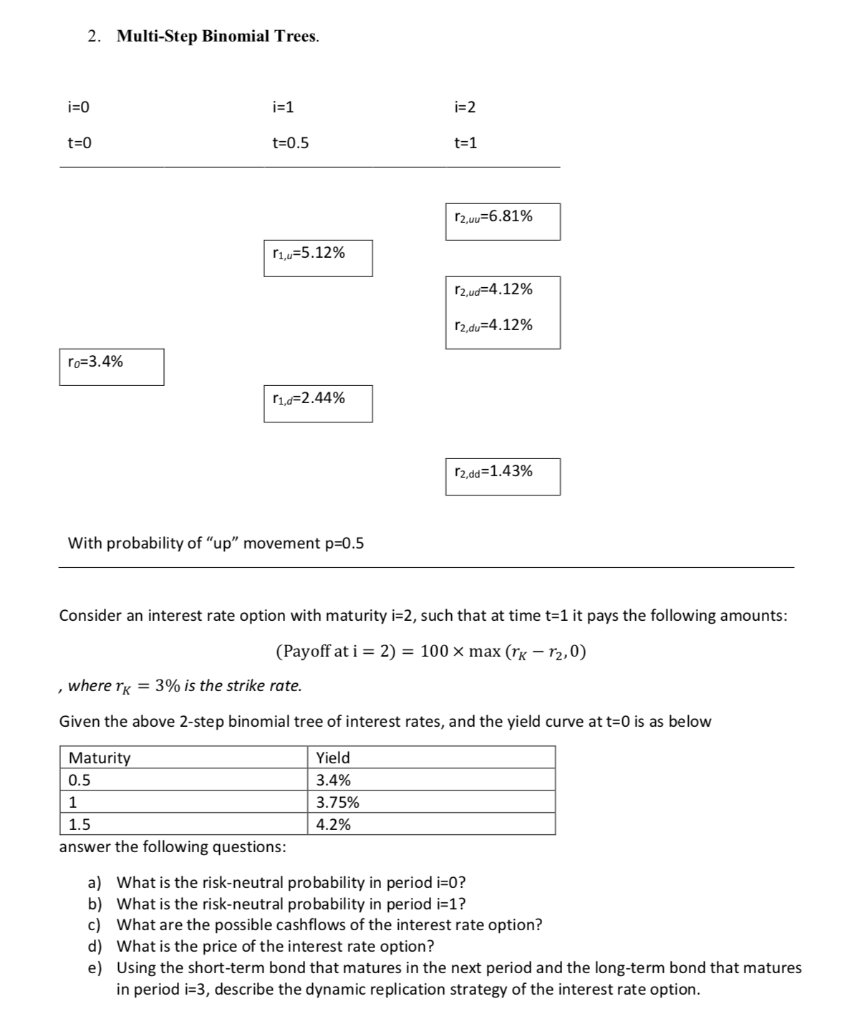

Question: 2. Multi-Step Binomial Trees. i=1 i=2 t=0 t=0.5 r2, uu=6.81% 11,=5.12% r2, ud=4.12% r2,du=4.12% Po=3.4% 11.-2.44% 12,dd=1.43% With probability of up movement p=0.5 Consider an

2. Multi-Step Binomial Trees. i=1 i=2 t=0 t=0.5 r2, uu=6.81% 11,=5.12% r2, ud=4.12% r2,du=4.12% Po=3.4% 11.-2.44% 12,dd=1.43% With probability of "up" movement p=0.5 Consider an interest rate option with maturity i=2, such that at time t=1 it pays the following amounts: (Payoff at i = 2) = 100 x max (rk r2,0) , where rx = 3% is the strike rate. Given the above 2-step binomial tree of interest rates, and the yield curve at t=0 is as below Maturity 0.5 Yield 3.4% 3.75% 4.2% 1.5 answer the following questions: a) What is the risk-neutral probability in period i=0? b) What is the risk-neutral probability in period i=1? c) What are the possible cashflows of the interest rate option? d) What is the price of the interest rate option? e) Using the short-term bond that matures in the next period and the long-term bond that matures in period i=3, describe the dynamic replication strategy of the interest rate option. 2. Multi-Step Binomial Trees. i=1 i=2 t=0 t=0.5 r2, uu=6.81% 11,=5.12% r2, ud=4.12% r2,du=4.12% Po=3.4% 11.-2.44% 12,dd=1.43% With probability of "up" movement p=0.5 Consider an interest rate option with maturity i=2, such that at time t=1 it pays the following amounts: (Payoff at i = 2) = 100 x max (rk r2,0) , where rx = 3% is the strike rate. Given the above 2-step binomial tree of interest rates, and the yield curve at t=0 is as below Maturity 0.5 Yield 3.4% 3.75% 4.2% 1.5 answer the following questions: a) What is the risk-neutral probability in period i=0? b) What is the risk-neutral probability in period i=1? c) What are the possible cashflows of the interest rate option? d) What is the price of the interest rate option? e) Using the short-term bond that matures in the next period and the long-term bond that matures in period i=3, describe the dynamic replication strategy of the interest rate option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts