Question: 2 Question 2 (a) Roots Extracts PLC is mainly into the research of biomedical applications. The company acquired a Magnetic Resonance Imaging (MRI) Scanner at

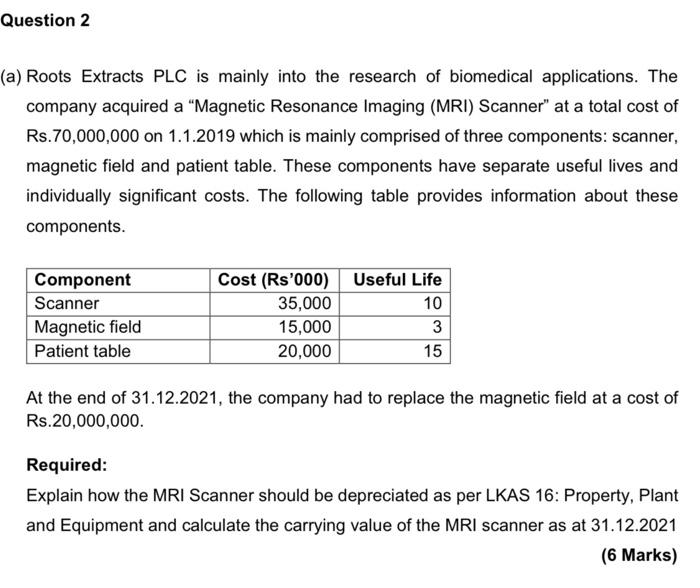

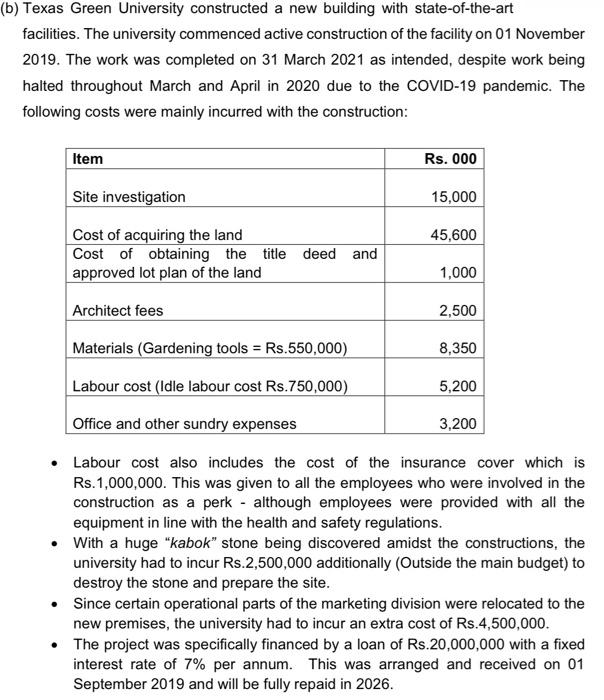

Question 2 (a) Roots Extracts PLC is mainly into the research of biomedical applications. The company acquired a "Magnetic Resonance Imaging (MRI) Scanner" at a total cost of Rs.70,000,000 on 1.1.2019 which is mainly comprised of three components: scanner, magnetic field and patient table. These components have separate useful lives and individually significant costs. The following table provides information about these components. Cost (Rs'000) Useful Life Component Scanner 35,000 10 Magnetic field 15,000 3 Patient table 20,000 15 At the end of 31.12.2021, the company had to replace the magnetic field at a cost of Rs.20,000,000. Required: Explain how the MRI Scanner should be depreciated as per LKAS 16: Property, Plant and Equipment and calculate the carrying value of the MRI scanner as at 31.12.2021 (6 Marks) (b) Texas Green University constructed a new building with state-of-the-art facilities. The university commenced active construction of the facility on 01 November 2019. The work was completed on 31 March 2021 as intended, despite work being halted throughout March and April in 2020 due to the COVID-19 pandemic. The following costs were mainly incurred with the construction: Item Rs. 000 Site investigation 15,000 Cost of acquiring the land 45,600 Cost of obtaining the title deed and approved lot plan of the land 1,000 Architect fees 2,500 Materials (Gardening tools = Rs.550,000) 8,350 Labour cost (Idle labour cost Rs.750,000) 5,200 Office and other sundry expenses 3,200 Labour cost also includes the cost of the insurance cover which is Rs.1,000,000. This was given to all the employees who were involved in the construction as a perk- although employees were provided with all the equipment in line with the health and safety regulations. With a huge "kabok" stone being discovered amidst the constructions, the university had to incur Rs.2,500,000 additionally (Outside the main budget) to destroy the stone and prepare the site. Since certain operational parts of the marketing division were relocated to the new premises, the university had to incur an extra cost of Rs.4,500,000. The project was specifically financed by a loan of Rs.20,000,000 with a fixed interest rate of 7% per annum. This was arranged and received on 01 September 2019 and will be fully repaid in 2026. Required: Assuming that you are working for the Finance Division of Texas Green University, prepare a report to be sent to the Head of Finance, outlining the following. I. The cost of the new facility as of 31 March 2021 as per LKAS 16 Property, Plant and Equipment. (5 Marks) II. A critical evaluation of the alternative models available for the measurement of the aforementioned facility after the initial recognition. (9 Marks) (c) Shenelle PLC is a toy manufacturing company. A special machine was acquired by Shenelle PLC on 1 January 2016 for Rs.2,400,000 to produce dolls. At the time of acquisition, the useful economic life of the machine was 20 years with no residual value. On 01 January 2021, the machine was revalued at Rs.1,850,000. The company policy is to make reserve transfers each year in respect of the realization of the revaluation surplus. Required: Explain the accounting treatment of the above transaction/event with necessary workings as per LKAS 16 Property, Plant and Equipment for the year ended 31 December 2021. (5 Marks) (Total-25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts