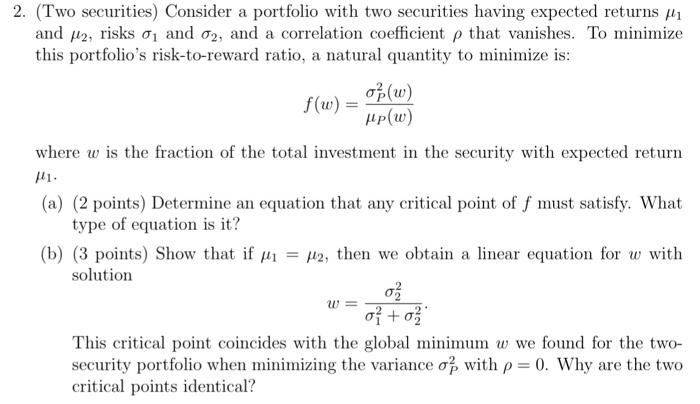

Question: 2. (Two securities) Consider a portfolio with two securities having expected returns Hi and M2, risks o1 and 02, and a correlation coefficient p that

2. (Two securities) Consider a portfolio with two securities having expected returns Hi and M2, risks o1 and 02, and a correlation coefficient p that vanishes. To minimize this portfolio's risk-to-reward ratio, a natural quantity to minimize is: o(w) f(w) = Mp(w) where w is the fraction of the total investment in the security with expected return (a) (2 points) Determine an equation that any critical point of f must satisfy. What type of equation is it? (b) (3 points) Show that if M1 = M2, then we obtain a linear equation for w with a solution o + o2 This critical point coincides with the global minimum w we found for the two- security portfolio when minimizing the variance o with p=0. Why are the two critical points identical? W = 2. (Two securities) Consider a portfolio with two securities having expected returns Hi and M2, risks o1 and 02, and a correlation coefficient p that vanishes. To minimize this portfolio's risk-to-reward ratio, a natural quantity to minimize is: o(w) f(w) = Mp(w) where w is the fraction of the total investment in the security with expected return (a) (2 points) Determine an equation that any critical point of f must satisfy. What type of equation is it? (b) (3 points) Show that if M1 = M2, then we obtain a linear equation for w with a solution o + o2 This critical point coincides with the global minimum w we found for the two- security portfolio when minimizing the variance o with p=0. Why are the two critical points identical? W =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts