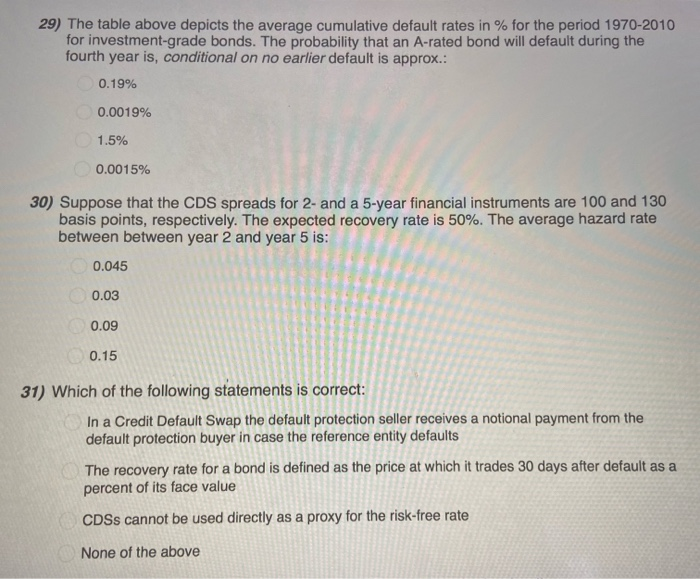

Question: 29) The table above depicts the average cumulative default rates in % for the period 1970-2010 for investment-grade bonds. The probability that an A-rated bond

29) The table above depicts the average cumulative default rates in % for the period 1970-2010 for investment-grade bonds. The probability that an A-rated bond will default during the fourth year is, conditional on no earlier default is approx.: 0.19% 0.0019% 1.5% 0.0015% 30) Suppose that the CDS spreads for 2- and a 5-year financial instruments are 100 and 130 basis points, respectively. The expected recovery rate is 50%. The average hazard rate between between year 2 and year 5 is: 0.045 0.03 0.09 0.15 31) Which of the following statements is correct: In a Credit Default Swap the default protection seller receives a notional payment from the default protection buyer in case the reference entity defaults The recovery rate for a bond is defined as the price at which it trades 30 days after default as a percent of its face value CDSs cannot be used directly as a proxy for the risk-free rate None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts