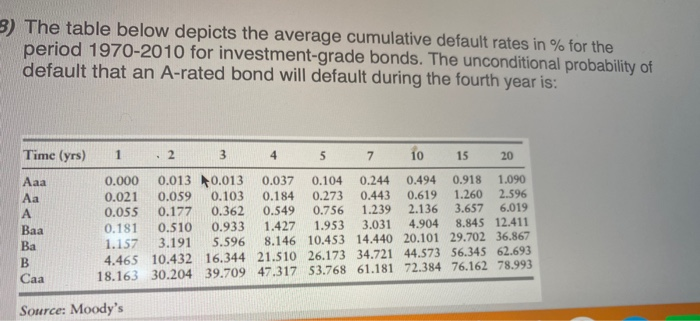

Question: 3) The table below depicts the average cumulative default rates in % for the period 1970-2010 for investment-grade bonds. The unconditional probability of default that

3) The table below depicts the average cumulative default rates in % for the period 1970-2010 for investment-grade bonds. The unconditional probability of default that an A-rated bond will default during the fourth year is: Time (yrs) 1 Baa 2 3 4 5 7 10 15 20 0.000 0.013 0.013 0.037 0.104 0.244 0.494 0.918 1.090 0.021 0.059 0.103 0.184 0.273 0.443 0.619 1.260 2.596 0.055 0.177 0.362 0.549 0.756 1.239 2.136 3.657 6.019 0.181 0.510 0.933 1.427 1.953 3.031 4.904 8.845 12.411 1.157 3.191 5.596 8.146 10.453 14.440 20.101 29.702 36.867 4.465 10.432 16.344 21.510 26.173 34.721 44.573 56.345 62.693 18.163 30.204 39.709 47.317 53.768 61.181 72.384 76.162 78.993 Ba B Caa Source: Moody's Caa 18.163 62.693 30.204 39.709 47.317 53.768 61.181 72.384 76.162 78.993 Source: Moody's 0.549% 0.362% O 0.184% 0.187% 29) The table above depicts the average cumulative default rates in % for the period 1970-2010 for investment-grade bonds. The probability that an A-rated bond will default during the fourth year is, conditional on no earlier default is approx.: 0.19% 0.0019% 1.5% 0.0015% 30) Suppose that the CDS spreads for 2- and a 5-year financial instruments are 100 and 130 basis points, respectively. The expected recovery rate is 50%. The average hazard rate between between year 2 and year 5 is: 0.045 0.03 0.09 0.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts