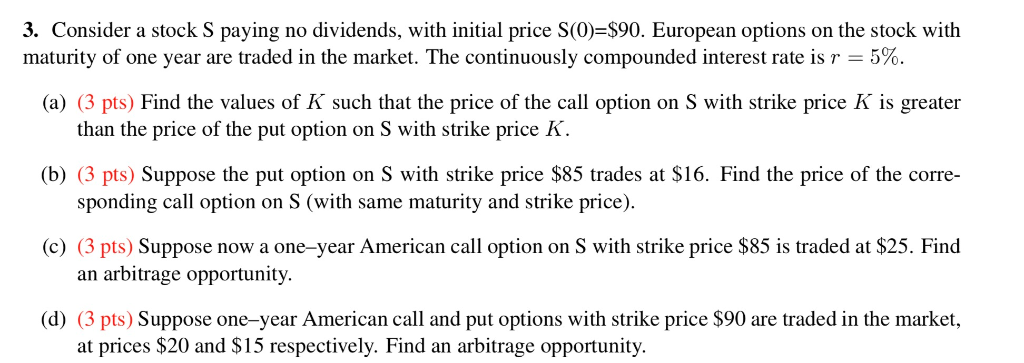

Question: 3. Consider a stock S paying no dividends, with initial price S(0)-$90. European options on the stock with maturity of one year are traded in

3. Consider a stock S paying no dividends, with initial price S(0)-$90. European options on the stock with maturity of one year are traded in the market. The continuously compounded interest rate is 5%. (a) (3 pts) Find the values of K such that the price of the call option on S with strike price K is greater than the price of the put option on S with strike price K (b) (3 pts) Suppose the put option on S with strike price $85 trades at S16. Find the price of the corre- sponding call option on S (with same maturity and strike price) (c) (3 pts) Suppose now a one-year American call option on S with strike price $85 is traded at $25. Find an arbitrage opportunity (d) (3 pts) Suppose one-year American call and put options with strike price $90 are traded in the market, at prices $20 and S15 respectively. Find an arbitrage opportunity. 3. Consider a stock S paying no dividends, with initial price S(0)-$90. European options on the stock with maturity of one year are traded in the market. The continuously compounded interest rate is 5%. (a) (3 pts) Find the values of K such that the price of the call option on S with strike price K is greater than the price of the put option on S with strike price K (b) (3 pts) Suppose the put option on S with strike price $85 trades at S16. Find the price of the corre- sponding call option on S (with same maturity and strike price) (c) (3 pts) Suppose now a one-year American call option on S with strike price $85 is traded at $25. Find an arbitrage opportunity (d) (3 pts) Suppose one-year American call and put options with strike price $90 are traded in the market, at prices $20 and S15 respectively. Find an arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts