Question: 3. Enter an AVERAGEIF function in cell C3 on the Summary worksheet. The function should compute the average of the entries in the Dividend/Yield column

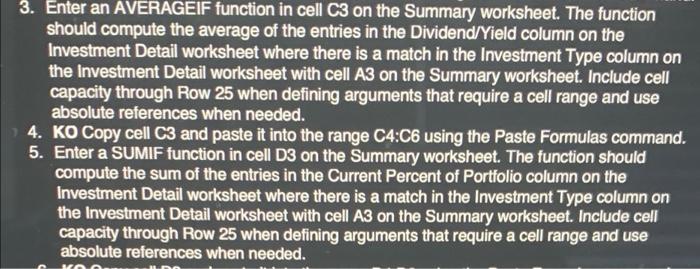

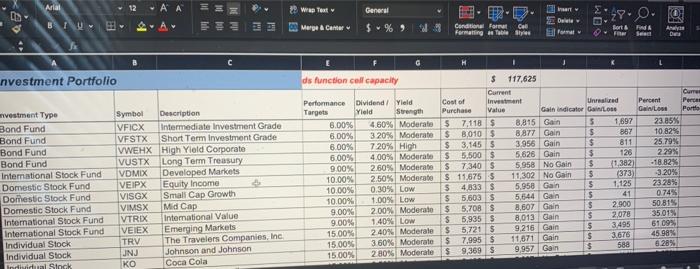

3. Enter an AVERAGEIF function in cell C3 on the Summary worksheet. The function should compute the average of the entries in the Dividend/Yield column on the Investment Detail worksheet where there is a match in the Investment Type column on the Investment Detail worksheet with cell A3 on the Summary worksheet. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. 4. KO Copy cell C3 and paste it into the range C4:C6 using the Paste Formulas command. 5. Enter a SUMIF function in cell D3 on the Summary worksheet. The function should compute the sum of the entries in the Current Percent of Portfolio column on the Investment Detail worksheet where there is a match in the Investment Type column on the Investment Detail worksheet with cell A3 on the Summary worksheet. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. Alla 12 A A NE Wrap Test General , Hili Dell BIU COM 3 02 Marge & Carta $%% Conditions For Cel Formaning Table Styles Sort & FI FA See D investment Portfolio 126 vestment Type Bond Fund Bond Fund Bond Fund Bond Fund International Stock Fund Domestic Stock Fund Domestic Stock Fund Domestic Stock Fund International Stock Fund Interational Stock Fund Individual Stock Individual Stock individual Sinck Symbol Description VFICX Intermediate Investment Grade VFSTX Short Term Investment Grade VWEHX High Yield Corporate VUSTX Long Term Treasury VDMIX Developed Markets VEIPX Equity Income VISGX Small Cap Growth VIMSX Mid Cap VTRIX Interational Value VEIEX Emerging Markets TRV The Travelers Companies, Inc JNJ Johnson and Johnson KO Coca Cola F G ds function cell capacity $ 117,625 Current Performance Dividend Yield Cost of Investment Unresed Targets Yield Strength Purchase Value Gain indicator Los 6.00% 4.60% Moderate $ 7,118 8,815 Gain 5 1,897 5.00% 320% Moderate $ 8.010 8.877 Gain $ 887 6.00% 720% High $ 3,145 S 3.956 Gain $ 811 6.00% 4.00% Moderate $ 5,500 $ 5.626 Gain $ 9.00% 2.60% Moderate $ 7.340 S 5958 No Gain $ 1382) 10.00% 2.50% Moderate $ 11,6755 11,302 No Gain $ (373 10.00% 0,30% LOW $ 4,833 $ 5.958 Gain $ 1,125 10.00% 1.00% Low $ 5.603$ 5,644 Gain 5 41 9.00% 200% Moderato $ 5,708 $ 8,607 Gain $ 2.900 9.00% 1.40% Low $ 5,9355 8,013 Gain $ 2.078 15.00% 2.40% erate $ 5.721 5 9,216 Gain $ 15.0096 3.60% Moderate $ 7.995 $ 11871 Gain $ 3.676 588 $ 9.957 Gain 15.00% 280% Moderate $9,369 S Curre Percent Ganitos Portfo 23.85% 10.82% 25.79% 229% -18.8293 -3.20% 23 28% 0.74% 50,81% 35.01% 61 09% 45.98% 6.28% 3495 ste 20 Wrap Text General BIURA fx AVERAGEIF('Investment Detail $F$3:$F$25,Summary:A3) Merge & Centar $ % Darlene Conditional Formula Formales SEM Form A D Portfolio Summary Investment Type Bond Fund Domestic Stock Fund Intomational Stock Fund Individual Stock Number of Investments Average Yield 1.4 #V/O! 3 #DIV/01 3 #DIV/0! 5 #DIV/0! Percent of Portfolio 0.00% 0.00% 0.00% 0.00% Number of Investments Total Unrealized Gain 0 Months Owned High Profit Investments Investment Type Bond Fund Domestic Stock Fund International Stock Fund Individual Stock 0 0 0 4 3. Enter an AVERAGEIF function in cell C3 on the Summary worksheet. The function should compute the average of the entries in the Dividend/Yield column on the Investment Detail worksheet where there is a match in the Investment Type column on the Investment Detail worksheet with cell A3 on the Summary worksheet. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. 4. KO Copy cell C3 and paste it into the range C4:C6 using the Paste Formulas command. 5. Enter a SUMIF function in cell D3 on the Summary worksheet. The function should compute the sum of the entries in the Current Percent of Portfolio column on the Investment Detail worksheet where there is a match in the Investment Type column on the Investment Detail worksheet with cell A3 on the Summary worksheet. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. Alla 12 A A NE Wrap Test General , Hili Dell BIU COM 3 02 Marge & Carta $%% Conditions For Cel Formaning Table Styles Sort & FI FA See D investment Portfolio 126 vestment Type Bond Fund Bond Fund Bond Fund Bond Fund International Stock Fund Domestic Stock Fund Domestic Stock Fund Domestic Stock Fund International Stock Fund Interational Stock Fund Individual Stock Individual Stock individual Sinck Symbol Description VFICX Intermediate Investment Grade VFSTX Short Term Investment Grade VWEHX High Yield Corporate VUSTX Long Term Treasury VDMIX Developed Markets VEIPX Equity Income VISGX Small Cap Growth VIMSX Mid Cap VTRIX Interational Value VEIEX Emerging Markets TRV The Travelers Companies, Inc JNJ Johnson and Johnson KO Coca Cola F G ds function cell capacity $ 117,625 Current Performance Dividend Yield Cost of Investment Unresed Targets Yield Strength Purchase Value Gain indicator Los 6.00% 4.60% Moderate $ 7,118 8,815 Gain 5 1,897 5.00% 320% Moderate $ 8.010 8.877 Gain $ 887 6.00% 720% High $ 3,145 S 3.956 Gain $ 811 6.00% 4.00% Moderate $ 5,500 $ 5.626 Gain $ 9.00% 2.60% Moderate $ 7.340 S 5958 No Gain $ 1382) 10.00% 2.50% Moderate $ 11,6755 11,302 No Gain $ (373 10.00% 0,30% LOW $ 4,833 $ 5.958 Gain $ 1,125 10.00% 1.00% Low $ 5.603$ 5,644 Gain 5 41 9.00% 200% Moderato $ 5,708 $ 8,607 Gain $ 2.900 9.00% 1.40% Low $ 5,9355 8,013 Gain $ 2.078 15.00% 2.40% erate $ 5.721 5 9,216 Gain $ 15.0096 3.60% Moderate $ 7.995 $ 11871 Gain $ 3.676 588 $ 9.957 Gain 15.00% 280% Moderate $9,369 S Curre Percent Ganitos Portfo 23.85% 10.82% 25.79% 229% -18.8293 -3.20% 23 28% 0.74% 50,81% 35.01% 61 09% 45.98% 6.28% 3495 ste 20 Wrap Text General BIURA fx AVERAGEIF('Investment Detail $F$3:$F$25,Summary:A3) Merge & Centar $ % Darlene Conditional Formula Formales SEM Form A D Portfolio Summary Investment Type Bond Fund Domestic Stock Fund Intomational Stock Fund Individual Stock Number of Investments Average Yield 1.4 #V/O! 3 #DIV/01 3 #DIV/0! 5 #DIV/0! Percent of Portfolio 0.00% 0.00% 0.00% 0.00% Number of Investments Total Unrealized Gain 0 Months Owned High Profit Investments Investment Type Bond Fund Domestic Stock Fund International Stock Fund Individual Stock 0 0 0 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts