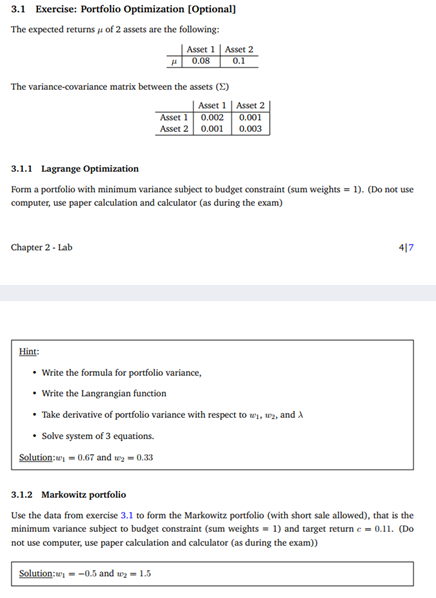

Question: 3.1 Exercise: Portfolio Optimization (Optional) The expected returns ju of 2 assets are the following: Asset 1 Asset 2 M 0.08 0.1 The variance-covariance matrix

3.1 Exercise: Portfolio Optimization (Optional) The expected returns ju of 2 assets are the following: Asset 1 Asset 2 M 0.08 0.1 The variance-covariance matrix between the assets (2) Asset 1 Asset 2 Asset 1 0.002 0.001 Asset 2 0.001 0.003 3.1.1 Lagrange Optimization Form a portfolio with minimum variance subject to budget constraint (sum weights = 1). (Do not use computer, use paper calculation and calculator (as during the exam) Chapter 2 - Lab 417 Hint: .Write the formula for portfolio variance, Write the Langrangian function Take derivative of portfolio variance with respect to wy, u2, and a Solve system of 3 equations. Solution:w; -0.67 and 2 = 0.33 3.1.2 Markowitz portfolio Use the data from exercise 3.1 to form the Markowitz portfolio (with short sale allowed), that is the minimum variance subject to budget constraint (sum weights - 1) and target return c = 0.11. (Do not use computer, use paper calculation and calculator (as during the exam)) Solution: - -0.5 and wz - 1.5 3.1 Exercise: Portfolio Optimization (Optional) The expected returns ju of 2 assets are the following: Asset 1 Asset 2 M 0.08 0.1 The variance-covariance matrix between the assets (2) Asset 1 Asset 2 Asset 1 0.002 0.001 Asset 2 0.001 0.003 3.1.1 Lagrange Optimization Form a portfolio with minimum variance subject to budget constraint (sum weights = 1). (Do not use computer, use paper calculation and calculator (as during the exam) Chapter 2 - Lab 417 Hint: .Write the formula for portfolio variance, Write the Langrangian function Take derivative of portfolio variance with respect to wy, u2, and a Solve system of 3 equations. Solution:w; -0.67 and 2 = 0.33 3.1.2 Markowitz portfolio Use the data from exercise 3.1 to form the Markowitz portfolio (with short sale allowed), that is the minimum variance subject to budget constraint (sum weights - 1) and target return c = 0.11. (Do not use computer, use paper calculation and calculator (as during the exam)) Solution: - -0.5 and wz - 1.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts