Question: 3.2- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. TRUE OR FALSE 4. 5. Multiple Choice Option A Option B Option

3.2-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

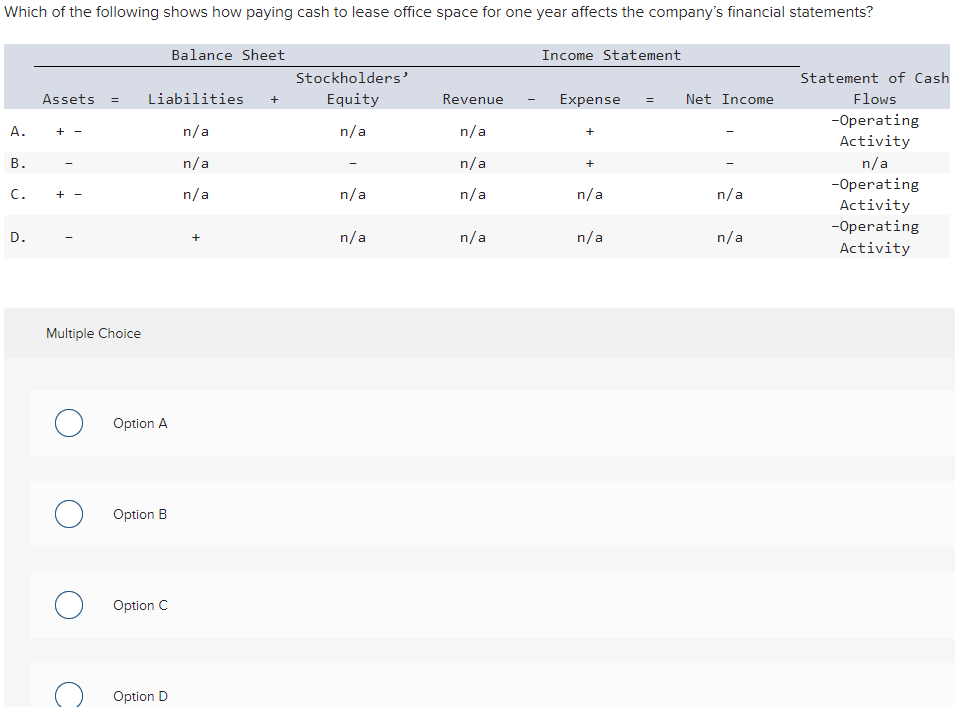

1.

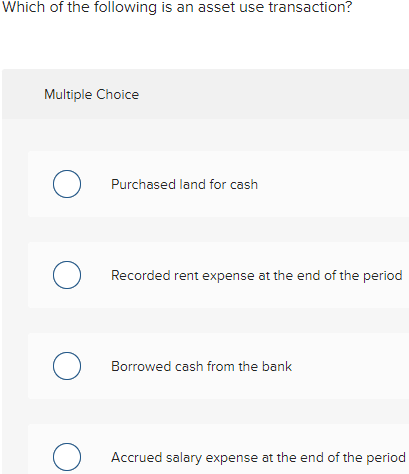

2.

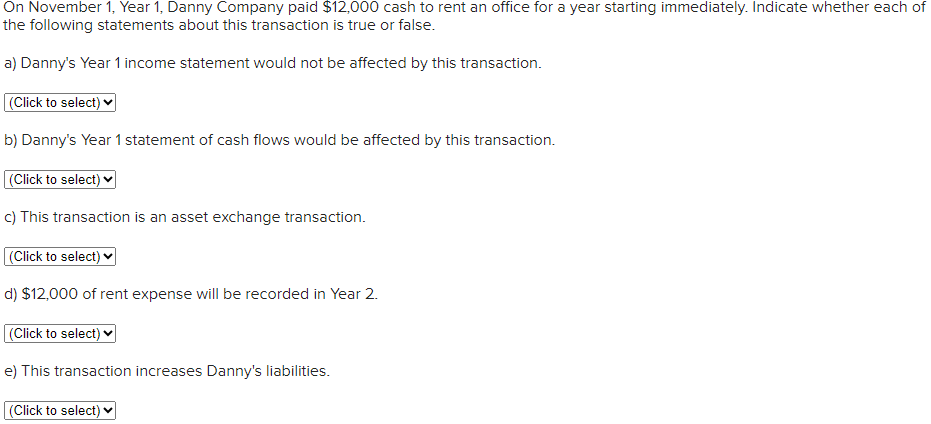

3. TRUE OR FALSE

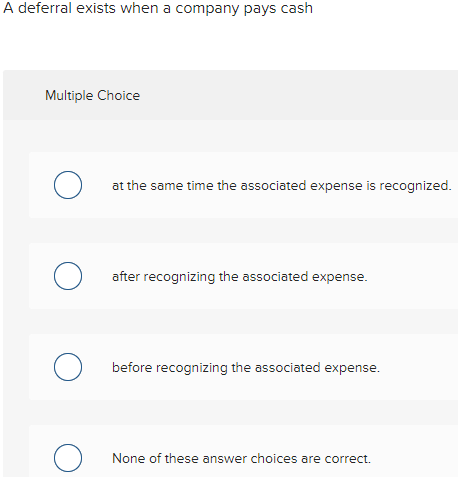

4.

5.

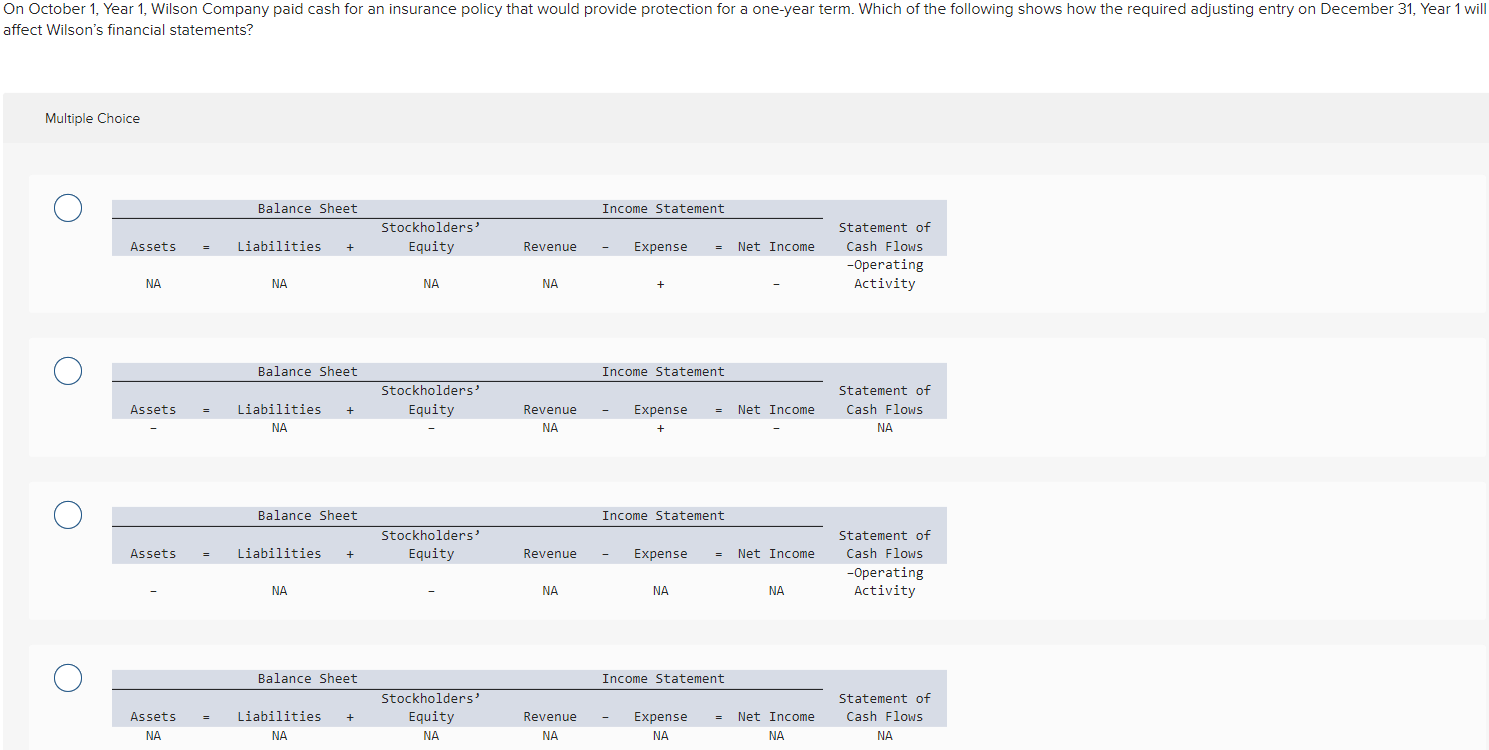

Multiple Choice Option A Option B Option C Option D Which of the following is an asset use transaction? Multiple Choice Purchased land for cash Recorded rent expense at the end of the period Borrowed cash from the bank Accrued salary expense at the end of the period On November 1, Year 1, Danny Company paid $12,000 cash to rent an office for a year starting immediately. Indicate whether each of the following statements about this transaction is true or false. a) Danny's Year 1 income statement would not be affected by this transaction. b) Danny's Year 1 statement of cash flows would be affected by this transaction. c) This transaction is an asset exchange transaction. d) $12,000 of rent expense will be recorded in Year 2. e) This transaction increases Danny's liabilities. A deferral exists when a company pays cash Multiple Choice at the same time the associated expense is recognized. after recognizing the associated expense. before recognizing the associated expense. None of these answer choices are correct. ffect Wilson's financial statements? Multiple Choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts