Question: 8.5- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. 4. 5. A-E TRUE OR FALSE Multiple Choice Option A Option B

8.5-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

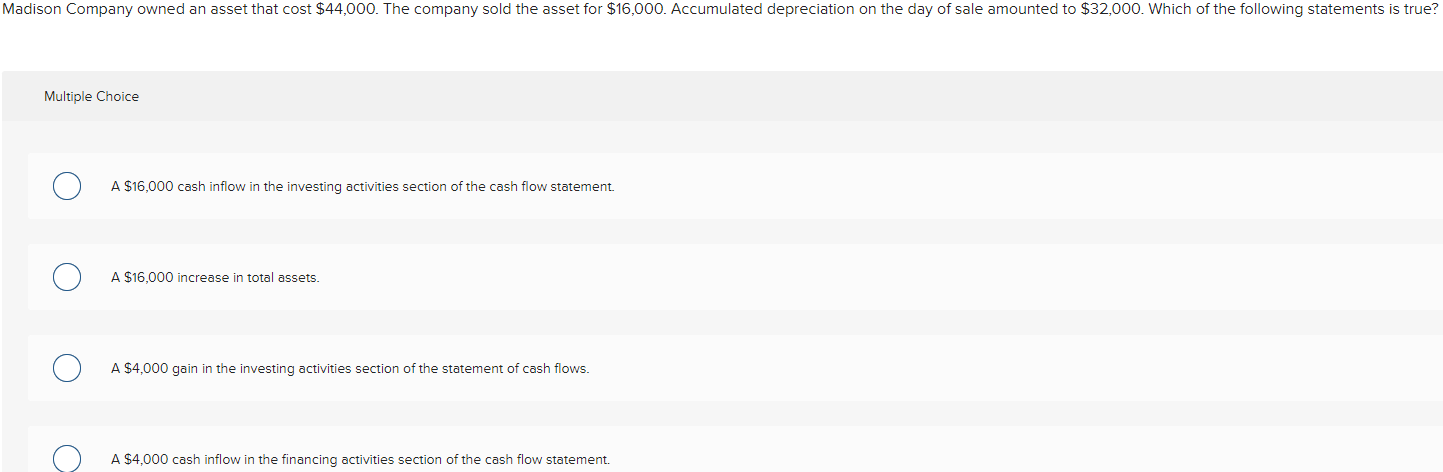

1.

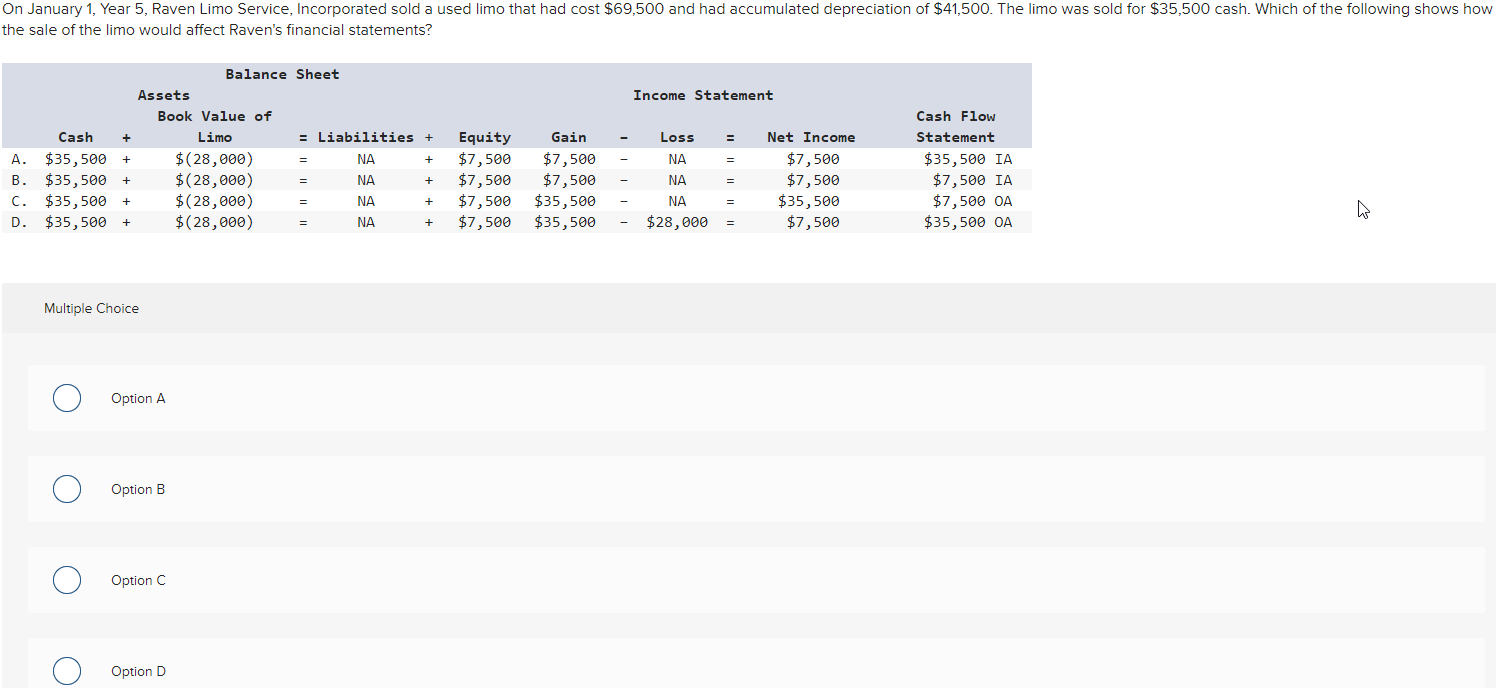

2.

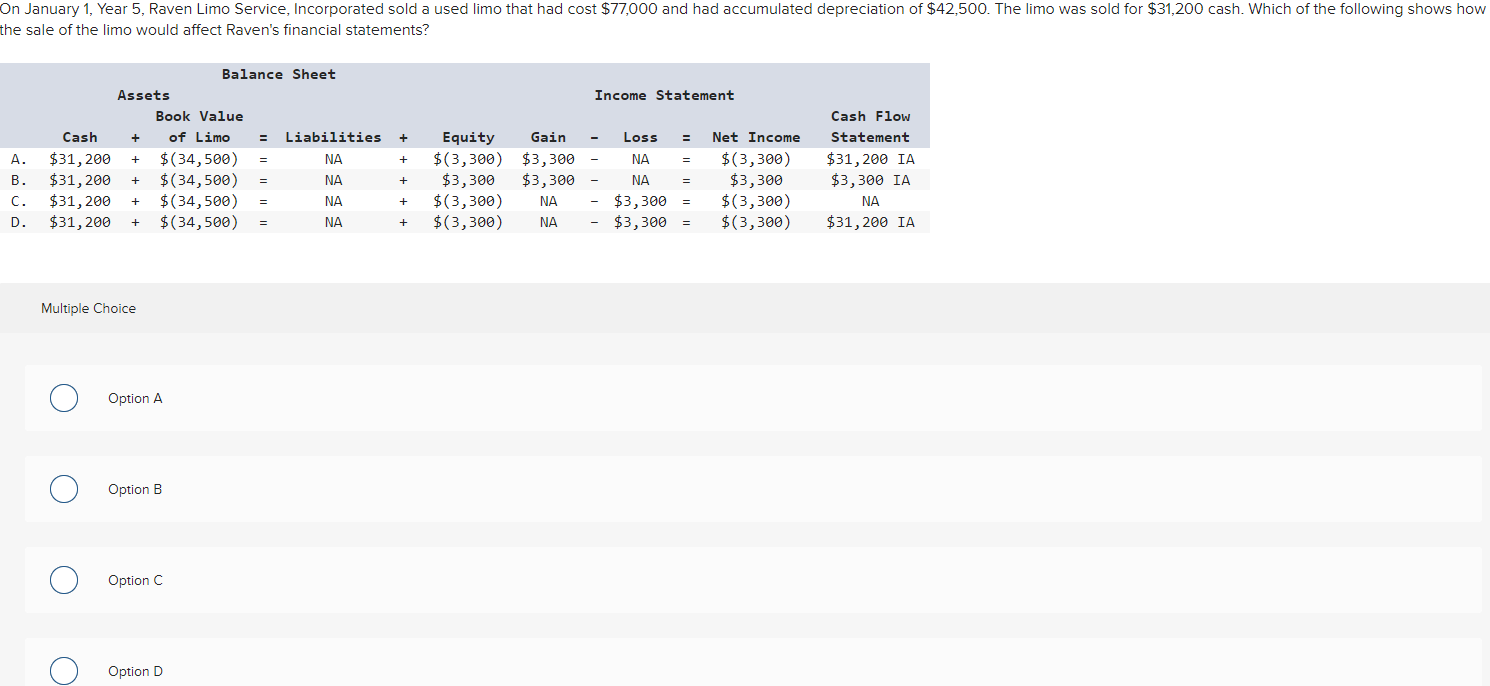

3.

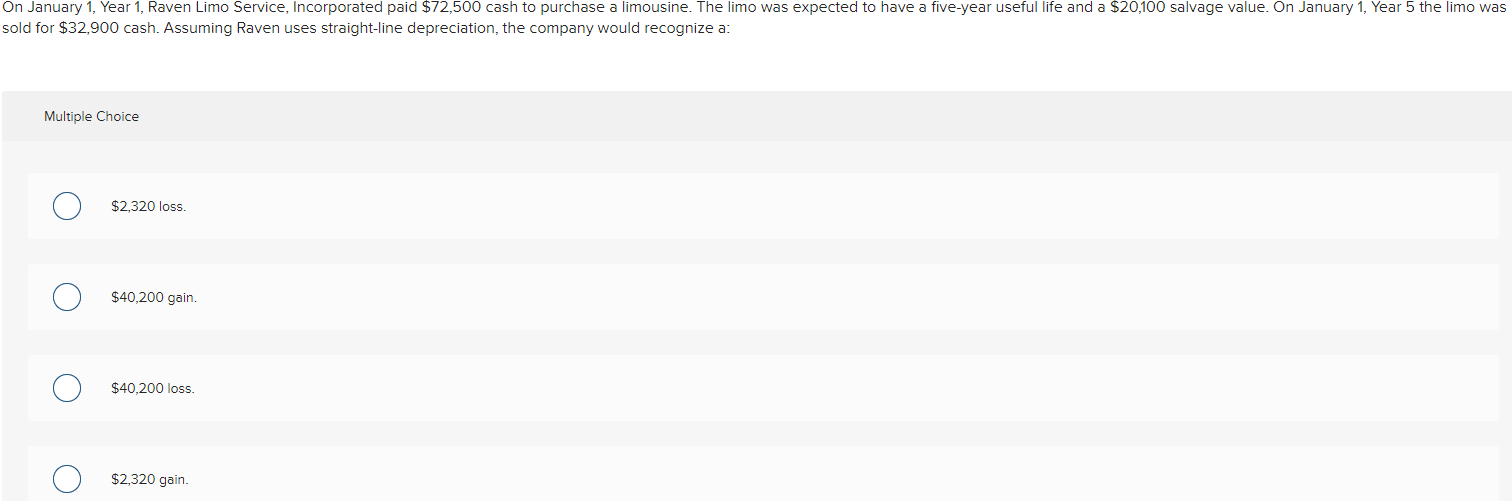

4.

5. A-E TRUE OR FALSE

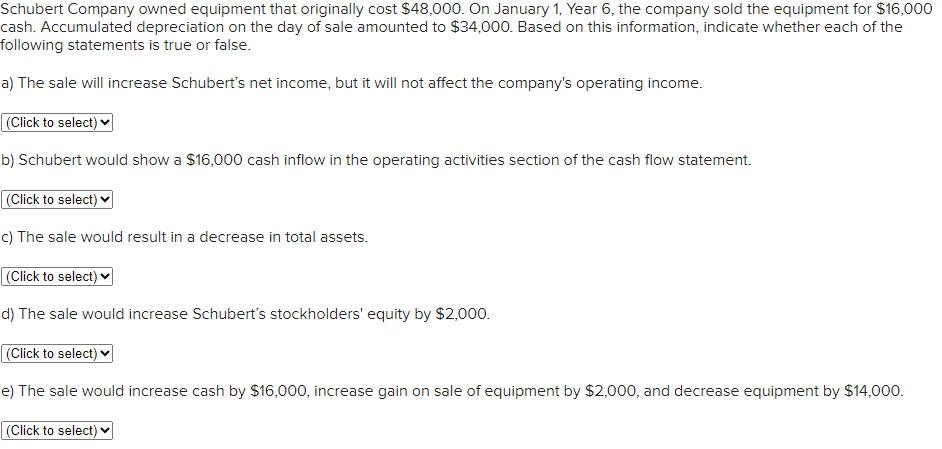

Multiple Choice Option A Option B Option C Option D Multiple Choice A $16,000 cash inflow in the investing activities section of the cash flow statement. A $16,000 increase in total assets. A $4,000 gain in the investing activities section of the statement of cash flows. A $4,000 cash inflow in the financing activities section of the cash flow statement. Schubert Company owned equipment that originally cost $48,000. On January 1 , Year 6 , the company sold the equipment for $16,000 cash. Accumulated depreciation on the day of sale amounted to $34,000. Based on this information, indicate whether each of the following statements is true or false. a) The sale will increase Schubert's net income, but it will not affect the company's operating income. b) Schubert would show a $16,000 cash inflow in the operating activities section of the cash flow statement. c) The sale would result in a decrease in total assets. d) The sale would increase Schubert's stockholders' equity by $2,000. e) The sale would increase cash by $16,000, increase gain on sale of equipment by $2,000, and decrease equipment by $14,000. old for $32,900 cash. Assuming Raven uses straight-line depreciation, the company would recognize a: Multiple Choice $2,320 loss. $40,200 gain. $40,200 loss. $2,320 gain. Multiple Choice Option A Option B Option C Option D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts