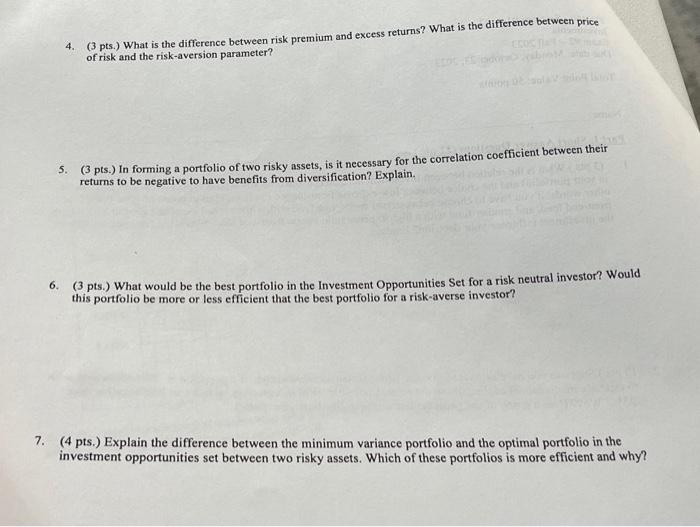

Question: 4. (3 pts.) What is the difference between risk premium and excess returns? What is the difference between price of risk and the risk-aversion parameter?

4. (3 pts.) What is the difference between risk premium and excess returns? What is the difference between price of risk and the risk-aversion parameter? 5. (3 pts.) In forming a portfolio of two risky assets, is it necessary for the correlation coefficient between their returns to be negative to have benefits from diversification? Explain. 6. (3 pts.) What would be the best portfolio in the Investment Opportunities Set for a risk neutral investor? Would this portfolio be more or less efficient that the best portfolio for a risk-averse investor? (4 pts.) Explain the difference between the minimum variance portfolio and the optimal portfolio in the investment opportunities set between two risky assets. Which of these portfolios is more efficient and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts