Question: 4. Lockheed Martin has a bond outstanding with a 7.625% coupon, paid semiannually, $1,000 par value and matures in 2025. The bond yield to

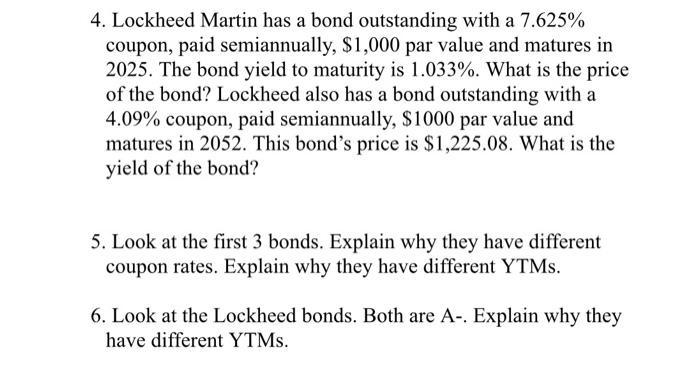

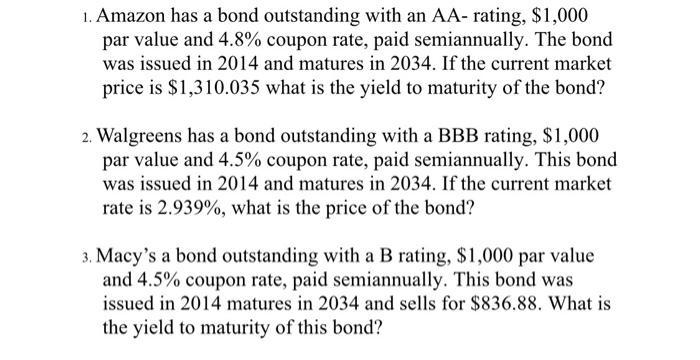

4. Lockheed Martin has a bond outstanding with a 7.625% coupon, paid semiannually, $1,000 par value and matures in 2025. The bond yield to maturity is 1.033%. What is the price of the bond? Lockheed also has a bond outstanding with a 4.09% coupon, paid semiannually, $1000 par value and matures in 2052. This bond's price is $1,225.08. What is the yield of the bond? 5. Look at the first 3 bonds. Explain why they have different coupon rates. Explain why they have different YTMs. 6. Look at the Lockheed bonds. Both are A-. Explain why they have different YTMs. 1. Amazon has a bond outstanding with an AA- rating, $1,000 par value and 4.8% coupon rate, paid semiannually. The bond was issued in 2014 and matures in 2034. If the current market price is $1,310.035 what is the yield to maturity of the bond? 2. Walgreens has a bond outstanding with a BBB rating, $1,000 par value and 4.5% coupon rate, paid semiannually. This bond was issued in 2014 and matures in 2034. If the current market rate is 2.939%, what is the price of the bond? 3. Macy's a bond outstanding with a B rating, $1,000 par value and 4.5% coupon rate, paid semiannually. This bond was issued in 2014 matures in 2034 and sells for $836.88. What is the yield to maturity of this bond?

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

4To calculate the price of the 7625 coupon bond from Lockheed Martin we first need to calculate the semiannual coupon payment This is 1000 x 7625 2 38... View full answer

Get step-by-step solutions from verified subject matter experts