Question: 4. Mrs. Janet is provided with an auto mobile by her employer. The employer acquired the auto mobile in 2015 for $25000 plus $1250

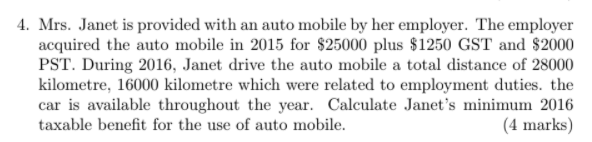

4. Mrs. Janet is provided with an auto mobile by her employer. The employer acquired the auto mobile in 2015 for $25000 plus $1250 GST and $2000 PST. During 2016, Janet drive the auto mobile a total distance of 28000 kilometre, 16000 kilometre which were related to employment duties. the car is available throughout the year. Calculate Janet's minimum 2016 taxable benefit for the use of auto mobile. (4 marks)

Step by Step Solution

★★★★★

3.27 Rating (153 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Puchase price of a car 25000 GST 1250 PST 2000 Total purchase ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock