Question: 5. Consider n risky assets with expected returns 71, 72, ..., fr. Let = (F1,F2, ...,Pn)'be the column vector of expected returns, rj be the

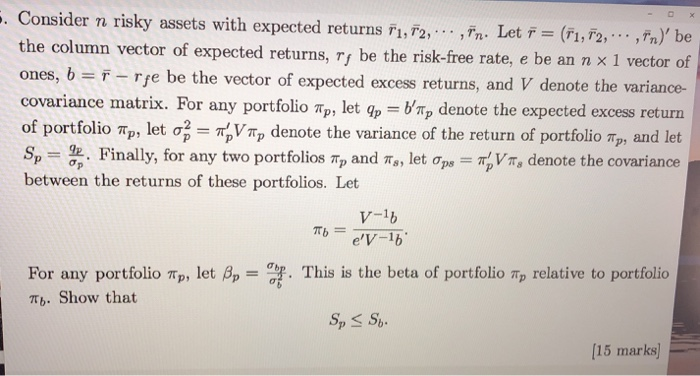

5. Consider n risky assets with expected returns 71, 72, ..., fr. Let = (F1,F2, ...,Pn)'be the column vector of expected returns, rj be the risk-free rate, e be an n x 1 vector of ones, b = r -rfe be the vector of expected excess returns, and V denote the variance- covariance matrix. For any portfolio Tlp, let qp = b'mp denote the expected excess return of portfolio Tip, let = TVT denote the variance of the return of portfolio #p, and let Sp = %. Finally, for any two portfolios Tp and 7s, let Ops = VT, denote the covariance between the returns of these portfolios. Let LV-10 To = V-16 . This is the beta of portfolio p relative to portfolio For any portfolio 7p, let Bp = Tb. Show that Sp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts