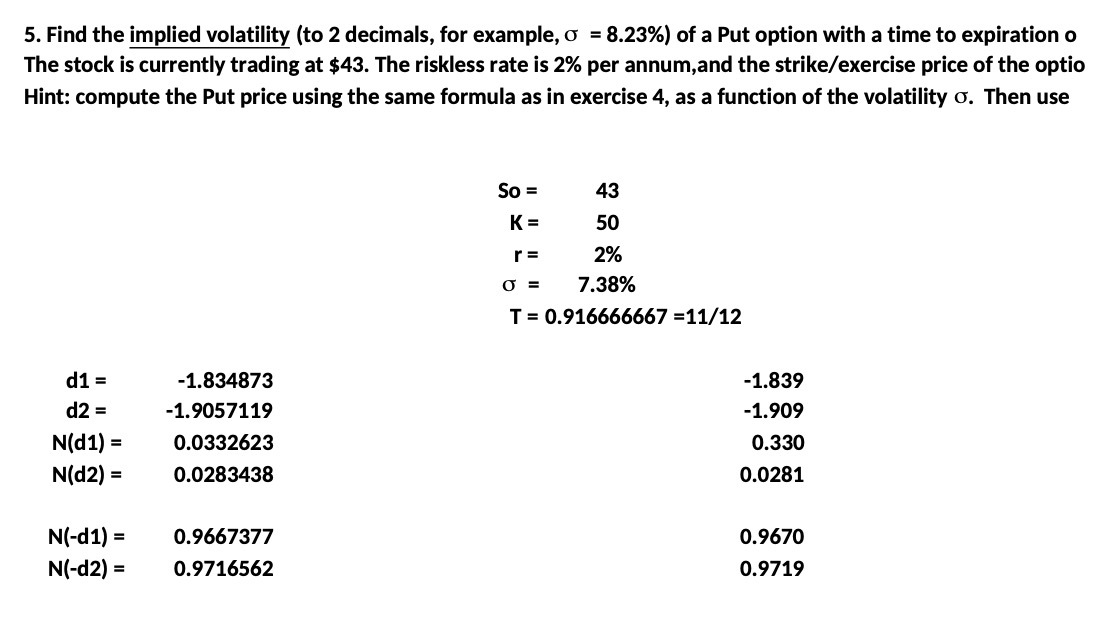

Question: 5. Find the implied volatility (to 2 decimals, for example, o =8.23%) of a Put option with a time to expiration o The stock is

5. Find the implied volatility (to 2 decimals, for example, o =8.23%) of a Put option with a time to expiration o The stock is currently trading at $43. The riskless rate is 2% per annum, and the strike/exercise price of the optio Hint: compute the Put price using the same formula as in exercise 4, as a function of the volatility o. Then use So = 43 K= 50 r= 2% O= 7.38% T = 0.916666667 =11/12 d1 = -1.834873 -1.839 d2 = -1.9057119 -1.909 N(d1) = 0.0332623 0.330 N(d2) = 0.0283438 0.0281 N(-d1) = 0.9667377 0.9670 N(-d2) = 0.9716562 0.9719

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts