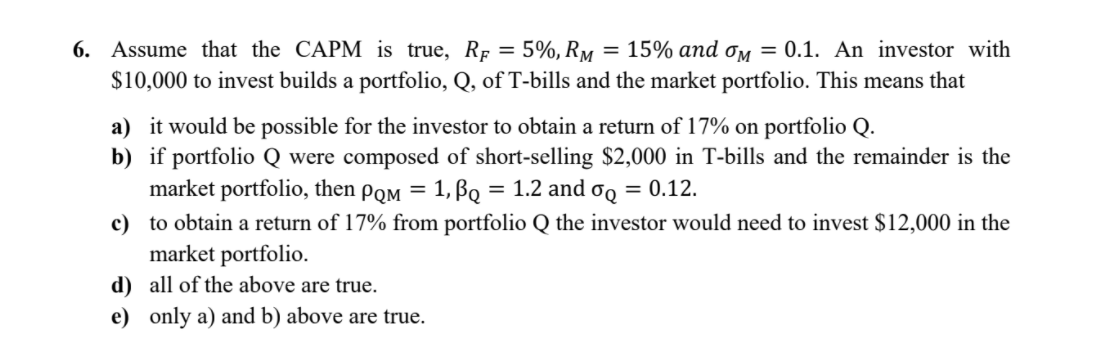

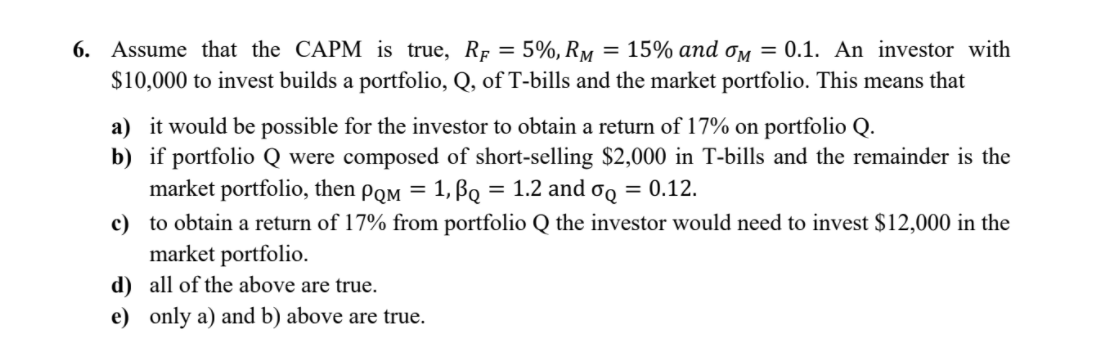

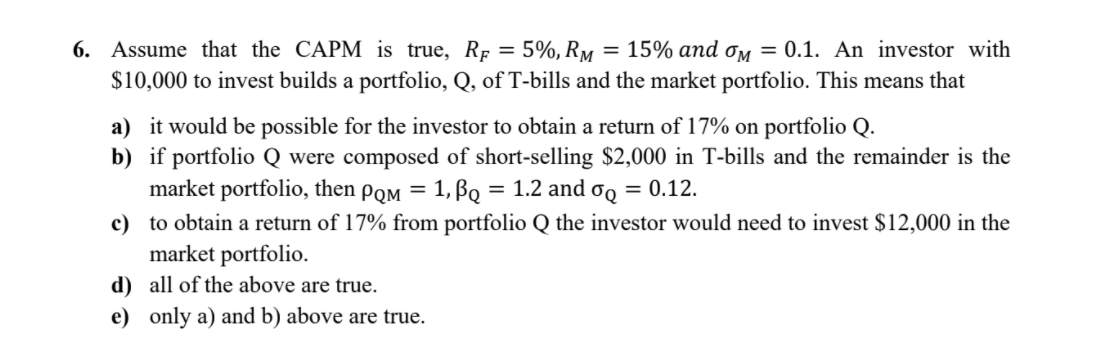

Question: 6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a

6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then PQM = 1, BQ = 1.2 and OQ = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d) all of the above are true. e) only a) and b) above are true. 6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then PQM = 1, BQ = 1.2 and OQ = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d) all of the above are true. e) only a) and b) above are true. 6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then PQM = 1, BQ = 1.2 and OQ = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d) all of the above are true. e) only a) and b) above are true. 6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then PQM = 1, BQ = 1.2 and OQ = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d) all of the above are true. e) only a) and b) above are true. 6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then PQM = 1, BQ = 1.2 and OQ = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d) all of the above are true. e) only a) and b) above are true. 6. Assume that the CAPM is true, RF = 5%, RM = 15% and om = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then PQM = 1, BQ = 1.2 and OQ = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d) all of the above are true. e) only a) and b) above are true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts