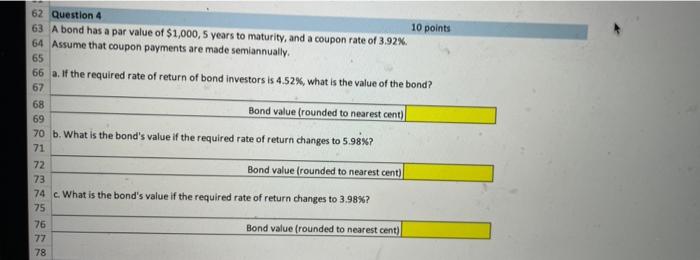

Question: 68 62 Question 4 10 points 63 A bond has a par value of $1,000, 5 years to maturity, and a coupon rate of 3.92%

68 62 Question 4 10 points 63 A bond has a par value of $1,000, 5 years to maturity, and a coupon rate of 3.92% 64 Assume that coupon payments are made semiannually. 65 66 a. If the required rate of return of bond investors is 4.52%, what is the value of the bond? 67 Bond value (rounded to nearest cent) 69 70 b. What is the bond's value if the required rate of return changes to 5.98%? 71 72 Bond value (rounded to nearest cent) 73 74 . What is the bond's value if the required rate of return changes to 3.98%? 75 76 Bond value (rounded to nearest cent) 77 78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts