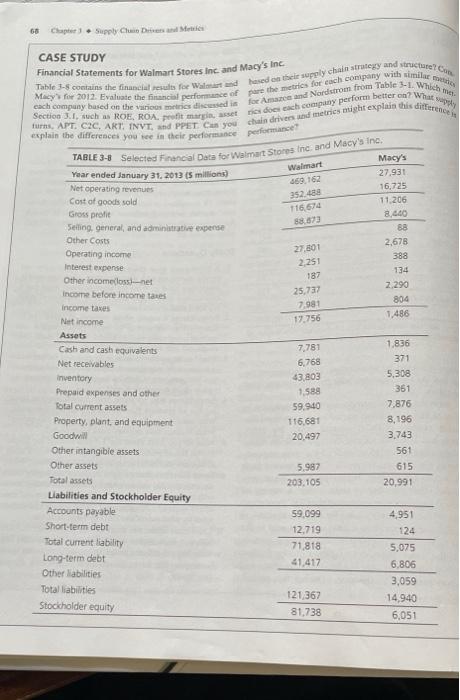

Question: 68 Chapter 3 Supply Chain Divers and Metrics CASE STUDY Financial Statements for Walmart Stores Inc. and Macy's Inc. Table 3-8 contains the financial results

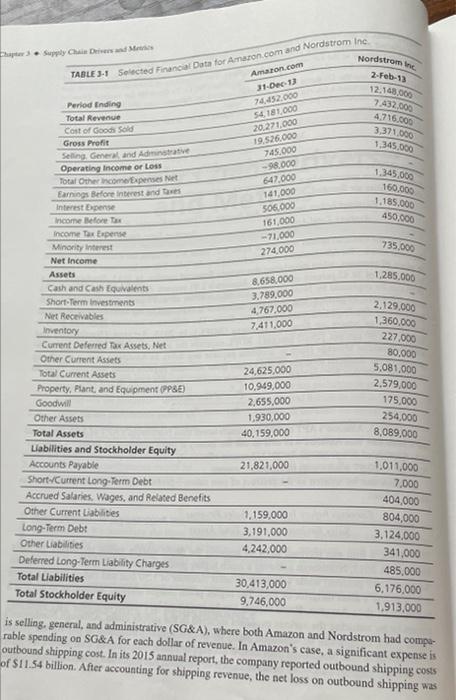

68 Chapter 3 Supply Chain Divers and Metrics CASE STUDY Financial Statements for Walmart Stores Inc. and Macy's Inc. Table 3-8 contains the financial results for Walmart and based on their supply chain strategy and structure! Con Macy's for 2012. Evaluate the financial performance of pare the metrics for each company with similar matc for Amazon and Nordstrom from Table 3-1. Which me furns, APT. C2C, ART. INVT, and PPET. Can you chain drivers and metrics might explain this difference is Section 3.1, such as ROE, ROA. profit margin, asset rics does each company perform better on? What supply each company based on the various metrics discussed in explain the differences you see in their performance performance? TABLE 3-8 Selected Financial Data for Walmart Stores Inc. and Macy's Inc. Macy's Walmart Year ended January 31, 2013 (5 millions) 27,931. 469,162 Net operating revenues 16,725 352.488 Cost of goods sold 11,206 Gross profit 116,674 8,440 88,473 Selling, general, and administrative expense 88 Other Costs 2,678 Operating income 388 Interest expense 134 Other income(lossi-net 2,290 income before income taxes 804 income taxes 1,486 Net income Assets 1,836 Cash and cash equivalents 371 Net receivables inventory 5,308 Prepaid expenses and other 361 Total current assets 7,876 Property, plant, and equipment 8,196 Goodwill 3,743 Other intangible assets 561 Other assets 615 Total assets 20,991 Liabilities and Stockholder Equity Accounts payable 4,951 Short-term debt 124 Total current liability 5,075 Long-term debt 6,806 Other liabilities 3,059 Total liabilities 14,940 Stockholder equity 6,051 27,801 2,251 187 25,737 7,981 17,756 7,781 6,768 43,803 1,588 59,940 116,681 20,497 5,987 203,105 59,099 12,719 71,818 41,417 121,367 81,738 TABLE 3-1 Selected Financial Data for Amazon.com and Nordstrom Inc.. Amazon.com 31-Dec-13 Period Ending 74,452.000 Total Revenue 54,181,000 Cost of Goods Sold 20,271,000 Gross Profit 19,526,000 745.000 Selling General and Adminstrative Operating Income or Loss -98.000 647,000 Total Other IncomeExpenses Net Earnings Before Interest and Taxes 141,000 Interest Expense 506,000 Income Before Tax 161,000 Income Tax Expense -71,000 Minority Interest 735,000 274,000 Net Income Assets 1,285,000 8,658,000 Cash and Cash Equivalents Short-Term Investments 3,789,000 2,129,000 Net Receivables 4,767,000 1,360,000 7,411,000 Inventory 227,000 Current Deferred Tax Assets, Net Other Current Assets 80,000 Total Current Assets 24,625,000 5,081,000 Property, Plant, and Equipment (PP&E) 10,949,000 2,579,000 Goodwill 2,655,000 175,000 Other Assets 1,930,000 254,000 Total Assets 40,159,000 8,089,000 Liabilities and Stockholder Equity Accounts Payable 21,821,000 1,011,000 Short-Current Long-Term Debt 7,000 Accrued Salaries, Wages, and Related Benefits 404,000 Other Current Liabilities 1,159,000 804,000 Long-Term Debt 3,191,000 Other Liabilities 3,124,000 4,242,000 Deferred Long-Term Liability Charges 341,000 Total Liabilities 485,000 30,413,000 Total Stockholder Equity 6,176,000 9,746,000 1,913,000 is selling, general, and administrative (SG&A), where both Amazon and Nordstrom had compa- rable spending on SG&A for each dollar of revenue. In Amazon's case, a significant expense is outbound shipping cost. In its 2015 annual report, the company reported outbound shipping costs of $11.54 billion. After accounting for shipping revenue, the net loss on outbound shipping was Chapter 3 Supply Chain Drivers and Metrics Nordstrom Inc 2-Feb-13 12.148.000 7,432,000 4,716.000 3,371,000 1,345,000 1,345,000 160.000 1,185.000 450,000