Question: 7.4- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. A-E TRUE OR FALSE 2. 3. 4. 5. a) Most companies expect to receive the

7.4-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

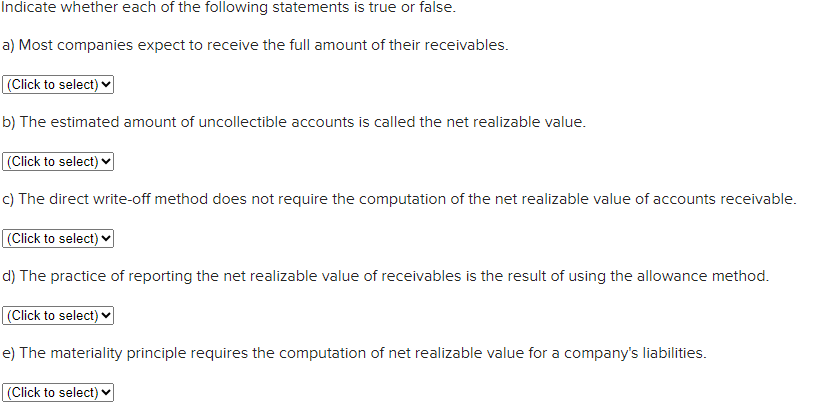

- A-E TRUE OR FALSE

2.

3.

4.

5.

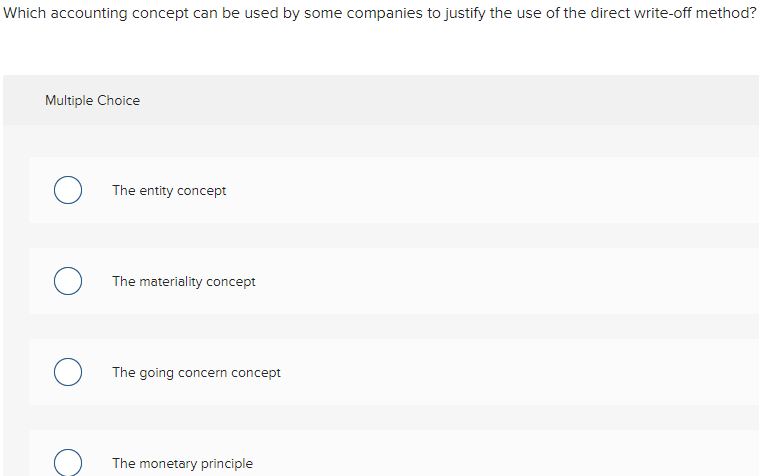

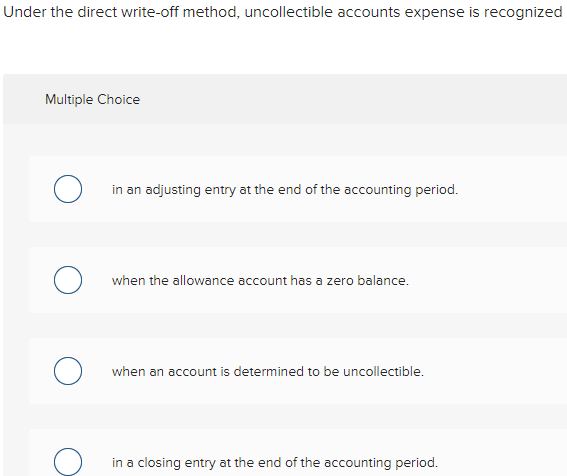

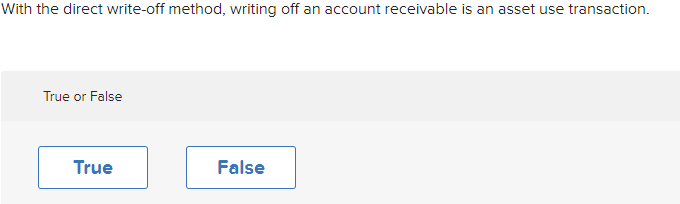

a) Most companies expect to receive the full amount of their receivables. b) The estimated amount of uncollectible accounts is called the net realizable value. c) The direct write-off method does not require the computation of the net realizable value of accounts receivable. d) The practice of reporting the net realizable value of receivables is the result of using the allowance method. e) The materiality principle requires the computation of net realizable value for a company's liabilities. The direct write-off method overstates assets on the balance sheet. True or False With the direct write-off method, writing off an account receivable is an asset use transaction. Which accounting concept can be used by some companies to justify the use of the direct write-off method? Multiple Choice The entity concept The materiality concept The going concern concept The monetary principle Under the direct write-off method, uncollectible accounts expense is recognized Multiple Choice in an adjusting entry at the end of the accounting period. when the allowance account has a zero balance. when an account is determined to be uncollectible. in a closing entry at the end of the accounting period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts