Question: 8. (4 points; 1 point each; no partial credit) a) Which of the following will lead to an increase in the value of a call

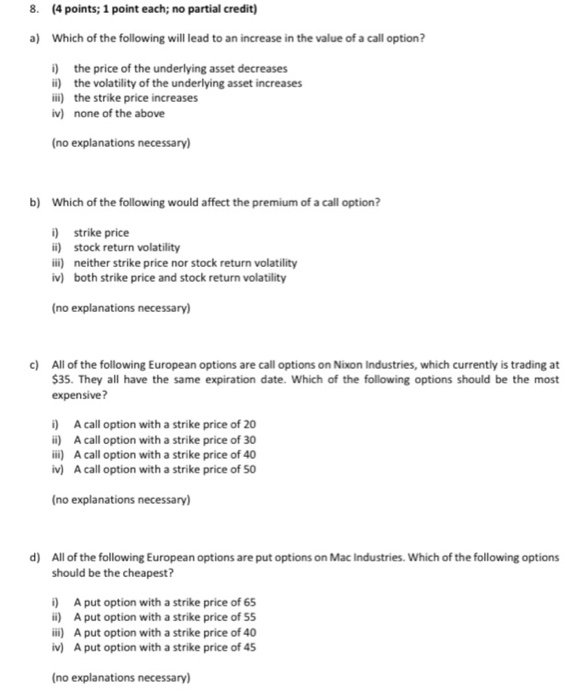

8. (4 points; 1 point each; no partial credit) a) Which of the following will lead to an increase in the value of a call option? i) the price of the underlying asset decreases ii) the volatility of the underlying asset increases iii) the strike price increases iv) none of the above (no explanations necessary) b) Which of the following would affect the premium of a call option? i) strike price ii) stock return volatility iii) neither strike price nor stock return volatility iv) both strike price and stock return volatility (no explanations necessary) c) All of the following European options are call options on Nixon Industries, which currently is trading at $35. They all have the same expiration date. Which of the following options should be the most expensive? i) A call option with a strike price of 20 ii) A call option with a strike price of 30 iii) A call option with a strike price of 40 iv) A call option with a strike price of 50 (no explanations necessary) d) All of the following European options are put options on Mac Industries. Which of the following options should be the cheapest? i) A put option with a strike price of 65 ii) A put option with a strike price of 55 iii) A put option with a strike price of 40 iv) A put option with a strike price of 45 (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts