Question: 9 & 16 please 9. IPO Costs. When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, existing shareholders

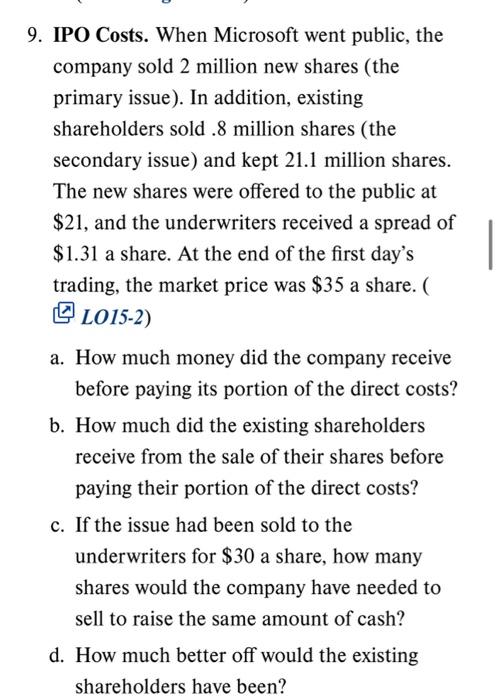

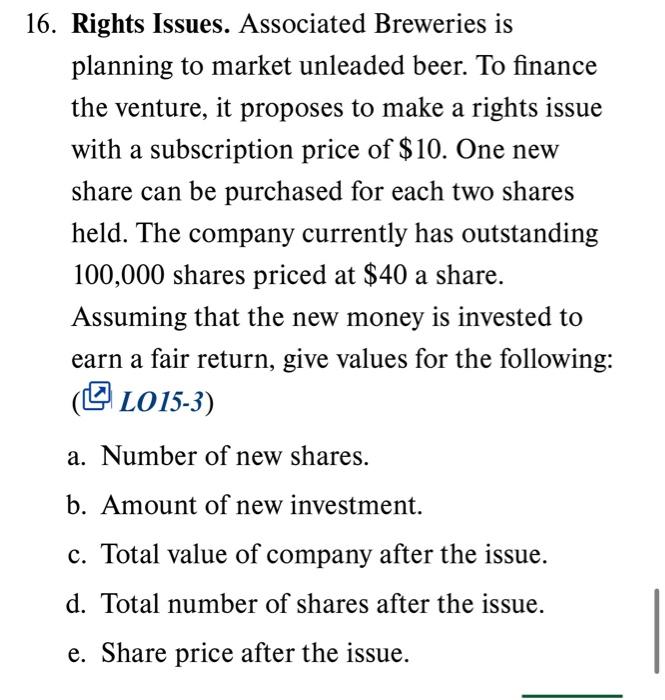

9. IPO Costs. When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, existing shareholders sold .8 million shares (the secondary issue) and kept 21.1 million shares. The new shares were offered to the public at $21, and the underwriters received a spread of $1.31 a share. At the end of the first day's trading, the market price was $35 a share. ( () LO15-2) a. How much money did the company receive before paying its portion of the direct costs? b. How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? c. If the issue had been sold to the underwriters for $30 a share, how many shares would the company have needed to sell to raise the same amount of cash? d. How much better off would the existing shareholders have been? Rights Issues. Associated Breweries is planning to market unleaded beer. To finance the venture, it proposes to make a rights issue with a subscription price of $10. One new share can be purchased for each two shares held. The company currently has outstanding 100,000 shares priced at $40 a share. Assuming that the new money is invested to earn a fair return, give values for the following: ( LO15-3) a. Number of new shares. b. Amount of new investment. c. Total value of company after the issue. d. Total number of shares after the issue. e. Share price after the issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts