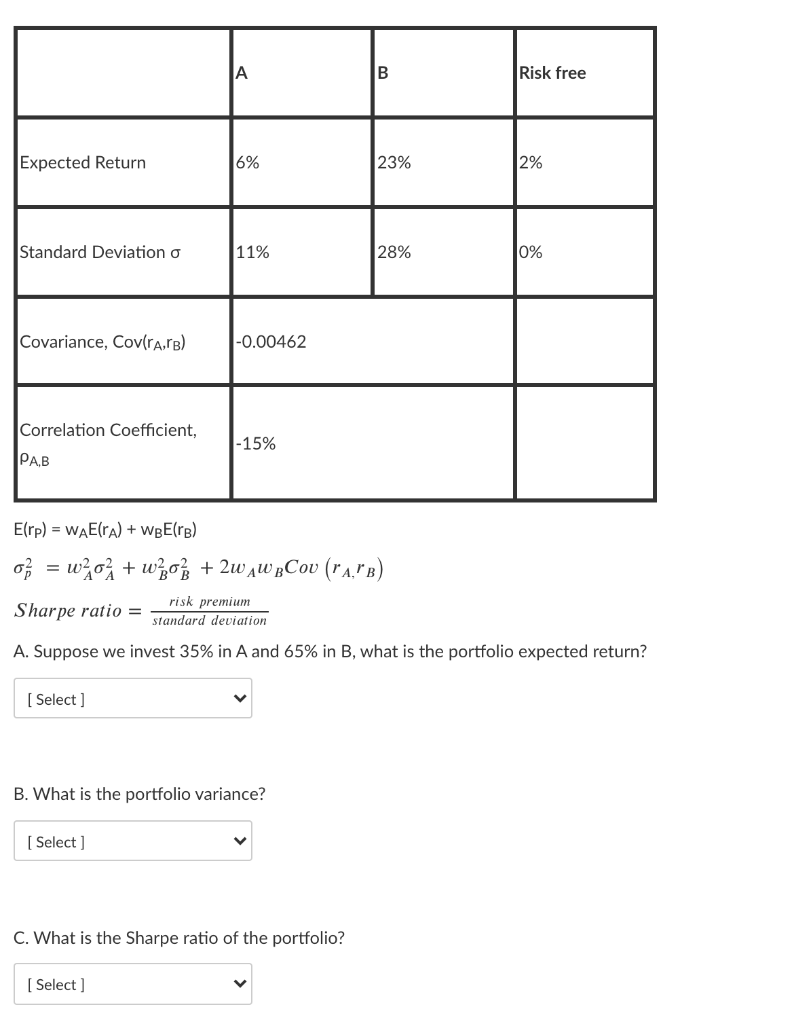

Question: A B Risk free Expected Return 6% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rarb) -0.00462 Correlation Coefficient, - 15% |, E(rp) =

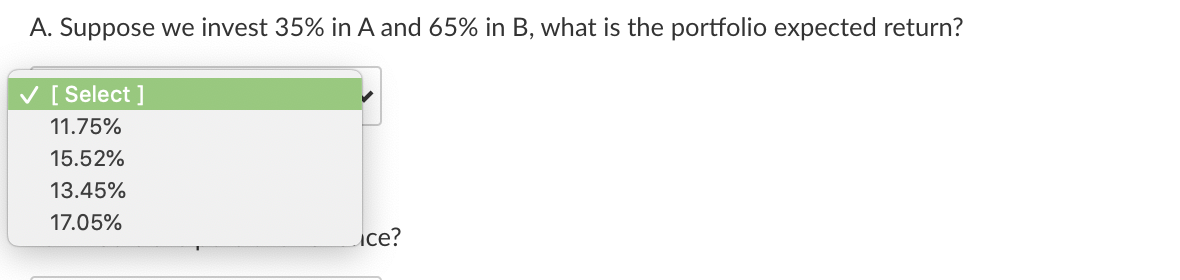

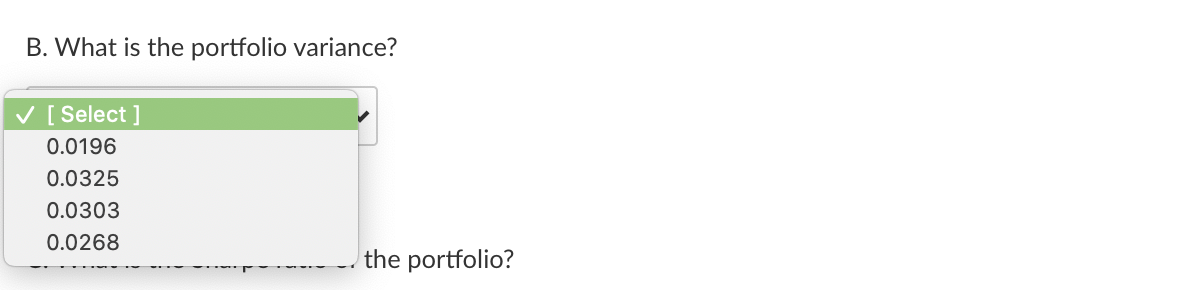

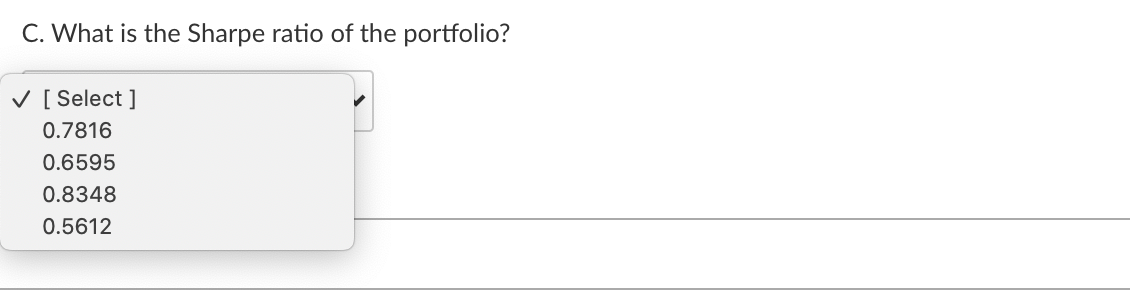

A B Risk free Expected Return 6% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rarb) -0.00462 Correlation Coefficient, - 15% |, E(rp) = WAE(ra) + WBE(r) c = 10 + updB + 2u Au Cou (CA, B) Sharpe ratio = risk premium standard deviation A. Suppose we invest 35% in A and 65% in B, what is the portfolio expected return? [ Select ] B. What is the portfolio variance? [ Select ] C. What is the Sharpe ratio of the portfolio? [ Select] A. Suppose we invest 35% in A and 65% in B, what is the portfolio expected return? [Select ] 11.75% 15.52% 13.45% 17.05% uce? B. What is the portfolio variance? [Select ] 0.0196 0.0325 0.0303 0.0268 the portfolio? C. What is the Sharpe ratio of the portfolio? [Select ] 0.7816 0.6595 0.8348 0.5612

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts