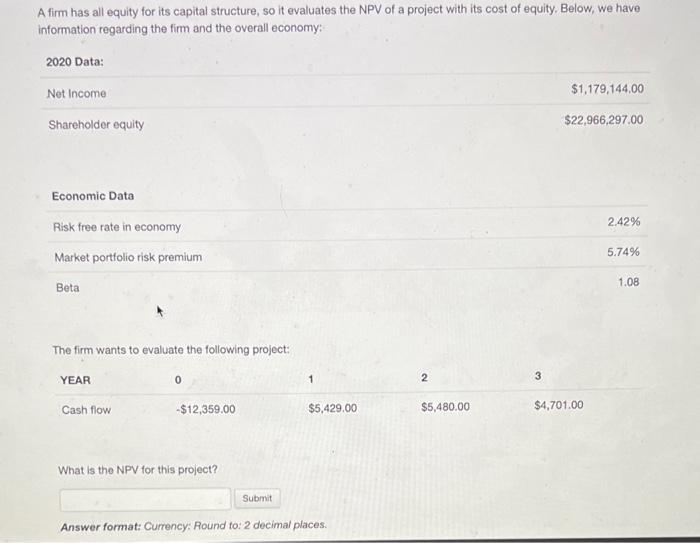

Question: A firm has all equity for its capital structure, so it evaluates the NPV of a project with its cost of equity. Below, we

A firm has all equity for its capital structure, so it evaluates the NPV of a project with its cost of equity. Below, we have information regarding the firm and the overall economy: 2020 Data: Net Income Shareholder equity $1,179,144,00 $22,966,297.00 Economic Data Risk free rate in economy Market portfolio risk premium Beta The firm wants to evaluate the following project: YEAR Cash flow 0 -$12,359.00 What is the NPV for this project? Submit 1 $5,429.00 Answer format: Currency: Round to: 2 decimal places. 2 3 $5,480.00 $4,701.00 2.42% 5.74% 1.08

Step by Step Solution

There are 3 Steps involved in it

To calculate the net present value NPV of the project using the firms cost of equi... View full answer

Get step-by-step solutions from verified subject matter experts