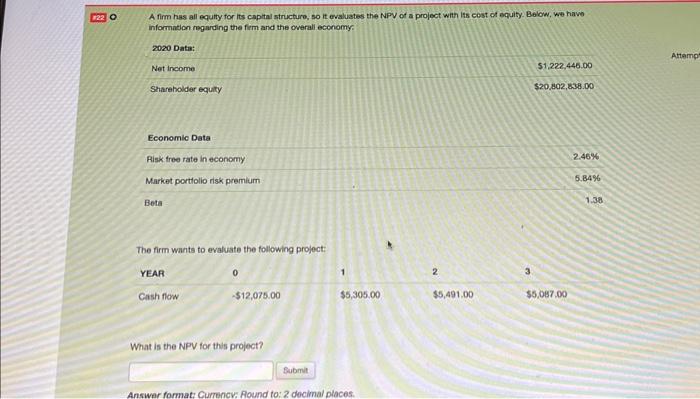

Question: A firm has all equity for its capital structuro, so it evaluates the NPV of a project with iss cost of equity. Bolow, we have

A firm has all equity for its capital structuro, so it evaluates the NPV of a project with iss cost of equity. Bolow, we have information regarding the firm and the overall ecconomy. \begin{tabular}{lr} 2020 Data: & \\ Net income & $1,222,446.00 \\ Shareholder equity & $20,802,838.00 \end{tabular} Economic Data Aisk free rate in economy Market portfollo risk premium Beta 2.46% 5.84% 1,38 The firm wants to evaluate the following project: YEAR Cash flow 0 $12,075.00 1 $5,305.00 2 $5,491,00 3 $5,087,00 Attamp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts