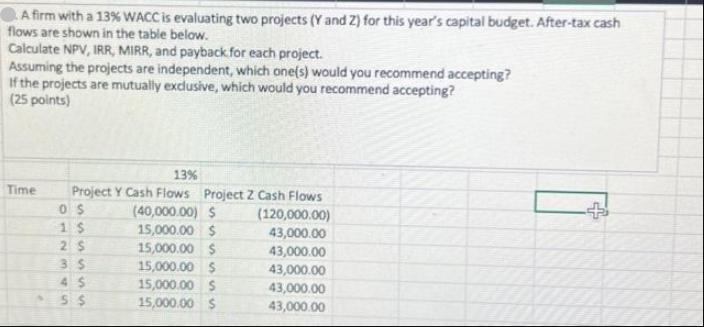

Question: A firm with a 13% WACC is evaluating two projects (Y and 2) for this year's capital budget. After-tax cash flows are shown in

A firm with a 13% WACC is evaluating two projects (Y and 2) for this year's capital budget. After-tax cash flows are shown in the table below. Calculate NPV, IRR, MIRR, and payback for each project. Assuming the projects are independent, which one(s) would you recommend accepting? If the projects are mutually exclusive, which would you recommend accepting? (25 points) Time 13% Project Y Cash Flows Project Z Cash Flows (40,000.00) $ 15,000.00 $ 15,000.00 $ 15,000.00 $ 15,000.00 $ 15,000.00 $ 05 15 2 S 3 5 45 55 (120,000.00) 43,000.00 43,000.00 43,000.00 43,000.00 43,000.00 +

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the NPV IRR MIRR and payback period for each project we need to discount the cash flows using the weighted average cost of capit... View full answer

Get step-by-step solutions from verified subject matter experts