Question: (a) Joe & Donald (J&D) Pty Ltd is a fast-growing manufacturing company. J&D is by far your largest audit client. While conducting the audit

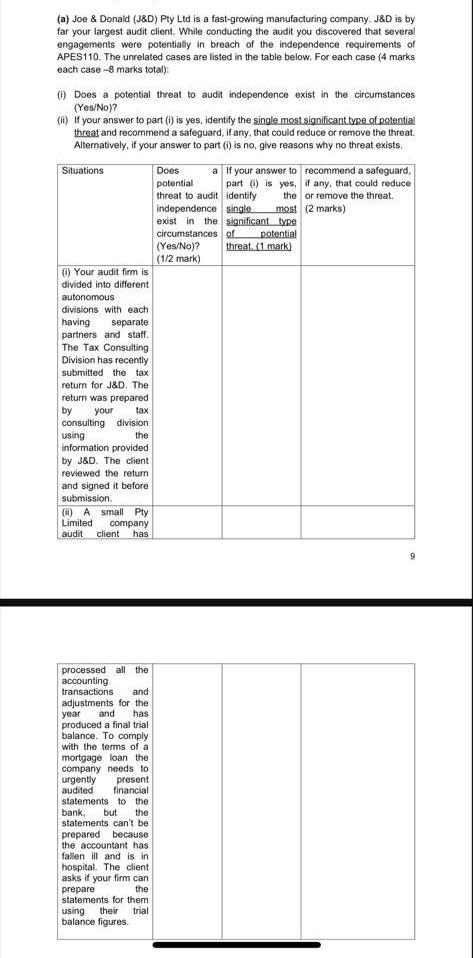

(a) Joe & Donald (J&D) Pty Ltd is a fast-growing manufacturing company. J&D is by far your largest audit client. While conducting the audit you discovered that several engagements were potentially in breach of the independence requirements of APES110. The unrelated cases are listed in the table below. For each case (4 marks each case-8 marks total): (1) Does a potential threat to audit independence exist in the circumstances (Yes/No)? (ii) If your answer to part (i) is yes, identify the single most significant type of potential threat and recommend a safeguard, if any, that could reduce or remove the threat. Alternatively, if your answer to part (i) is no, give reasons why no threat exists. Situations Does potential a If your answer to recommend a safeguard, part (i) is yes, if any, that could reduce the or remove the threat. threat to audit identify independence single most (2 marks) exist in the significant type circumstances of potential (i) Your audit firm is divided into different autonomous divisions with each having separate partners and staff. The Tax Consulting Division has recently submitted the tax return for J&D. The return was prepared by your tax consulting division using the information provided by J&D. The client i reviewed the return and signed it before submission. (i) A small Pty Limited company audit client has processed all the accounting transactions and has adjustments for thei year and produced a final trial balance. To comply with the terms of a mortgage loan the company needs to urgently present audited financial statements to the bank, but the statements can't be prepared because the accountant has fallen ill and is in hospital. The client asks if your firm can prepare statements for them the using their trial balance figures. (Yes/No)? (1/2 mark) threat. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

a i Yes a potential threat to audit independence exists in the circumstances ii The single most sign... View full answer

Get step-by-step solutions from verified subject matter experts