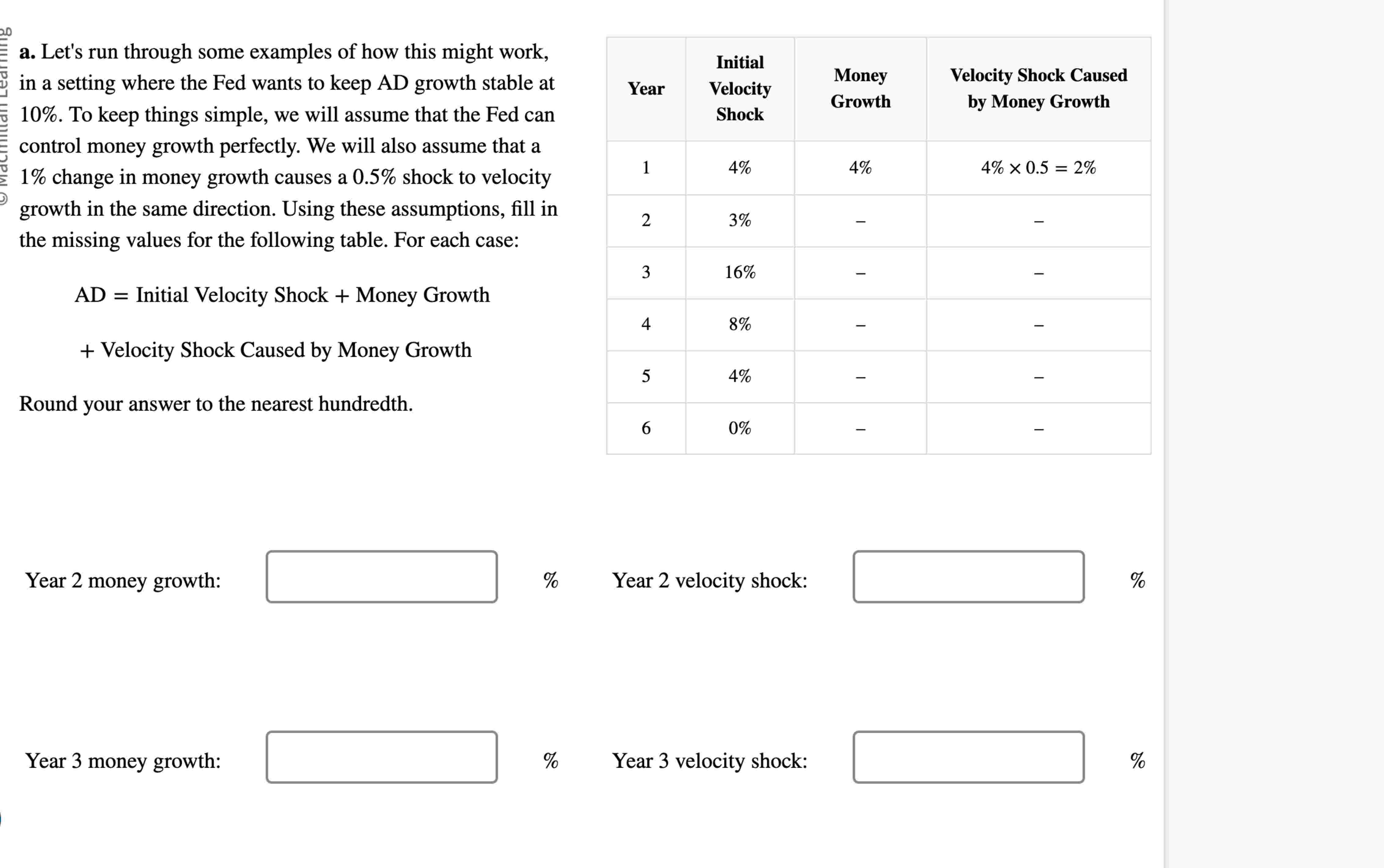

Question: a . Let's run through some examples of how this might work, in a setting where the Fed wants to keep AD growth stable at

a Let's run through some examples of how this might work, in a setting where the Fed wants to keep AD growth stable at To keep things simple, we will assume that the Fed can control money growth perfectly. We will also assume that a change in money growth causes a shock to velocity growth in the same direction. Using these assumptions, fill in the missing values for the following table. For each case:

mathrmAD Initial Velocity Shock Money Growth

Velocity Shock Caused by Money Growth

Round your answer to the nearest hundredth.

Year money growth:

Year velocity shock:

Year velocity shock:

Year money growth:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock