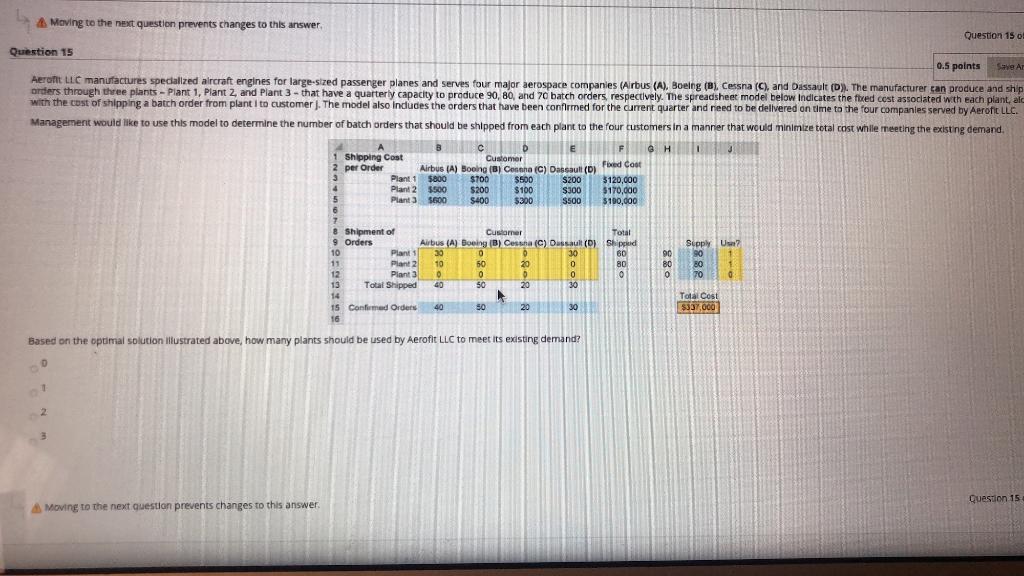

Question: A Moving to the next question prevents changes to this answer Question 15 : Question 15 0.5 points SA Aeroft LLC manufactures specialized aircraft engines

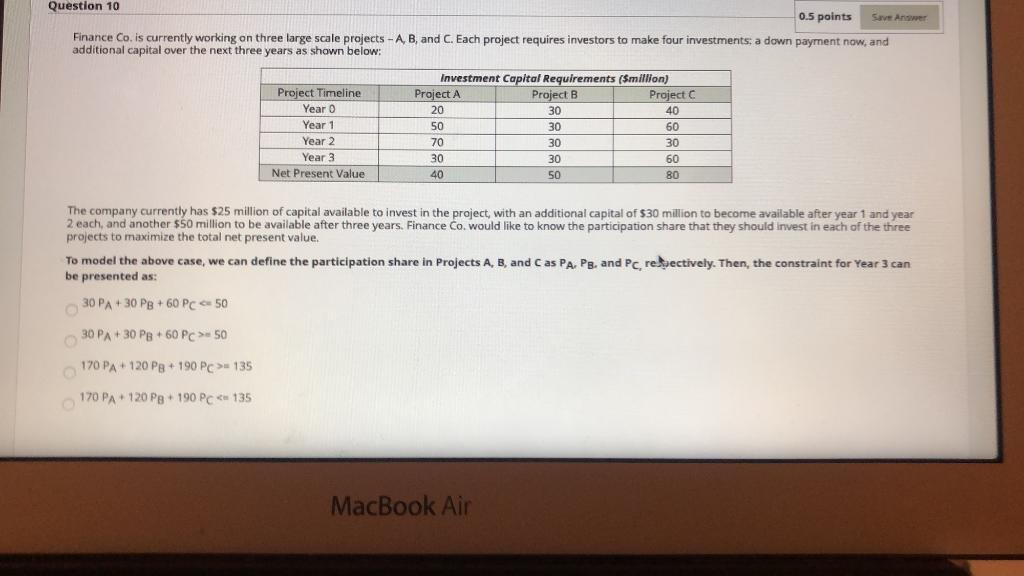

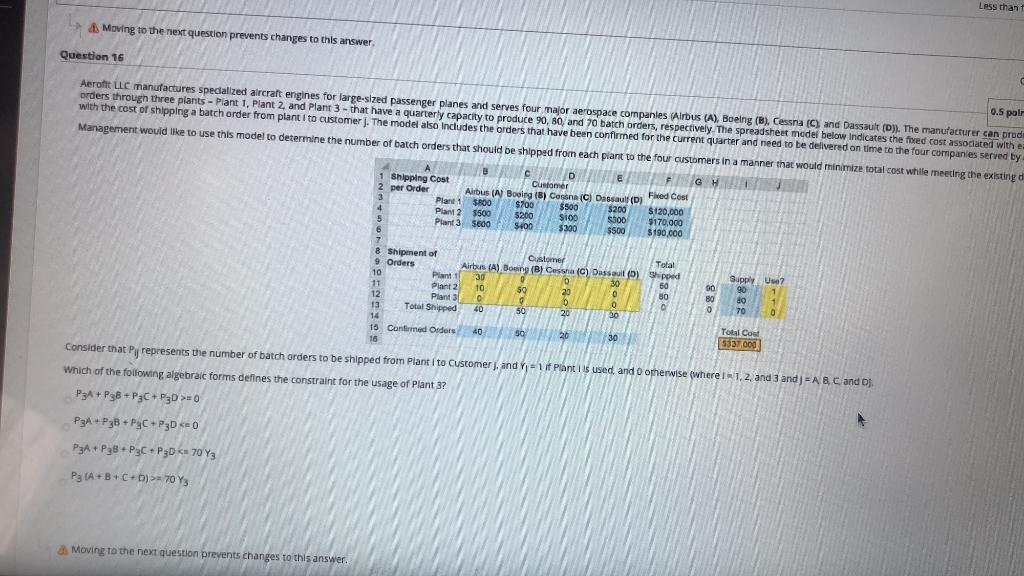

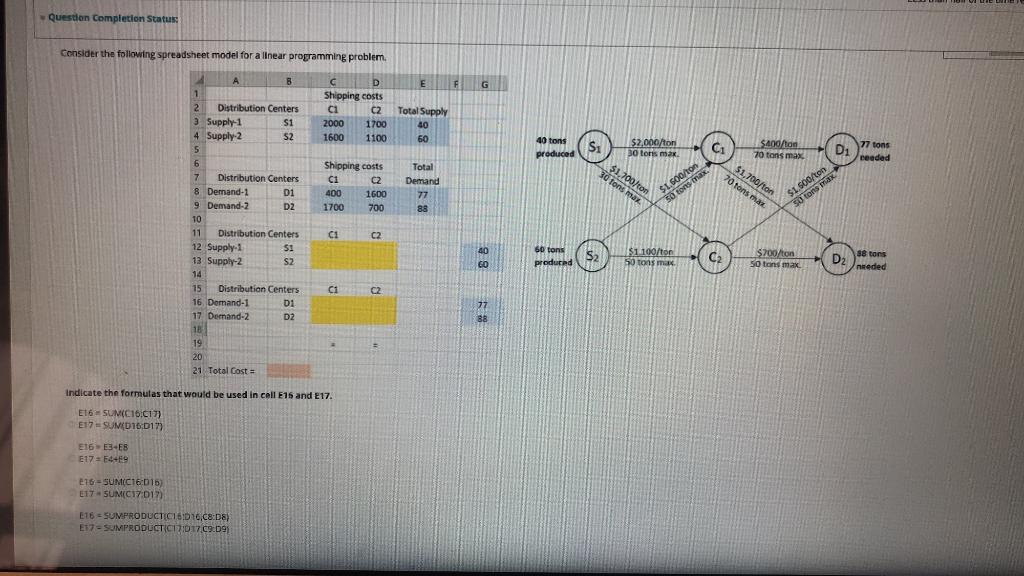

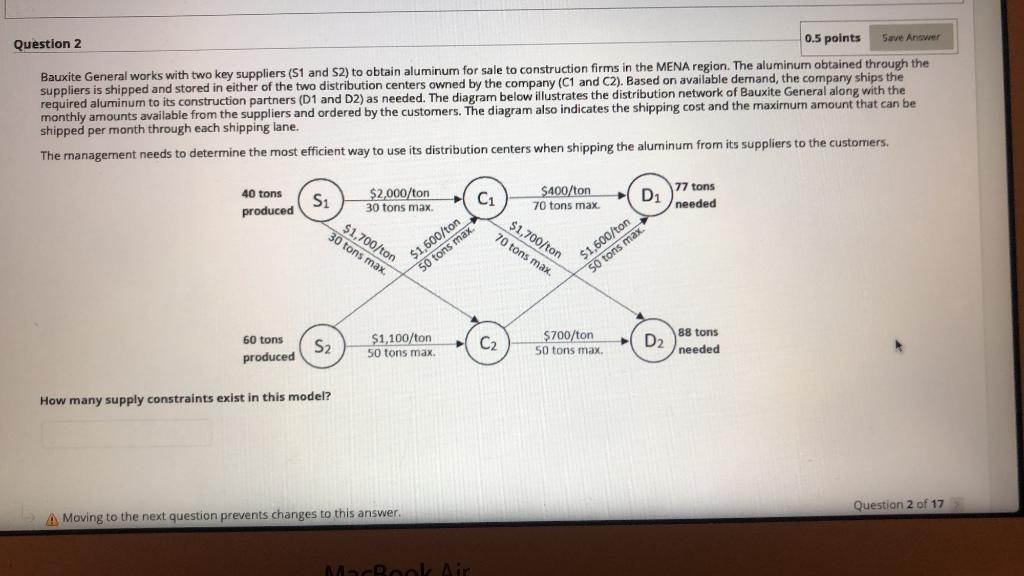

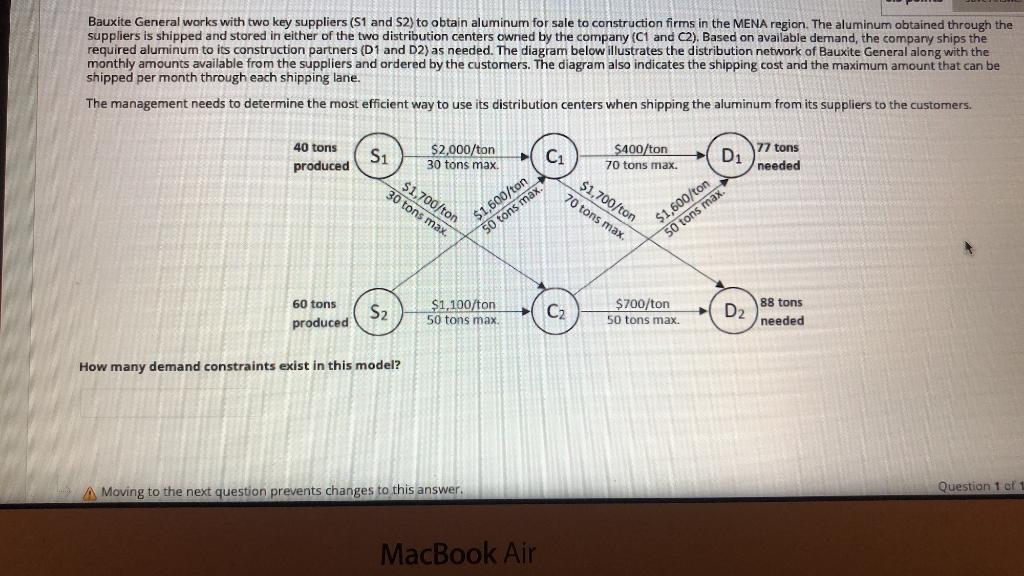

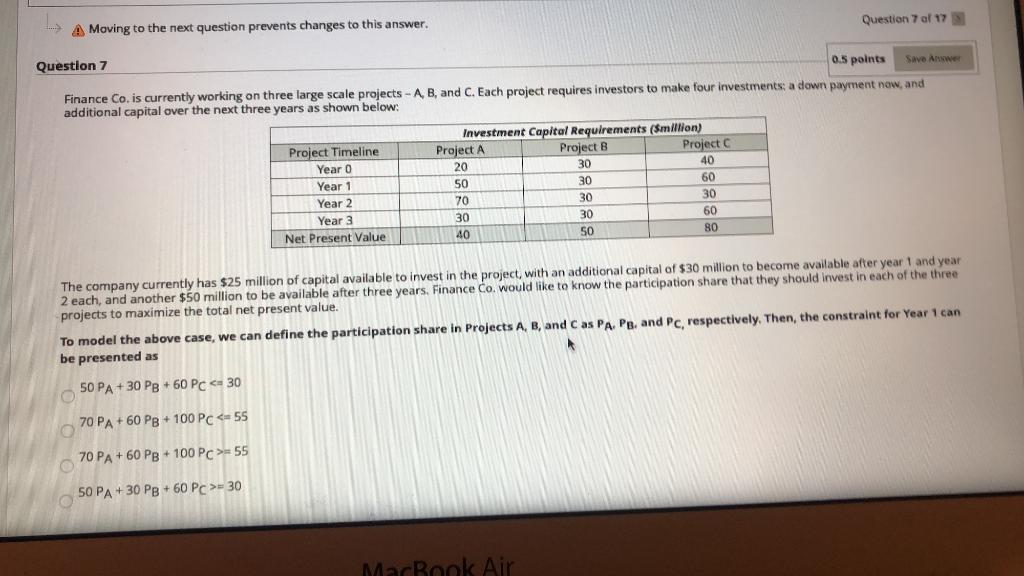

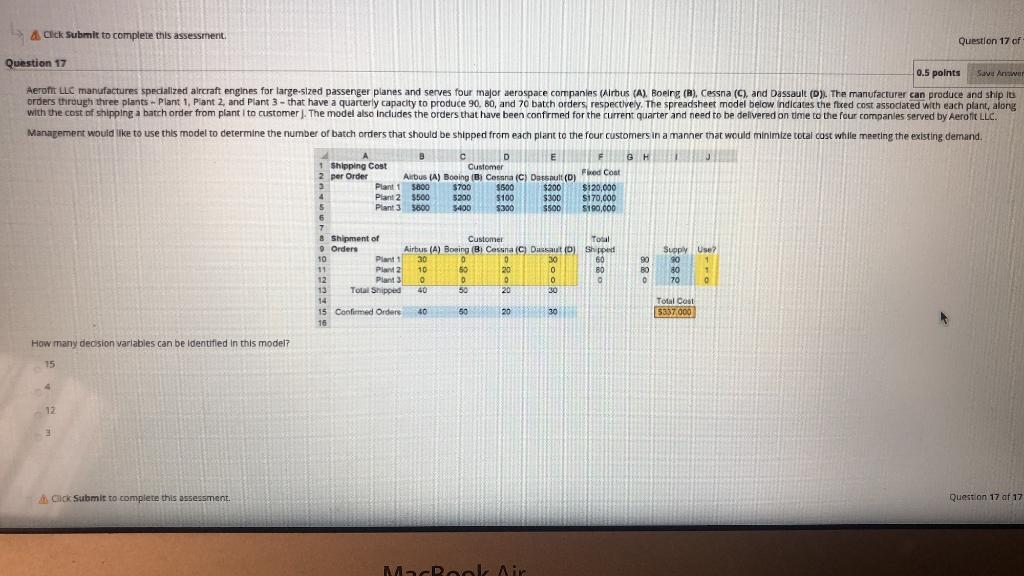

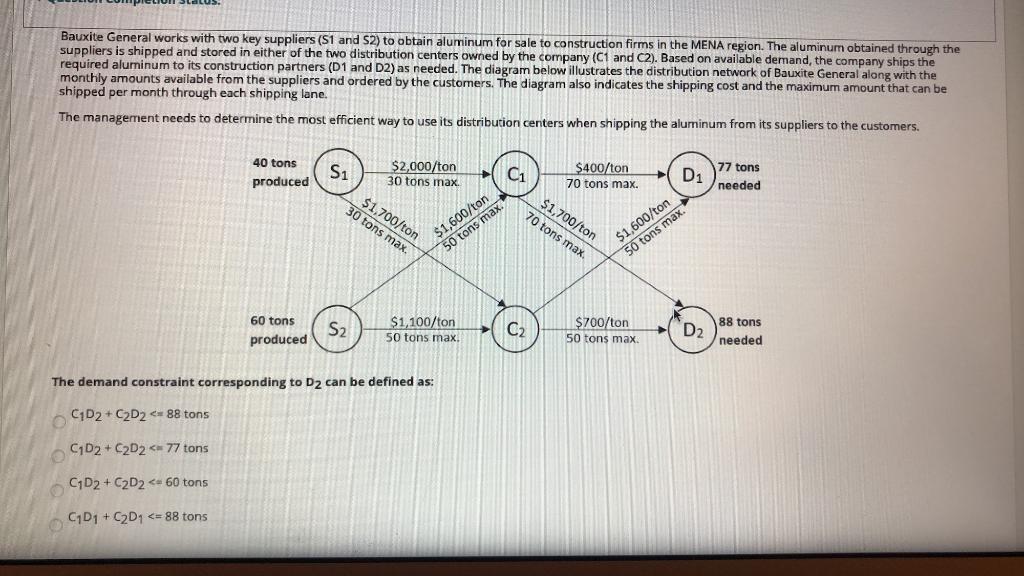

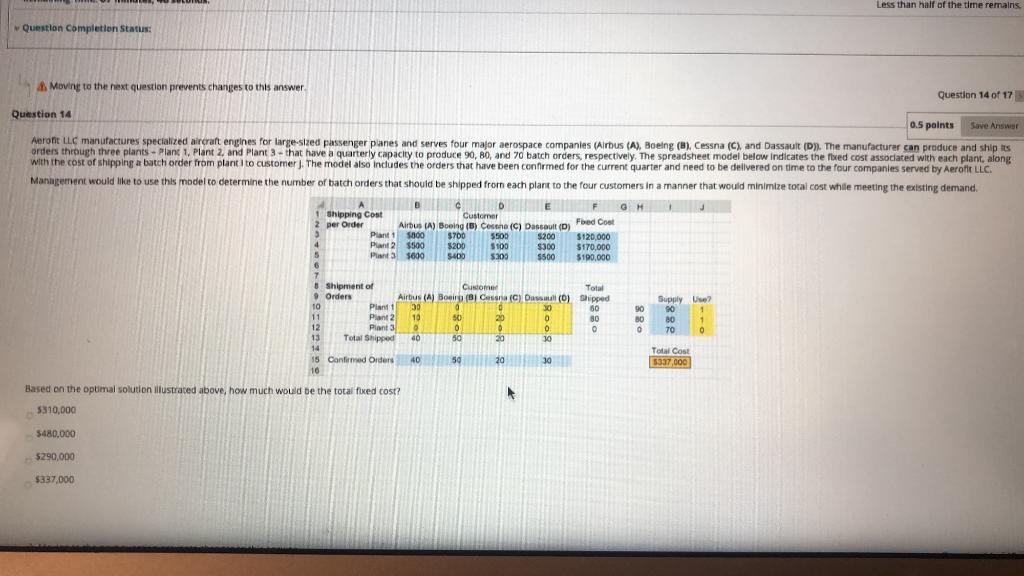

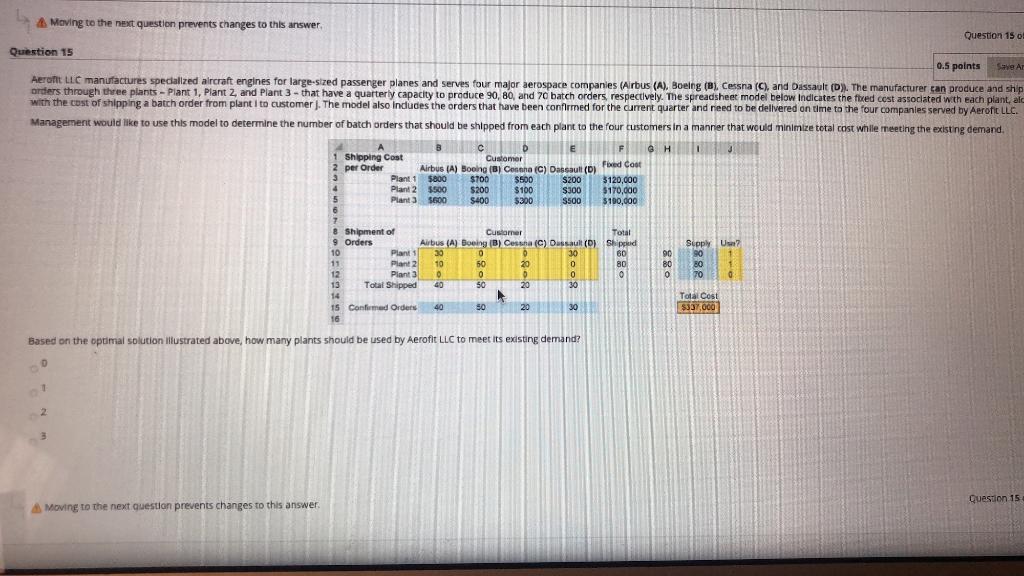

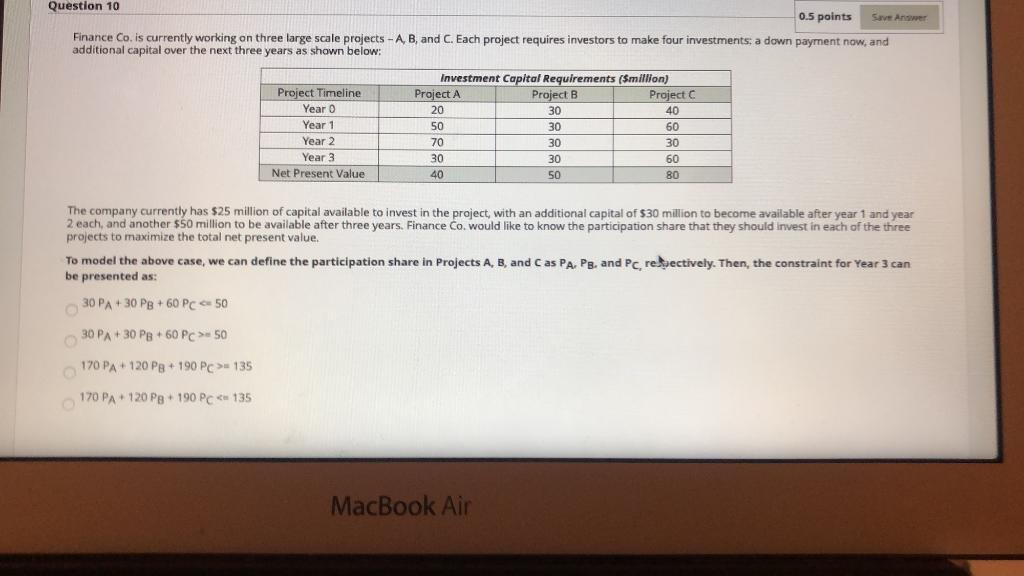

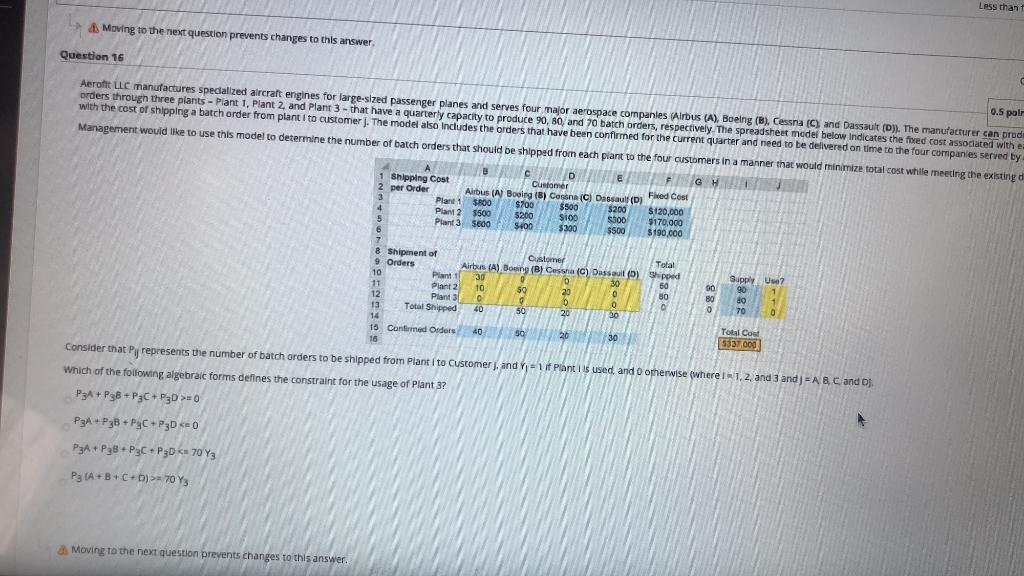

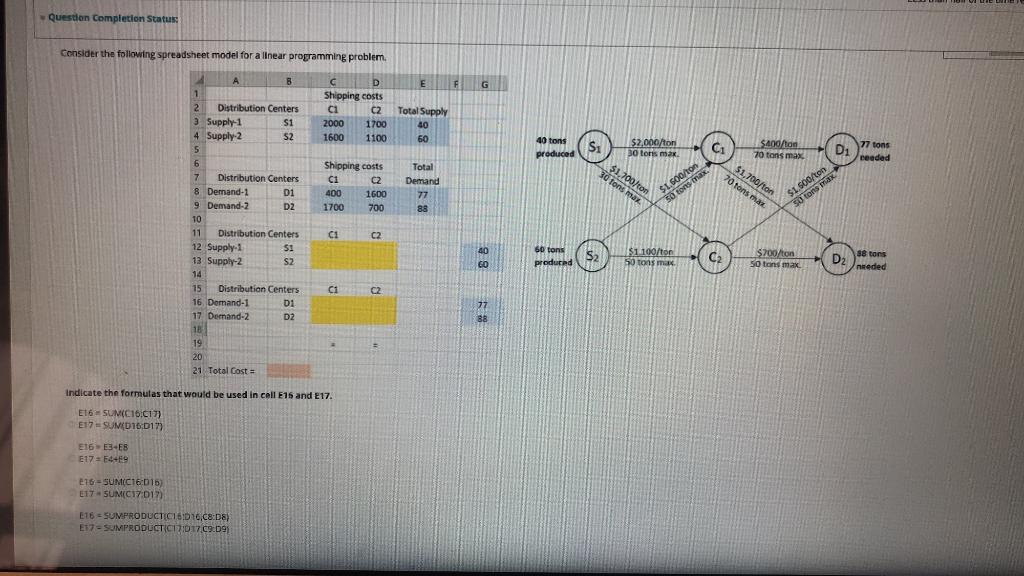

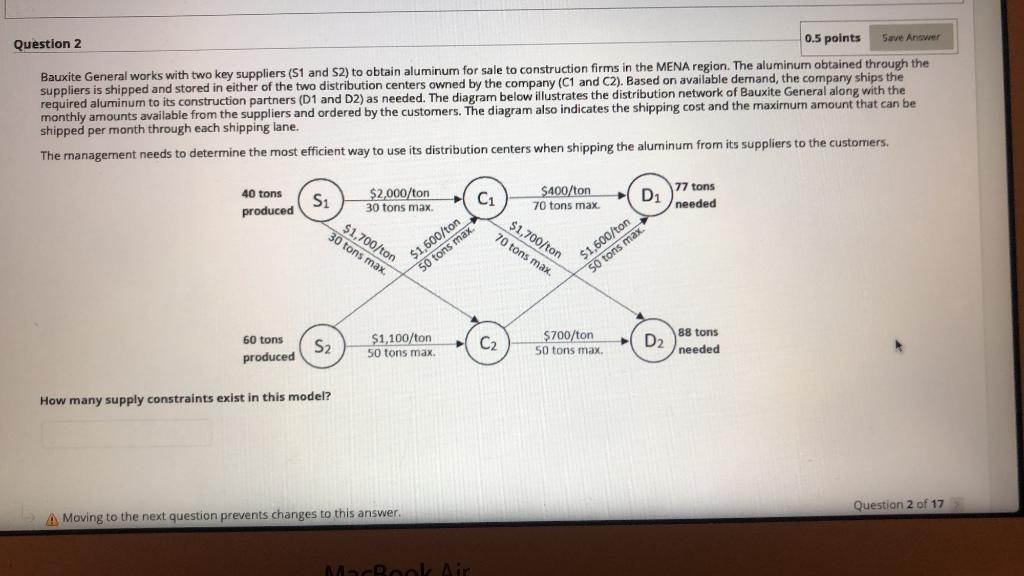

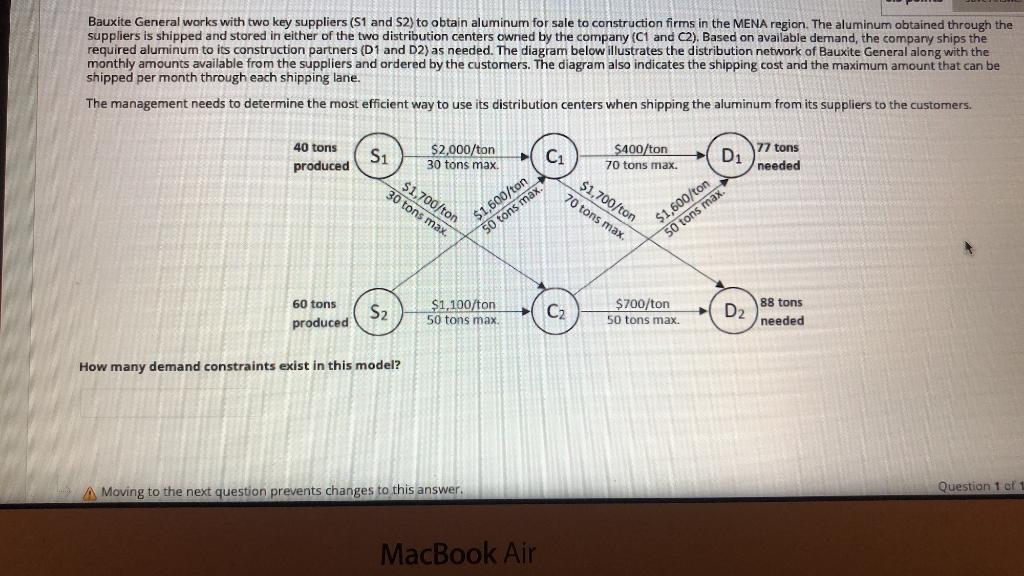

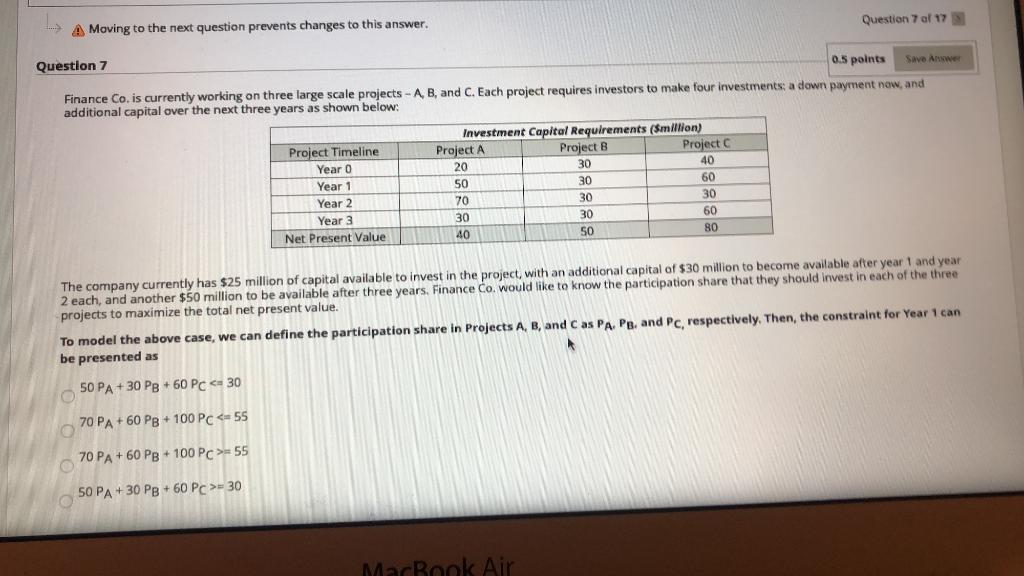

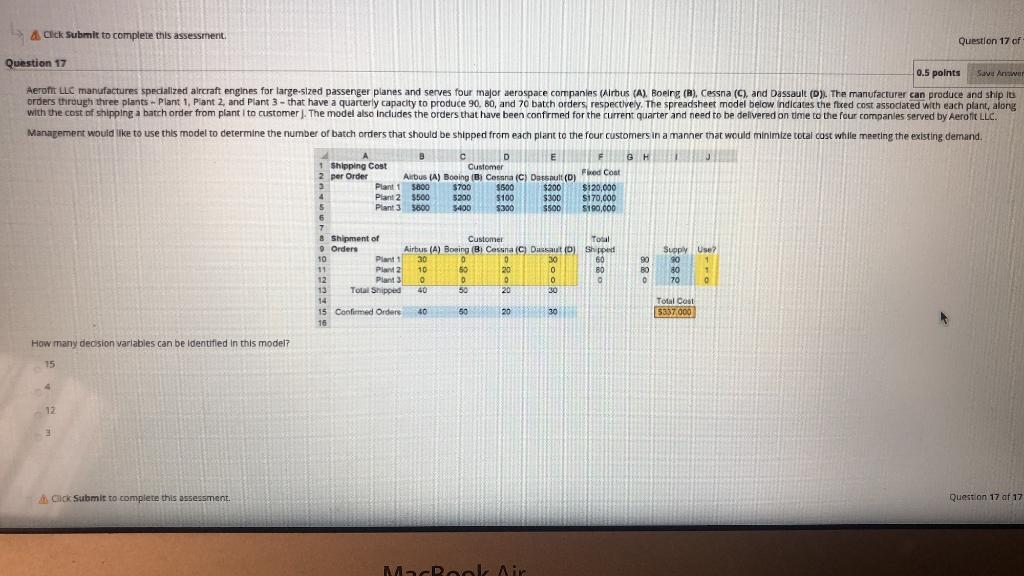

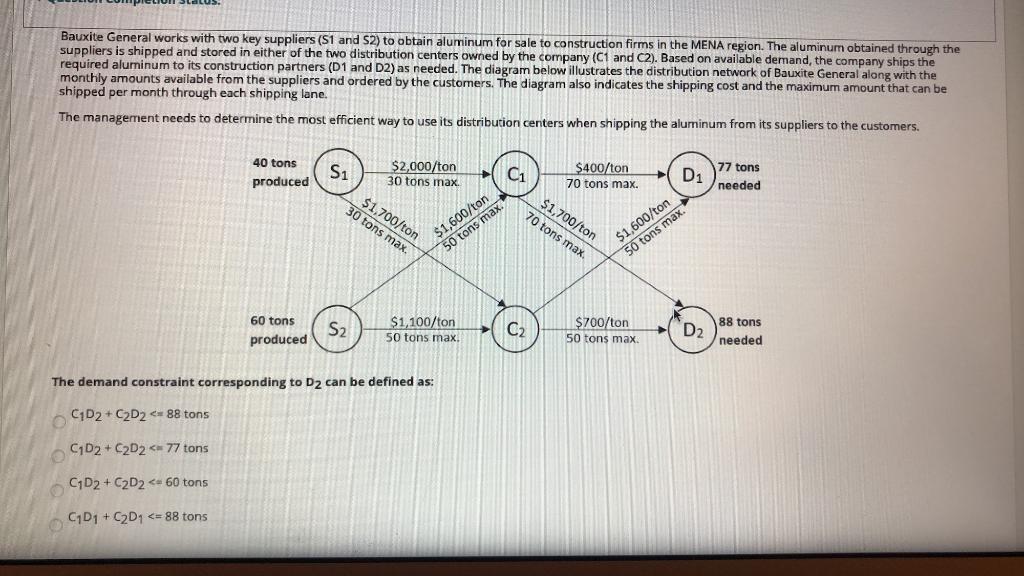

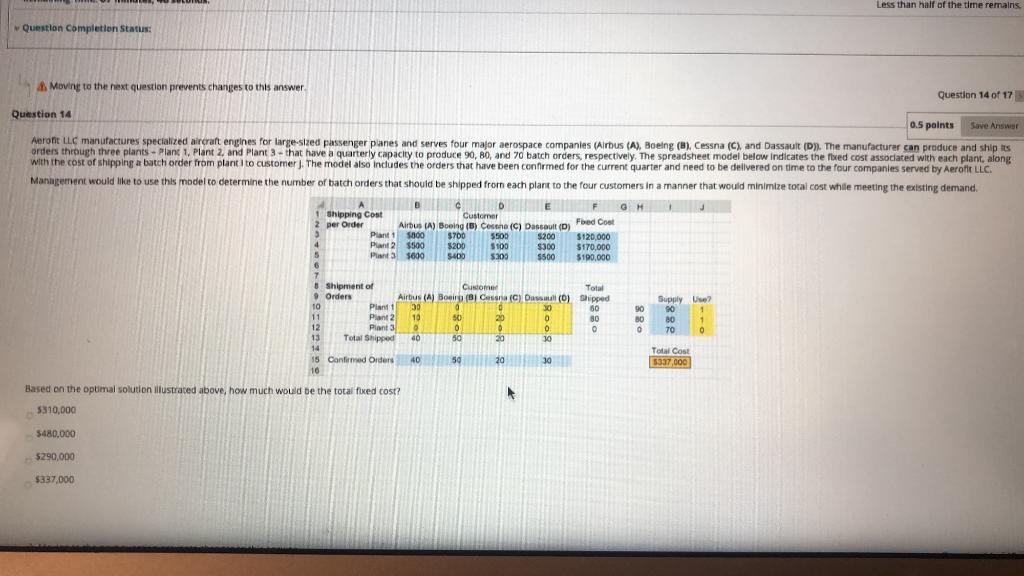

A Moving to the next question prevents changes to this answer Question 15 : Question 15 0.5 points SA Aeroft LLC manufactures specialized aircraft engines for large-sized passenger planes and serves four major aerospace companies (Airbus (A), Boeing (B), Cessna (C), and Dassault (D). The manufacturer can produce and ship orders through three plants - Plant 1, Plant 2 and Plant 3 - that have a quarterly capacity to produce 90, 80, and 70 batch orders, respectively. The spreadsheet model below Indicates the fixed cest associated with each plant, alc with the cost of shipping a batch order from plant i to customer. The model also Indudes the orders that have been confirmed for the current quarter and need to be delivered on time to the four companies served by Aeroft LLC. Management would like to use this model to determine the number of batch orders that should be shipped from each plant to the four customers in a manner that would minimize total cost while meeting the existing demand. D @H 1 Shipping Cost Customer 2 per Order Airbus (A) Boong (B) Cesena (C) Dassault (o) fwd Cost Plant 1 5800 $100 $200 $120,000 4 Plant 2 $500 $200 $100 S300 $170,000 5 Plant) $600 $400 $300 S500 $100,000 6 7 8 Shipment of Customer Total 9 Orders Airbus (A) Boeing (B) Cessna (C) Dassault() shipped Supply Us? 10 Plant 30 30 60 90 90 11 Plant 2 10 50 20 0 80 80 80 1 12 Plant 3 o 0 0 0 0 0 70 0 13 Total Shipped 50 20 30 14 Total Cost 15 Confirmed Orders 40 50 20 30 5337,000 16 Based on the optimal solution illustrated above, how many plants should be used by Aerofit LLC to meet its existing demand? 5500 0 Question 15 Moving to the next question prevents changes to this answer Question 10 0.5 points Save Answer Finance Co. is currently working on three large scale projects - A, B, and C. Each project requires investors to make four investments: a down payment now, and additional capital over the next three years as shown below: Investment Capital Requirements (Smillion) Project Timeline Project A Project B Project C Year o 20 30 40 Year 1 50 30 60 Year 2 70 30 30 Year 3 30 30 60 Net Present Value 40 50 80 The company currently has $25 million of capital available to invest in the project, with an additional capital of $30 million to become available after year 1 and year 2 each, and another $50 million to be available after three years. Finance Co. would like to know the participation share that they should invest in each of the three projects to maximize the total net present value. To model the above case, we can define the participation share in Projects A, B, and C as PA, Pg. and Pc, respectively. Then, the constraint for Year 3 can be presented as: 30 PA +30 P8 + 60 PC 50 30 PA+ 30 PB + 60 Pc > 50 170 PA+ 120 PB 190 PC > 135 170 PA+ 120 P8 + 190 PC-135 MacBook Air Less than Moving to the next question prevents changes to this answer Question 16 0.5 polr Aeroft Luc manufactures spedalized aircraft engines for large-sized passenger planes and serves four major aerospace companies (Arbus (A), Boeing (B). Cessna (C) and Dassault (D)). The manufacturer can prod orders through three plants - Plant 1, Plant 2 and Plant 3- that have a quarterly capacity to produce 90, 80, and 70 batch orders, respectively. The spreadsheet model below indicates the fored cost associated with e with the cost of shipping a batch order from plant i to customerJ. The model also includes the orders that have been confirmed for the current quarter and need to be delivered on time to the four companies served by Management would like to use this model to determine the number of batch orders that should be shipped from each plant to the four customers in a manner that would minimize total cost while meeting the existing Bc D E HIGH Shipping Cost Customer per Order Airbus (A) Booling (8) Casona (C) Dassault (Dj Fleed Cont Plant 1 $800 $7001 $500 $200 $120,000 Plant 2 $500 5200 $100 $300 3170.000 5 Plant 3 $600 $100 $300 $500 $190.000 6 7 8 Shipment of Customer Total 9 Orders Airbus (A) Boeing (B) Cessna (C) Dassault) Shipped Supply Us? 10 Plant 30 0 30 50 30 00 11 Plant 2 10 50 22 80 80 12 Plant 3 0 0 o 70 13 Total Shipped 40 50 20 30 14 Total Cost 15 Confirmed Orders 40 30 20 30 5337.000 16 Consider that represents the number of batch orders to be shipped from Piant i to Customers, and Y - if plant is used, and otherwise where I 1.2 and 3 and} = A B C and Dj. Which of the following algebraic forms defines the constraint for the usage of Plant 3? P3A + P38 + P3CP30 >=0 30 0 PyA+P3B P3C-P3D 70 Y3 Moving to the next question prevents changes to this answer. Question Completion Status: Consider the following spreadsheet model for a linear programming problem E D Shipping costs CI C2 2000 1700 1600 1100 Total Supply 80 60 40 tons Si $/ $2,000/ton 30 tor max 77 tons $400/ 70 tons max produced Ci Di needed $1,700/ton 30 tons mar Shipping costs C1 C2 400 1600 1700 700 Total Demand 77 88 $1,700/ton 70 tons max $1.500/ 50 tons tax. $1.500/ton So tons max B 1 2 Distribution Centers 3 Supply-1 S1 4 Supply 2 52 5 6 7 Distribution Centers 8 Demand-1 D1 9 Demand-2 D2 10 11 Distribution Centers 12 Supply 1 SI 13 Supply-2 S2 14 15 Distribution Centers 16 Demand-1 01 17 Demand-2 D2 18 19 20 21 Total Cost CH C2 60 tons produced S2 $1100 ton 50 tons mu C2 88 tons $200/ton 50 tons max D2 needed CO C1 C2 77 88 Indicate the formulas that would be used in cell 16 and 17. E16 SUM(C16.017) E17 - SUND 16:017) E16E-8 E17 = E4-E9 116= SUM(C16:15) E17 SUM(C17012) E16 SUMPRODUCTICID 16.08:08) E17 = SUMPRODUCTC171017.09.09 Question 2 0.5 points Save Answer Bauxite General works with two key suppliers (51 and 52) to obtain aluminum for sale to construction firms in the MENA region. The aluminum obtained through the suppliers is shipped and stored in either of the two distribution centers owned by the company (C1 and C2). Based on available demand, the company ships the required aluminum to its construction partners (D1 and D2) as needed. The diagram below illustrates the distribution network of Bauxite General along with the monthly amounts available from the suppliers and ordered by the customers. The diagram also indicates the shipping cost and the maximum amount that can be shipped per month through each shipping lane. The management needs to determine the most efficient way to use its distribution centers when shipping the aluminum from its suppliers to the customers. 40 tons produced Si $2,000/ton 30 tons max $400/ton 70 tons max. D 77 tons needed $1,700/ton 30 tons max $1,700/ton 70 tons max $1,600/ton 50 tons max $1,600/ton 50 tons max. 60 tons produced S2 $1,100/ton 50 tons max C2 $700/ton 50 tons max. D2 88 tons needed How many supply constraints exist in this model? Question 2 of 17 A Moving to the next question prevents changes to this answer MB Air Bauxite General works with two key suppliers (S1 and S2) to obtain aluminum for sale to construction firms in the MENA region. The aluminum obtained through the suppliers is shipped and stored in either of the two distribution centers owned by the company (C1 and C2). Based on available demand, the company ships the required aluminum to its construction partners (D1 and D2) as needed. The diagram below illustrates the distribution network of Bauxite General along with the monthly amounts available from the suppliers and ordered by the customers. The diagram also indicates the shipping cost and the maximum amount that can be shipped per month through each shipping lane. The management needs to determine the most efficient way to use its distribution centers when shipping the aluminum from its suppliers to the customers. 77 tons 40 tons produced S1 $2,000/ton 30 tons max. C $400/ton 70 tons max. D1 needed $1,700/ton 30 tons max. $1,700/ton 70 tons max $1,600/ton 50 tons max. $1,600/ton 50 tons max. 60 tons produced S2 $1,100/ton 50 tons max. C2 $700/ton 50 tons max. D2 88 tons needed How many demand constraints exist in this model? Question 1 of 1 A Moving to the next question prevents changes to this answer. MacBook Air Question 7 of 12 A Moving to the next question prevents changes to this answer. Question 7 0.5 points Savo Answer Finance Co. is currently working on three large scale projects - A, B, and C. Each project requires investors to make four investments a down payment now, and additional capital over the next three years as shown below: Investment Capital Requirements (Smillion) Project Timeline Project A Project B Project Year 0 20 30 40 Year 1 50 30 60 Year 2 70 30 30 Year 30 30 60 Net Present Value 40 50 80 The company currently has $25 million of capital available to invest in the project, with an additional capital of $30 million to become available after year 1 and year 2 each, and another $50 million to be available after three years, Finance Co. would like to know the participation share that they should invest in each of the three projects to maximize the total net present value. To model the above case, we can define the participation share in Projects A, B, and C as PA, PB, and Pc, respectively. Then, the constraint for Year 1 can be presented as 50 PA + 30 PB 60 PC =55 50 PA +30 PB + 60 PC >= 30 MacBook Air A Click Submit to complete this assessmerit Question 17 of Question 17 0.5 points Save Answer Aeroft LLC manufactures specialized alrcraft engines for large-sized passenger planes and serves four major aerospace companies (Arbus (A), Boeing (R). Cessna (C), and Dassault (D). The manufacturer can produce and ship its orders through three plants - Plant 1, Plant 2, and Plant 3 - that have a quarterly capacity to produce 90, 80, and 70 batch orders respectively. The spreadsheet model below indicates the fixed cost associated with each plant, along with the cost of shipping a batch order from plant to customers. The model also includes the orders that have been confirmed for the current quarter and need to be delivered on time to the four companies served by Aeront LLC. Management would like to use this model to determine the number of batch orders that should be shipped from each plant to the four customers in a manner that would minimize total cost while meeting the existing demand. B D E G H G 1 Shipping Cost Customer 2 per Order Albus (A) Boeing (B) Comana (C) Dassault (o) Fred Coat Plant 1 5800 $700 $500 $200 $120,000 Plant 2 $500 5200 5100 $300 $170,000 5 Plant 3 5600 $400 $300 $500 $190,000 6 7 8 Shipment of Customer Total 9 Orders Airbus (A) Boeing B Cessna (C) Dassaut (Dj Shpped Supply Use? 10 Plant 1 30 0 0 30 60 90 1 11 Plan 2 10 50 20 0 80 80 1 12 Plant 3 3 0 0 0 0 0 70 0 13 Total Shipped 40 50 20 30 14 Total Cost 15 Confirmed Orders 40 50 20 30 5337,000 16 90 BO 0 How many decision variables can be identified in this model? ? 15 12 Click Submit to complete this assessment. Question 17 of 17 MP Air Bauxite General works with two key suppliers (51 and 52) to obtain aluminum for sale to construction firms in the MENA region. The aluminum obtained through the suppliers is shipped and stored in either of the two distribution centers owned by the company (C1 and C2). Based on available demand, the company ships the required aluminum to its construction partners (D1 and D2) as needed. The diagram below illustrates the distribution network of Bauxite General along with the monthly amounts available from the suppliers and ordered by the customers. The diagram also indicates the shipping cost and the maximum amount that can be shipped per month through each shipping lane. The management needs to determine the most efficient way to use its distribution centers when shipping the aluminum from its suppliers to the customers. 40 tons Si $2,000/ton 30 tons max 177 tons C1 $400/ton 70 tons max. D1 produced needed $1,700/ton 30 tons max. $1,700/ton 70 tons max $1,600 max. $1,600/ton 50 tons max. 60 tons produced S2 $1,100/ton 50 tons max. C2 $700/ton 50 tons max. D2 88 tons needed The demand constraint corresponding to D2 can be defined as: C1D2C2D2