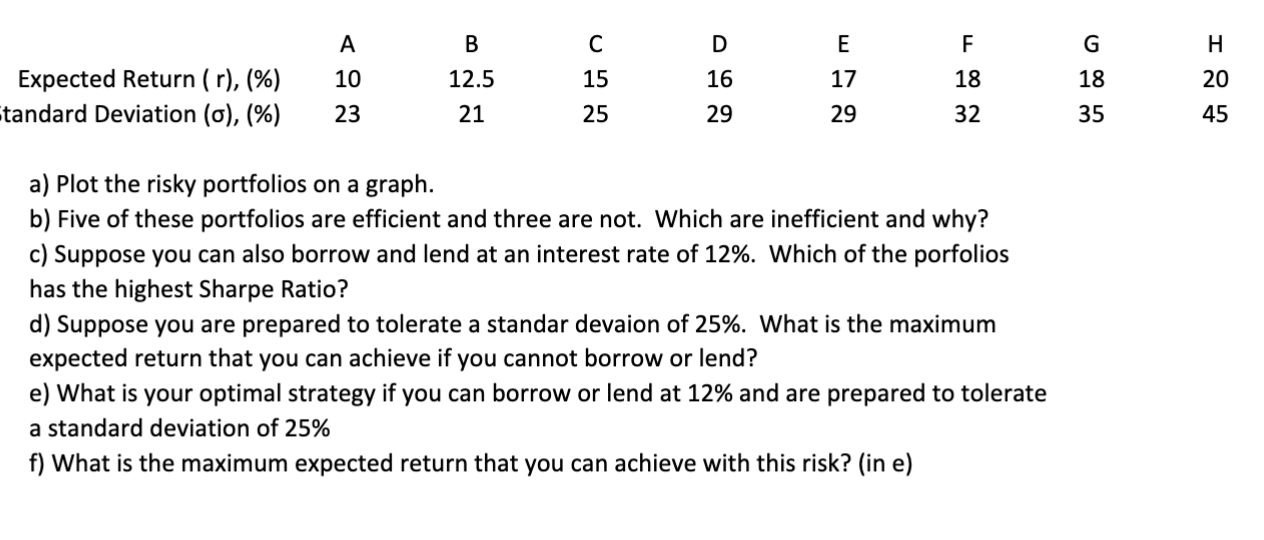

Question: a) Plot the risky portfolios on a graph. b) Five of these portfolios are efficient and three are not. Which are inefficient and why? c)

a) Plot the risky portfolios on a graph. b) Five of these portfolios are efficient and three are not. Which are inefficient and why? c) Suppose you can also borrow and lend at an interest rate of 12%. Which of the porfolios has the highest Sharpe Ratio? d) Suppose you are prepared to tolerate a standar devaion of 25%. What is the maximum expected return that you can achieve if you cannot borrow or lend? e) What is your optimal strategy if you can borrow or lend at 12% and are prepared to tolerate a standard deviation of 25% f) What is the maximum expected return that you can achieve with this risk? (in e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts