Question: A portfolio is to be constructed from two assets whose mean and variance of return rate are summarised in the table below. The correlation of

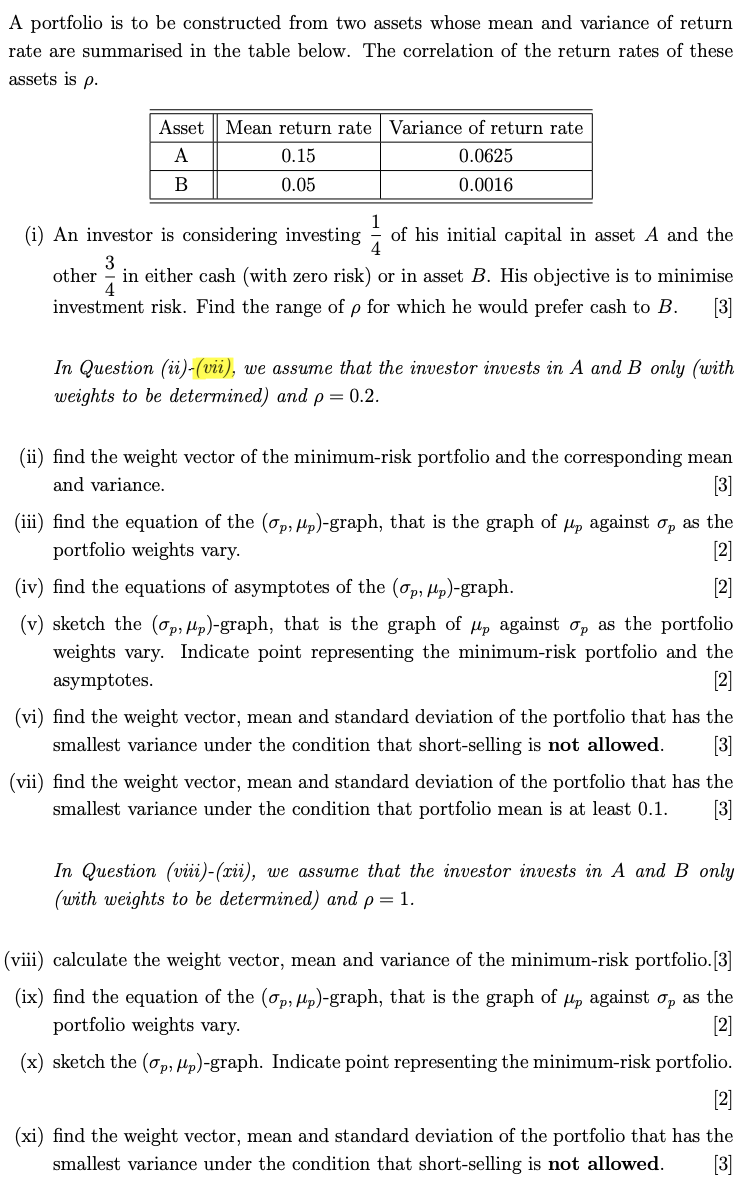

A portfolio is to be constructed from two assets whose mean and variance of return rate are summarised in the table below. The correlation of the return rates of these assets is p. Asset A B Mean return rate Variance of return rate 0.15 0.0625 0.0016 0.05 1 (i) An investor is considering investing of his initial capital in asset A and the 3 other in either cash (with zero risk) or in asset B. His objective is to minimise 4 investment risk. Find the range of p for which he would prefer cash to B. [3] In Question (ii)-(vii), we assume that the investor invests in A and B only (with weights to be determined) and p= 0.2. (ii) find the weight vector of the minimum-risk portfolio and the corresponding mean and variance. (iii) find the equation of the (Op, Mp)-graph, that is the graph of Mlp against op as the portfolio weights vary. [2] (iv) find the equations of asymptotes of the (Op, Mp)-graph. [2] (v) sketch the (Op, Mp)-graph, that is the graph of Hip against op as the portfolio weights vary. Indicate point representing the minimum-risk portfolio and the asymptotes. [2] (vi) find the weight vector, mean and standard deviation of the portfolio that has the smallest variance under the condition that short-selling is not allowed. [3] (vii) find the weight vector, mean and standard deviation of the portfolio that has the smallest variance under the condition that portfolio mean is at least 0.1. 3 In Question (viii)-(rii), we assume that the investor invests in A and B only (with weights to be determined) and p= 1. (viii) calculate the weight vector, mean and variance of the minimum-risk portfolio. [3] (ix) find the equation of the (Op, Mp)-graph, that is the graph of hp against op as the portfolio weights vary. (x) sketch the (Op, Mp)-graph. Indicate point representing the minimum-risk portfolio. [2] (xi) find the weight vector, mean and standard deviation of the portfolio that has the smallest variance under the condition that short-selling is not allowed. [3] A portfolio is to be constructed from two assets whose mean and variance of return rate are summarised in the table below. The correlation of the return rates of these assets is p. Asset A B Mean return rate Variance of return rate 0.15 0.0625 0.0016 0.05 1 (i) An investor is considering investing of his initial capital in asset A and the 3 other in either cash (with zero risk) or in asset B. His objective is to minimise 4 investment risk. Find the range of p for which he would prefer cash to B. [3] In Question (ii)-(vii), we assume that the investor invests in A and B only (with weights to be determined) and p= 0.2. (ii) find the weight vector of the minimum-risk portfolio and the corresponding mean and variance. (iii) find the equation of the (Op, Mp)-graph, that is the graph of Mlp against op as the portfolio weights vary. [2] (iv) find the equations of asymptotes of the (Op, Mp)-graph. [2] (v) sketch the (Op, Mp)-graph, that is the graph of Hip against op as the portfolio weights vary. Indicate point representing the minimum-risk portfolio and the asymptotes. [2] (vi) find the weight vector, mean and standard deviation of the portfolio that has the smallest variance under the condition that short-selling is not allowed. [3] (vii) find the weight vector, mean and standard deviation of the portfolio that has the smallest variance under the condition that portfolio mean is at least 0.1. 3 In Question (viii)-(rii), we assume that the investor invests in A and B only (with weights to be determined) and p= 1. (viii) calculate the weight vector, mean and variance of the minimum-risk portfolio. [3] (ix) find the equation of the (Op, Mp)-graph, that is the graph of hp against op as the portfolio weights vary. (x) sketch the (Op, Mp)-graph. Indicate point representing the minimum-risk portfolio. [2] (xi) find the weight vector, mean and standard deviation of the portfolio that has the smallest variance under the condition that short-selling is not allowed. [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts