Question: A risk averse decision maker with u(x) = vx faces a lottery L that delivers $2500 or $100 with equal (1/2) probabilities. (a) Would

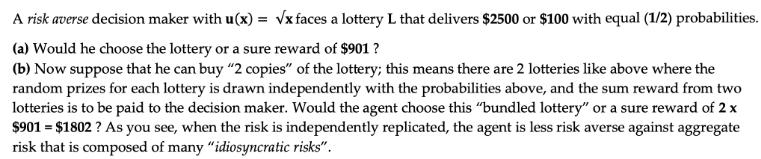

A risk averse decision maker with u(x) = vx faces a lottery L that delivers $2500 or $100 with equal (1/2) probabilities. (a) Would he choose the lottery or a sure reward of $901 ? (b) Now suppose that he can buy "2 copies" of the lottery; this means there are 2 lotteries like above where the random prizes for each lottery is drawn independently with the probabilities above, and the sum reward from two lotteries is to be paid to the decision maker. Would the agent choose this "bundled lottery" or a sure reward of 2 x $901 = $1802 ? As you see, when the risk is independently replicated, the agent is less risk averse against aggregate risk that is composed of many "idiosyncratic risks".

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Guen ux x2 Faces of lottery L delivers 2500 o l00 with equa... View full answer

Get step-by-step solutions from verified subject matter experts