Question: A2 fx G12 A 1 2 3 4 5 6 7 8 9 10 11 12 begin{tabular}{l} 13 hline 14 end{tabular} 14 15 16

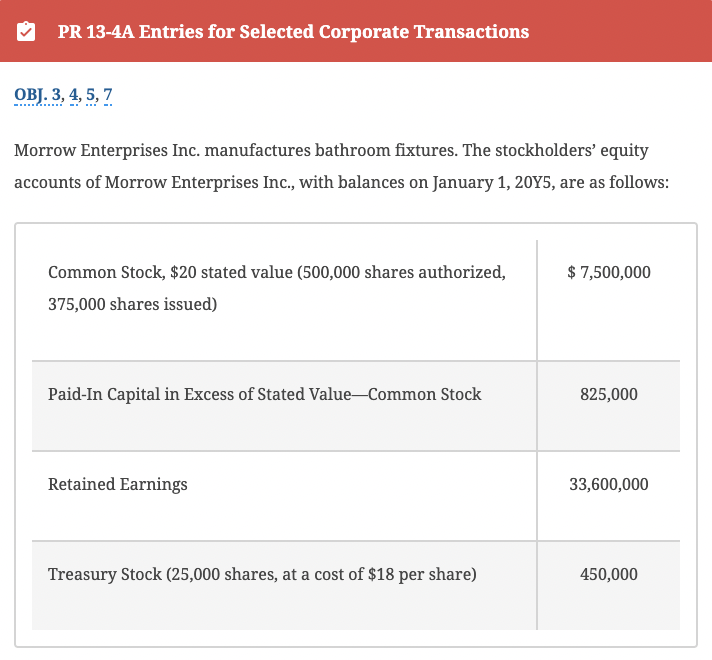

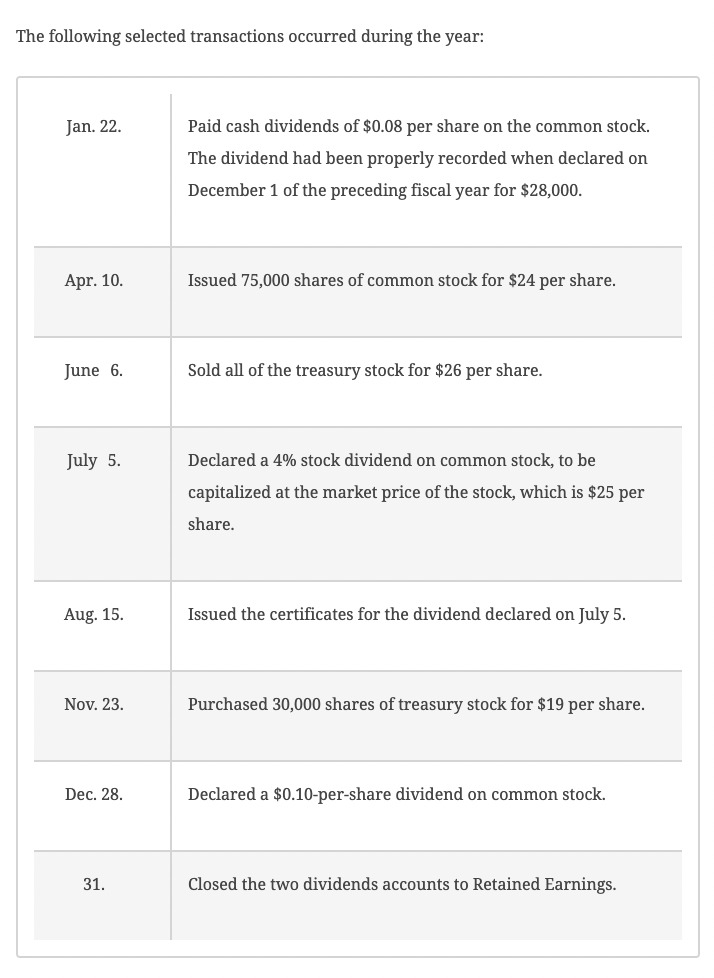

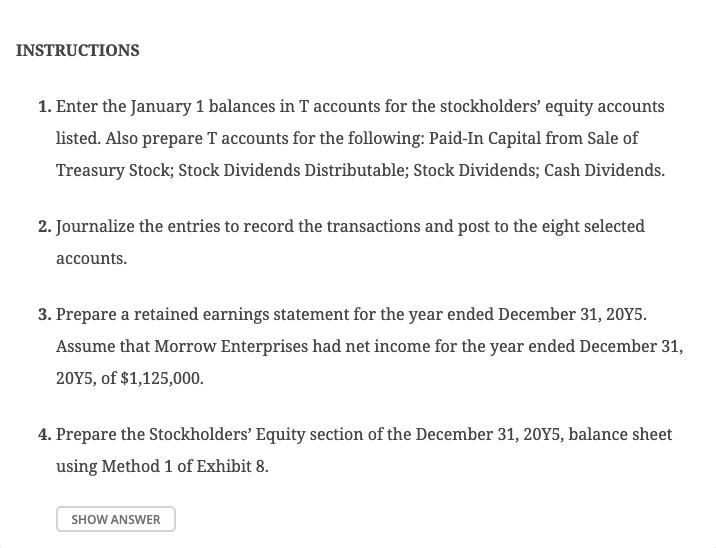

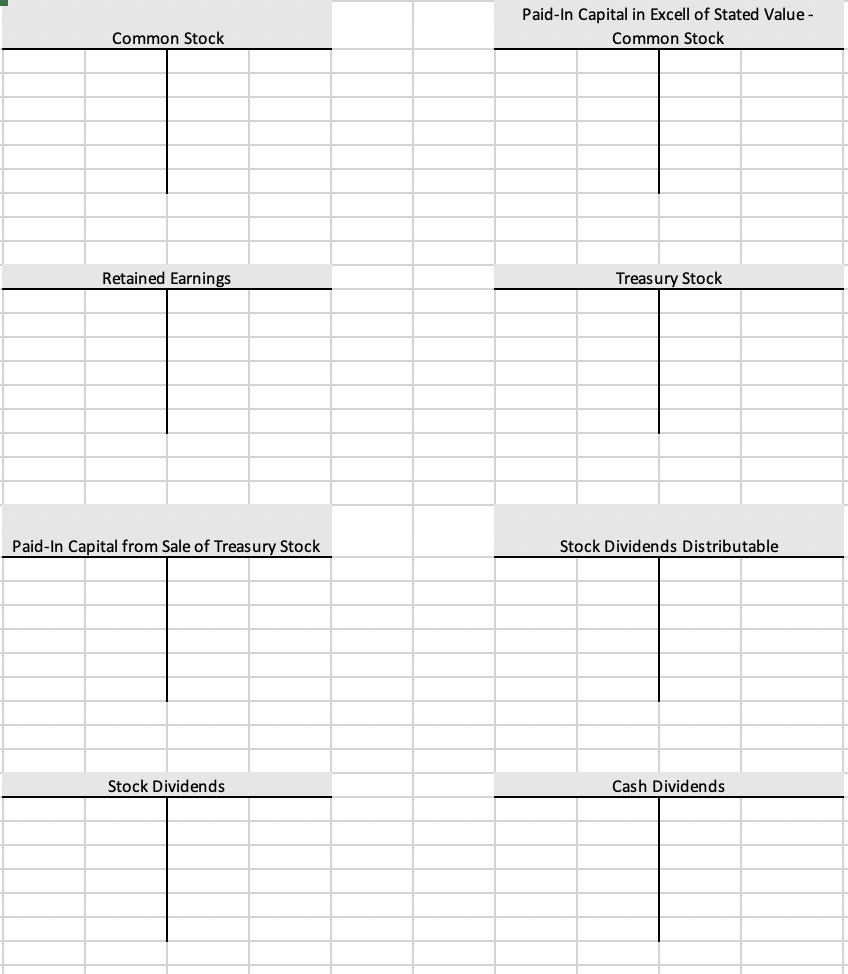

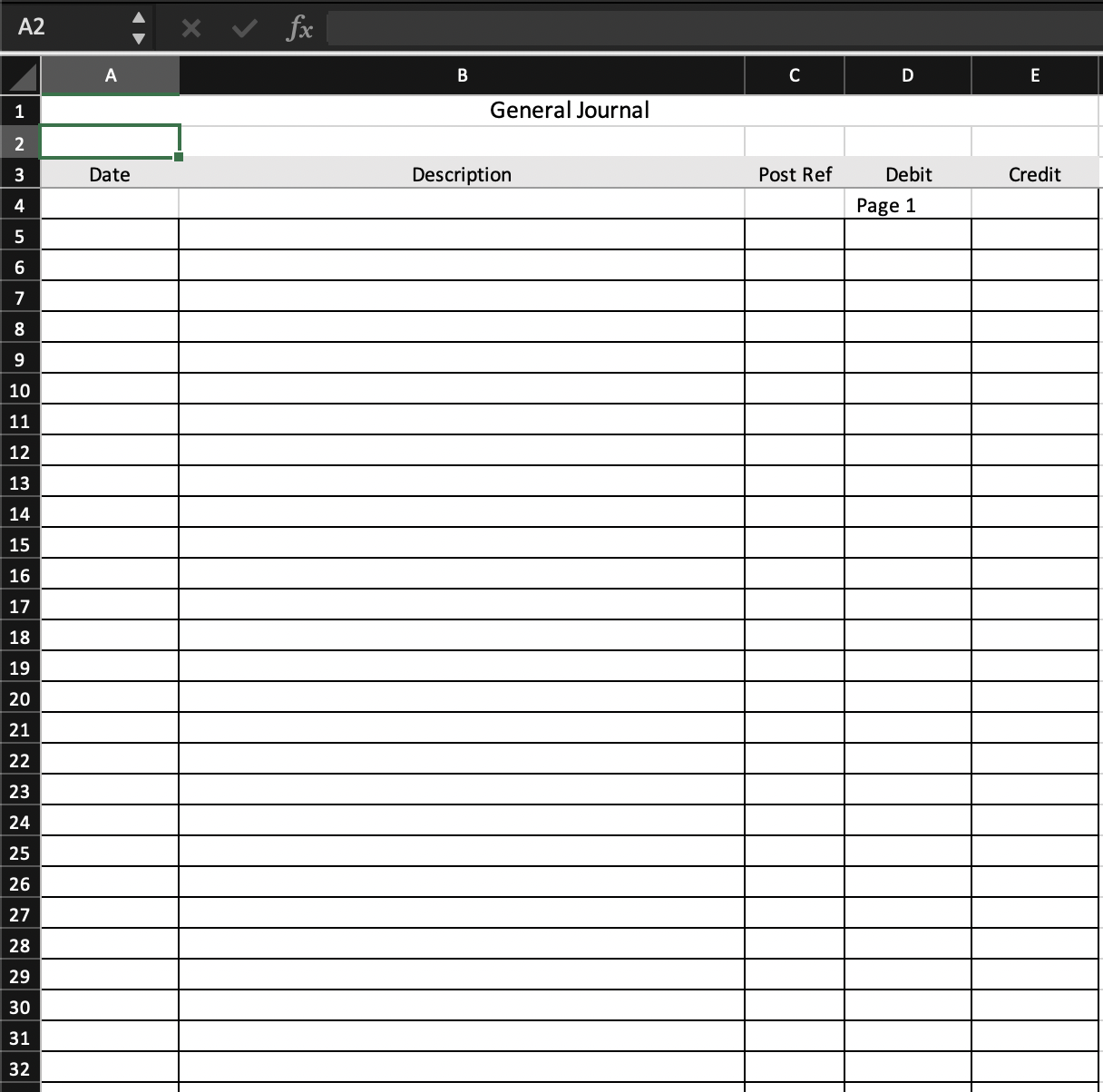

A2 fx G12 A 1 2 3 4 5 6 7 8 9 10 11 12 \begin{tabular}{l} 13 \\ \hline 14 \end{tabular} 14 15 16 17 18 \begin{tabular}{l} 19 \\ \hline 20 \end{tabular} 21 22 23 24 25 26 27 28 B C D Retained Earnings B3 A B C D 1 2 3 4 Stockholders' Equity 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Stockholders' Equity PR 13-4A Entries for Selected Corporate Transactions OBJ. 3, 4, 5,7 Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Morrow Enterprises Inc., with balances on January 1, 20Y5, are as follows: 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions and post to the eight selected accounts. 3. Prepare a retained earnings statement for the year ended December 31, 20YY. Assume that Morrow Enterprises had net income for the year ended December 31, 20Y5, of $1,125,000. 4. Prepare the Stockholders' Equity section of the December 31, 20Y5, balance sheet using Method 1 of Exhibit 8. The following selected transactions occurred during the year: A2 fx G12 A 1 2 3 4 5 6 7 8 9 10 11 12 \begin{tabular}{l} 13 \\ \hline 14 \end{tabular} 14 15 16 17 18 \begin{tabular}{l} 19 \\ \hline 20 \end{tabular} 21 22 23 24 25 26 27 28 B C D Retained Earnings B3 A B C D 1 2 3 4 Stockholders' Equity 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Stockholders' Equity PR 13-4A Entries for Selected Corporate Transactions OBJ. 3, 4, 5,7 Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Morrow Enterprises Inc., with balances on January 1, 20Y5, are as follows: 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions and post to the eight selected accounts. 3. Prepare a retained earnings statement for the year ended December 31, 20YY. Assume that Morrow Enterprises had net income for the year ended December 31, 20Y5, of $1,125,000. 4. Prepare the Stockholders' Equity section of the December 31, 20Y5, balance sheet using Method 1 of Exhibit 8. The following selected transactions occurred during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts