Question: a-2 must be completed. need correct answer. everything else is correct. Kumquat Farms Ltd. has decided to acquire a kumquat picking machine. The cost of

a-2 must be completed.

need correct answer.

everything else is correct.

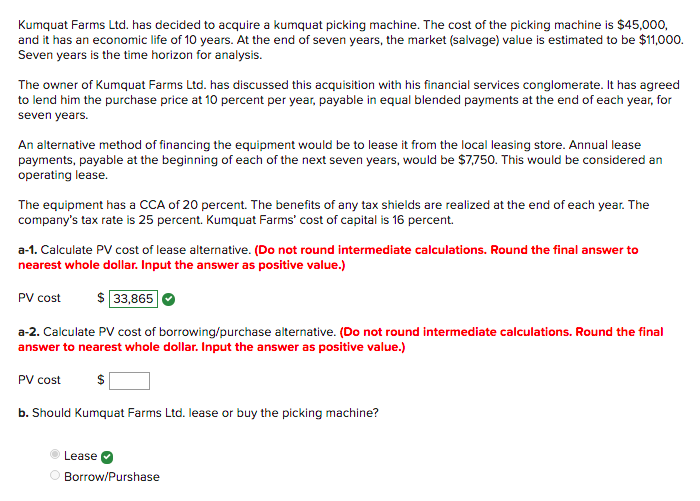

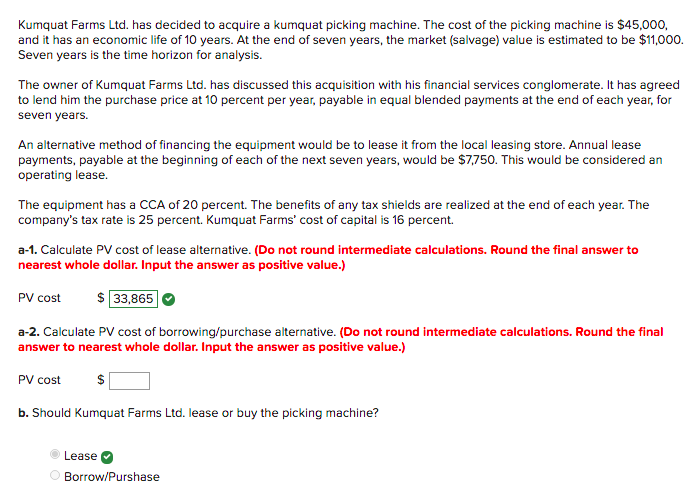

Kumquat Farms Ltd. has decided to acquire a kumquat picking machine. The cost of the picking machine is $45,000, and it has an economic life of 10 years. At the end of seven years, the market (salvage) value is estimated to be $11,000. Seven years is the time horizon for analysis. The owner of Kumquat Farms Lid. has discussed this acquisition with his financial services conglomerate. It has agreed to lend him the purchase price at 10 percent per year, payable in equal blended payments at the end of each year, for seven years. An alternative method of financing the equipment would be to lease it from the local leasing store. Annual lease payments, payable at the beginning of each of the next seven years, would be $7,750. This would be considered an operating lease. The equipment has a CCA of 20 percent. The benefits of any tax shields are realized at the end of each year. The company's tax rate is 25 percent. Kumquat Farms' cost of capital is 16 percent. a-1. Calculate PV cost of lease alternative. (Do not round intermediate calculations. Round the final answer to nearest whole dollar. Input the answer as positive value.) PV cost $ 33,865 a-2. Calculate PV cost of borrowing/purchase alternative. (Do not round intermediate calculations. Round the final answer to nearest whole dollar. Input the answer as positive value.) PV cost b. Should Kumquat Farms Ltd. lease or buy the picking machine? O Lease O Borrow/Purshase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts