Question: AA 02-03 Global Analysis LO A2 Key comparative figures for Apple, Google, and Samsung follow. In millions Total liabilities Total assets Samsung Current Year Prior

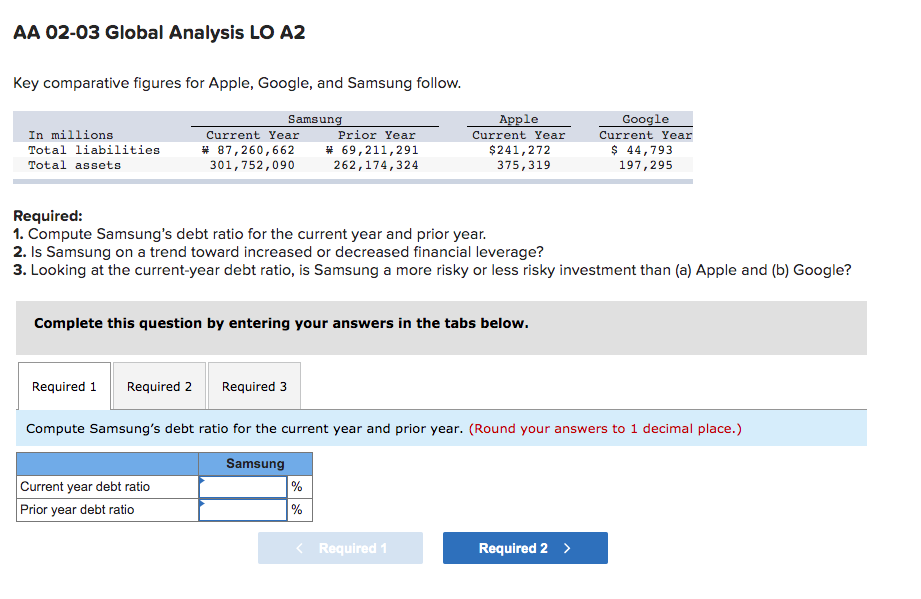

AA 02-03 Global Analysis LO A2 Key comparative figures for Apple, Google, and Samsung follow. In millions Total liabilities Total assets Samsung Current Year Prior Year # 87,260,662 # 69,211,291 301,752,090 262,174,324 Apple Current Year $241, 272 375, 319 Google Current Year $ 44,793 197,295 Required: 1. Compute Samsung's debt ratio for the current year and prior year. 2. Is Samsung on a trend toward increased or decreased financial leverage? 3. Looking at the current-year debt ratio, is Samsung a more risky or less risky investment than (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute Samsung's debt ratio for the current year and prior year. (Round your answers to 1 decimal place.) Samsung Current year debt ratio Prior year debt ratio %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts