Question: AA 12-2 Comparative Analysis LO A1 Key figures for Apple and Google follow. Apple $ millions Operating cash flows Total assets Current Year $

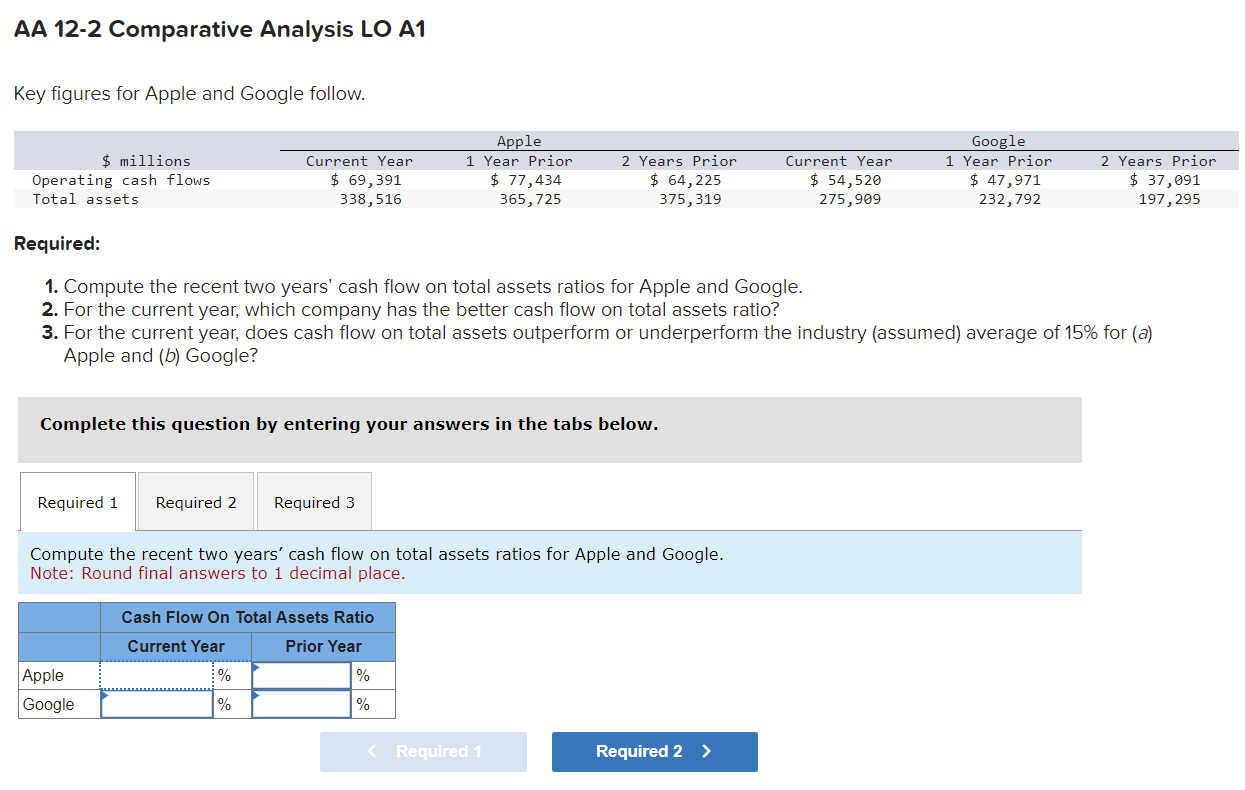

AA 12-2 Comparative Analysis LO A1 Key figures for Apple and Google follow. Apple $ millions Operating cash flows Total assets Current Year $ 69,391 338,516 1 Year Prior $ 77,434 365,725 2 Years Prior $ 64,225 375,319 Current Year $ 54,520 275,909 Required: Google 1 Year Prior $ 47,971 232,792 2 Years Prior $ 37,091 197,295 1. Compute the recent two years' cash flow on total assets ratios for Apple and Google. 2. For the current year, which company has the better cash flow on total assets ratio? 3. For the current year, does cash flow on total assets outperform or underperform the industry (assumed) average of 15% for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the recent two years' cash flow on total assets ratios for Apple and Google. Note: Round final answers to 1 decimal place. Cash Flow On Total Assets Ratio Current Year Apple Google Prior Year % % % % Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts