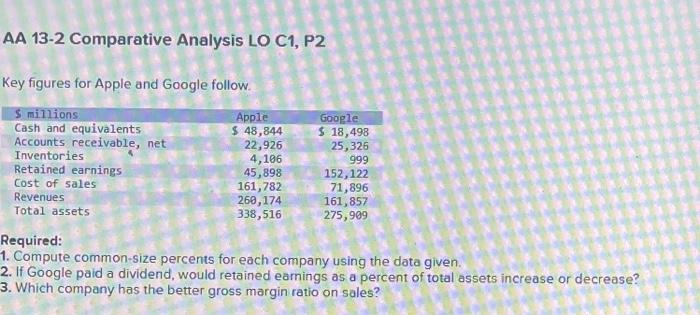

Question: AA 13-2 Comparative Analysis LO C1, P2 Key figures for Apple and Google follow. Si millions Apple Google Cash and equivalents $ 48,844 $ 18,498

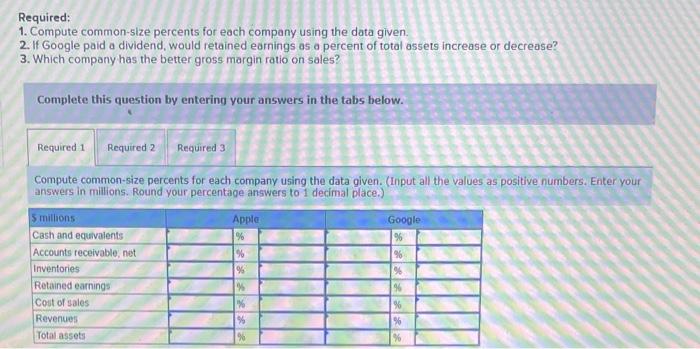

AA 13-2 Comparative Analysis LO C1, P2 Key figures for Apple and Google follow. Si millions Apple Google Cash and equivalents $ 48,844 $ 18,498 Accounts receivable, net 22,926 25,326 Inventories 4,106 999 Retained earnings 45,898 152,122 Cost of sales 161,782 71,896 Revenues 260,174 161,857 Total assets 338,516 275,999 Required: 1. Compute common-size percents for each company using the data given. 2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has the better gross margin ratio on sales? Required: 1. Compute common-size percents for each company using the data given 2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has the better gross margin ratio on sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute common-size percents for each company using the data given. (Input all the values as positive numbers. Enter your answers in millions. Round your percentage answers to 1 decimal place.) Apple % 5 millions Cash and equivalents Accounts receivable, net Inventories Retained earnings Cost of sales Revenues Total assets % 9 % % 96 % Google % % % % % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts