Question: ABC Trust, QTIP Trust: Please help me calculate this! These are question parts a-e: (a) Show the value of S1s estate. (b) Show the value

ABC Trust, QTIP Trust:

Please help me calculate this!

These are question parts a-e:

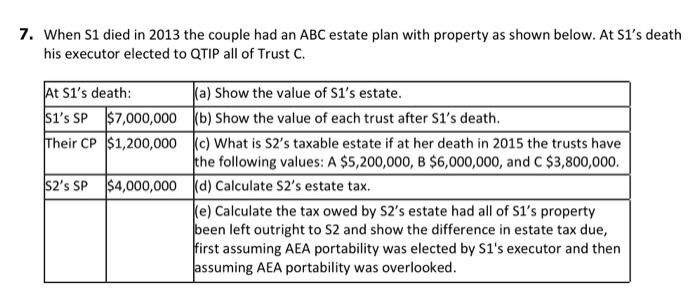

(a) Show the value of S1s estate.

(b) Show the value of each trust after S1s death.

(c) What is S2s taxable estate if at her death in 2015 the trusts have the following values: A $5,200,000, B $6,000,000, and C $3,800,000.

(d) Calculate S2s estate tax.

(e) Calculate the tax owed by S2s estate had all of S1s property been left outright to S2 and show the difference in estate tax due, first assuming AEA portability was elected by S1's executor and then assuming AEA portability was overlooked.

*SP means separate property

*CP means community property

The first 2 columns show the values in community property and separate property. The last column is the question: part a-e.

7. When S1 died in 2013 the couple had an ABC estate plan with property as shown below. At S1's death his executor elected to QTIP all of Trust C. At Si's death: (a) Show the value of Si's estate. Si's SP $7,000,000 b) Show the value of each trust after Si's death. Their CP $1,200,000 c) What is S2's taxable estate if at her death in 2015 the trusts have the following values: A $5,200,000, B $6,000,000, and C $3,800,000. $2's SP $4,000,000 (d) Calculate S2's estate tax. (e) Calculate the tax owed by S2's estate had all of Si's property been left outright to S2 and show the difference in estate tax due, first assuming AEA portability was elected by S1's executor and then assuming AEA portability was overlooked. 7. When S1 died in 2013 the couple had an ABC estate plan with property as shown below. At S1's death his executor elected to QTIP all of Trust C. At Si's death: (a) Show the value of Si's estate. Si's SP $7,000,000 b) Show the value of each trust after Si's death. Their CP $1,200,000 c) What is S2's taxable estate if at her death in 2015 the trusts have the following values: A $5,200,000, B $6,000,000, and C $3,800,000. $2's SP $4,000,000 (d) Calculate S2's estate tax. (e) Calculate the tax owed by S2's estate had all of Si's property been left outright to S2 and show the difference in estate tax due, first assuming AEA portability was elected by S1's executor and then assuming AEA portability was overlooked

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts