Question: . 3. Consider Mean-Variance analysis to construct the optimal portfolio. The relevant sample statistics are summarized in the table below and an investor i's utility

.

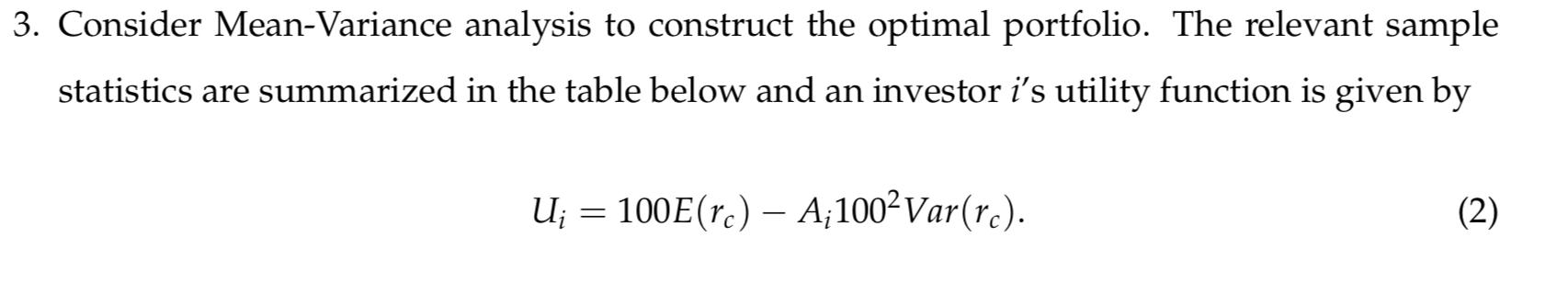

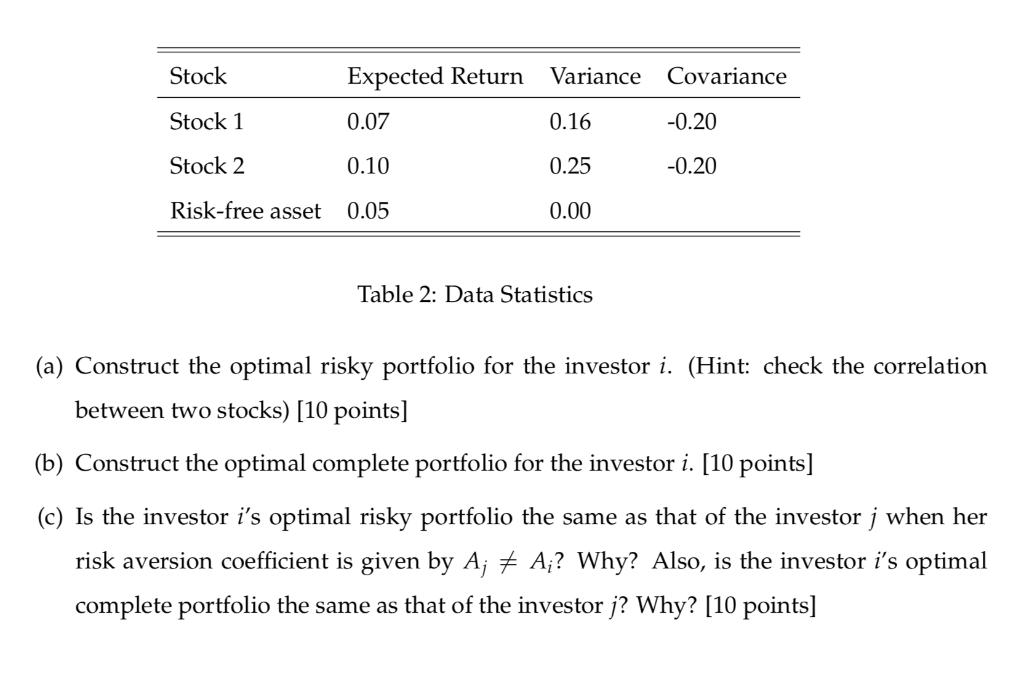

3. Consider Mean-Variance analysis to construct the optimal portfolio. The relevant sample statistics are summarized in the table below and an investor i's utility function is given by U; = 100E(r.) A;100Var(r.). (2)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Please see the answer as attachment 3 r 020 025 xr016 020 5804 02FI var ro 104w05W2 O 3 ay Wit propo... View full answer

Get step-by-step solutions from verified subject matter experts