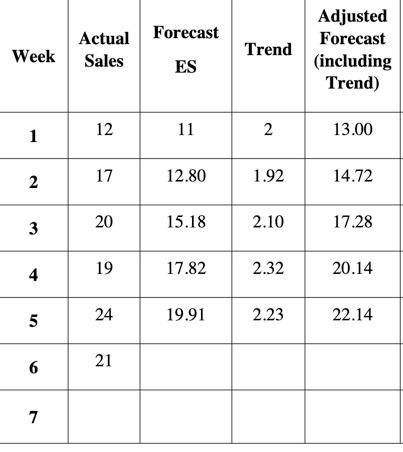

Question: Actual sales and initial forecasts are given below. Your company is using alpha of 0.2and beta of 0.4for an adjusted exponential smoothing including trend model.Currently

Actual sales and initial forecasts are given below. Your company is using alpha of 0.2and beta of 0.4for an adjusted exponential smoothing including trend model.Currently you have been asked to determine if the existing adjusted exponential smoothing including trend model should be used ora 3 period weightedmoving average(use 0.5, 0.3, 0.2). a)Calculate the forecast for week 6 and 7using both methods.[8 points]b)Using quantitative reasoning,which method would you recommend and why? [3points]Use the table below as you need to answer the questions above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock