Question: al 0 Required 1. How much joint costs per batch should be allocated to turpentine and to methanol, assuming that joint costs are allocated based

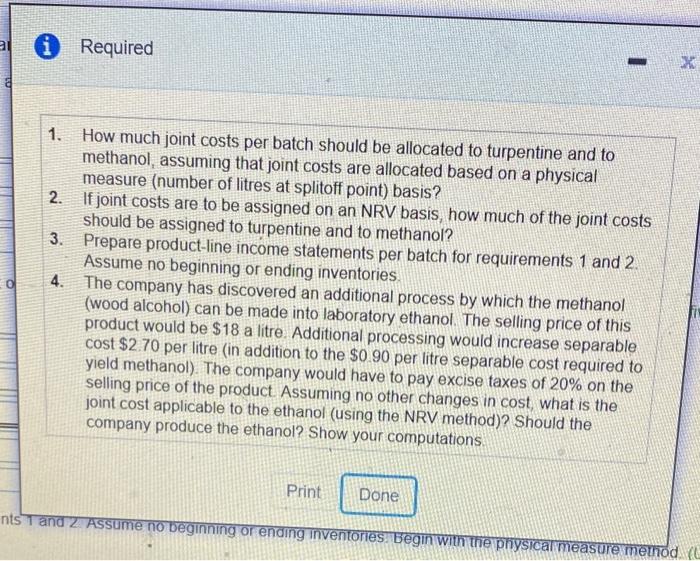

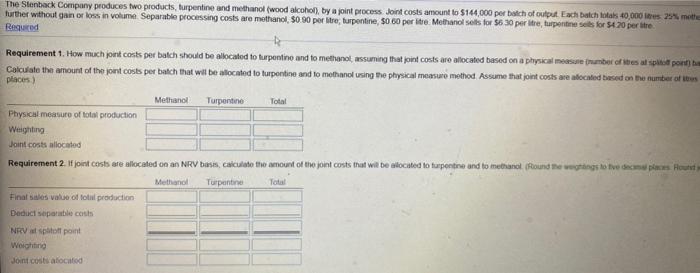

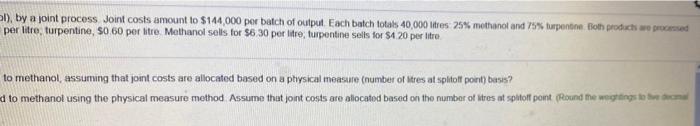

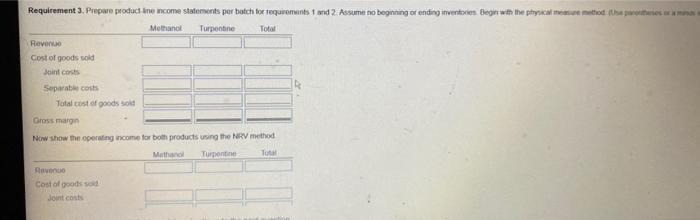

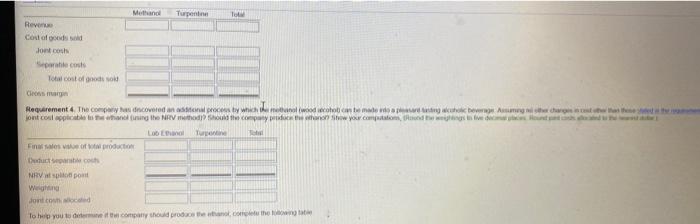

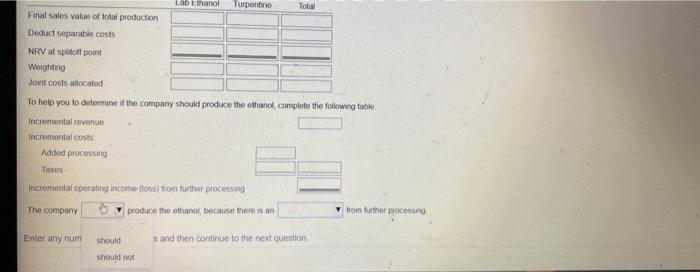

al 0 Required 1. How much joint costs per batch should be allocated to turpentine and to methanol, assuming that joint costs are allocated based on a physical measure (number of litres at splitoff point) basis? 2. If joint costs are to be assigned on an NRV basis, how much of the joint costs should be assigned to turpentine and to methanol? 3. Prepare product-line income statements per batch for requirements 1 and 2. Assume no beginning or ending inventories 4. The company has discovered an additional process by which the methanol (wood alcohol) can be made into laboratory ethanol. The selling price of this product would be $18 a litre. Additional processing would increase separable cost $2 70 per litre (in addition to the $0.90 per litre separable cost required to yield methanol). The company would have to pay excise taxes of 20% on the selling price of the product. Assuming no other changes in cost what is the joint cost applicable to the ethanol (using the NRV method)? Should the company produce the ethanol? Show your computations Print Done nts Tand 2 Assume no beginning or ending inventories. Begin with the physical measure medd. (L The Stonback Company produces two products, turpentine and methanol wood alcohol), by a joint process Joint costs amount to $144,000 per batch of output. Each batch totals 40,000 es 25 mette further without gain or loss in volume. Separable processing costs are methanol 50 90 por litre, turpentine, 50 60 per lite Methanol sols for $630 per litre, turpentine sells for $4 20 per litre Resumed Requirement 1. How much joint costs per batch should be allocated to turpentine and to methanol assuming that joint costs are allocated based on a physical measure trumber of es al sito por Calculate the amount of the joint costs per batch that will be allocated to turpentine and to mothanol using the physical measure method. Assume that joint costs are allocated besed on the number of ons places) Methanol Turpentino Physical measure of total production Weighting Joint costs allocated Total Requirement 2. If joint costs are allocated on an NRV basis, calculate the amount of the joint costs that will be allocated to turpentine and to methanol (Round the wings to the decades Hot Methanol Turpentine Total Final sales value of total production Deduci separate costs NRV split point Weighting Joint costs about Requirement 3. Prepare product ano ncome statements per botch toe tequirements 1 and 2 Assume no beginning or ending inventories Begins why the physical measure method (beste wanna Turpeine Methanol Total Revono Cost of goods sold Sint costs Separate costs Total cost of goods sold Grossmag Now show the operating come for both products using the NRV method Methanol Turpentine Total Ravn Cost of goods sod Joint costs Muthand Turpentine To Reven Cost of Jont costs Separatie costs Total cost of not Com Requirement 4. The company covered in a proces by which menol wood choleste mode de the cost jontcoul applicable than using the NRV hodhi the company and the anon Sow youw.componentes Loo Tube Finales of product to NRVW poput Weg Jor To help you to company should protect the LOO Lanol Turpentino Total Final sales value of total production Deduct separable costs NRV at spildot point Weighting Joint costs allocated To help you to determine if the company should produce the othanol, complete the following table Incremental revenue Incremental costs Added processing Taxes incremental operating income oss) from further processing The company o produce the offrono, because there is an trom further proces Enter any num s and then continue to the next question should should not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts