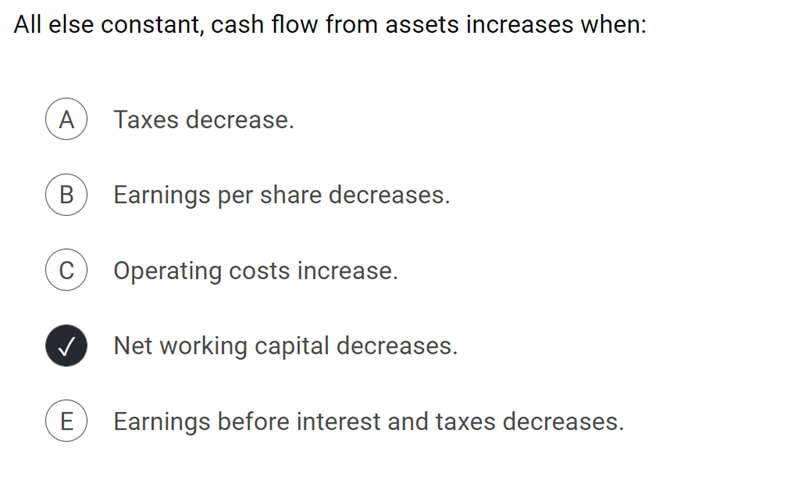

Question: All else constant, cash ow from assets increases when: Taxes decrease. Earnings per share decreases. Operating costs increase. Net working capital decreases. Earnings before interest

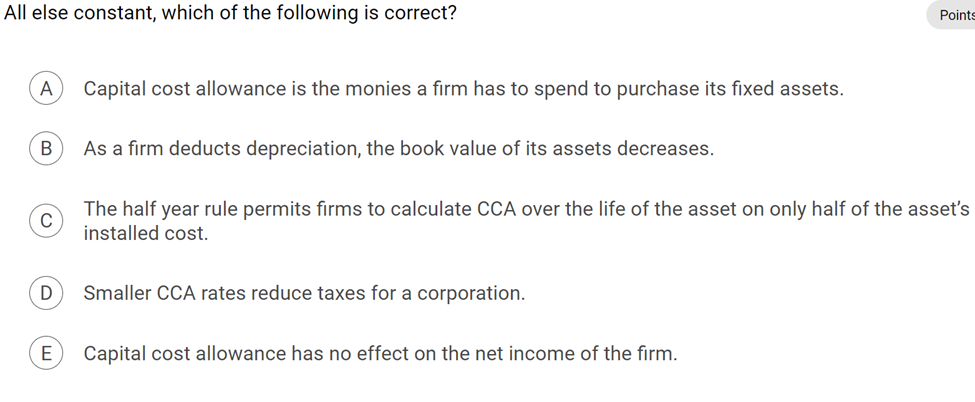

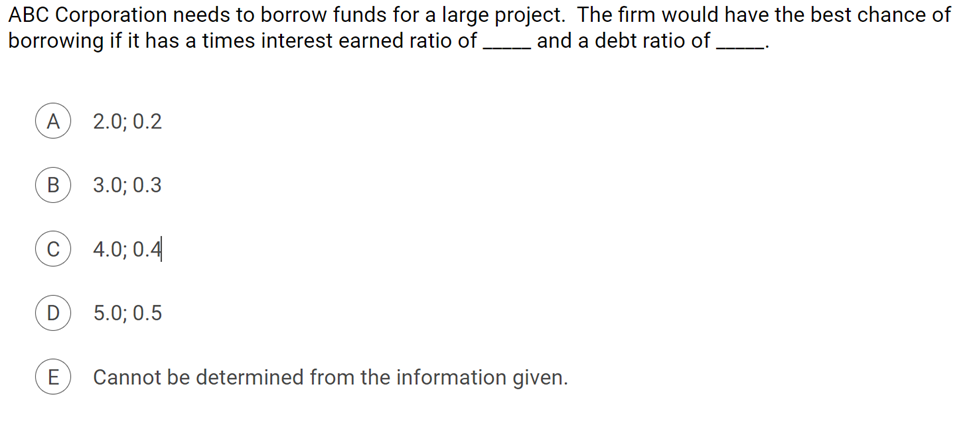

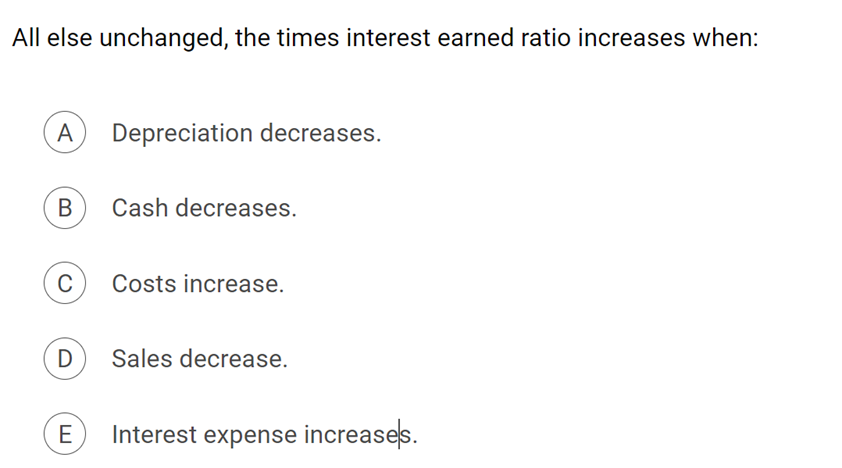

All else constant, cash ow from assets increases when: Taxes decrease. Earnings per share decreases. Operating costs increase. Net working capital decreases. Earnings before interest and taxes decreases. 9@ All else constant. which of the following is correct? mm Capital cost allowance is the monies a rm has to spend to purchase its fixed assets. @969 As a rm deducts depreciation, the book value of its assets decreases. The half year rule permits rms to calculate CCA over the life of the asset on only half of the asset's installed cost. @ Smaller CCA rates reduce taxes for a corporation. @GD Capital cost allowance has no effect on the net income of the rm. ABC Corporation needs to borrow funds for a large project. The rm would have the best chance of borrowing if it has a times interest earned ratio of _____ and a debt ratio of _. 2.0; 0.2 3.0; 0.3 4.0; 0.4 5.0; 0.5 @@@ Cannot be determined from the information given. All else unchanged, the times interest earned ratio increases when: A Depreciation decreases. B Cash decreases. C Costs increase. D Sales decrease. E Interest expense increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts