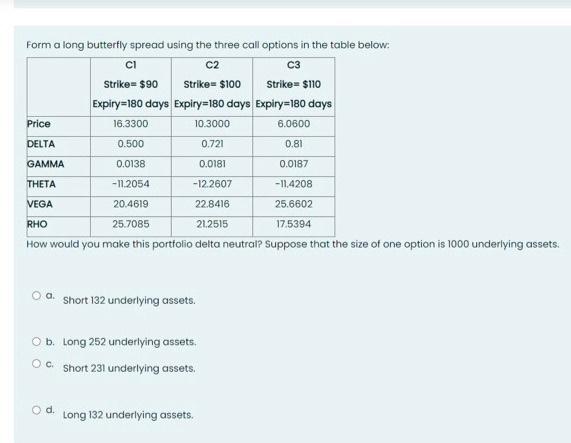

Question: how can I solve Form a long butterfly spread using the three call options in the table below: C2 c Strike= $90 Strike= $100 Strike=

Form a long butterfly spread using the three call options in the table below: C2 c Strike= $90 Strike= $100 Strike= $110 Expiry=180 days Expiry=180 days Expiry=180 days Price 16.3300 10.3000 6.0600 DELTA 0.500 0.721 0.81 GAMMA 0.0138 0.0181 0.0187 THETA - 11.2054 -12.2607 -11,4208 VEGA 20.4619 22.8416 25.6602 RHO 25.7085 212515 17.5394 How would you make this portfolio delta neutral Suppose that the size of one option is 1000 underlying assets. a short 132 underlying assets. O b. Long 252 underlying assets. OC Short 231 underlying assets. O d. Long 132 underlying assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts