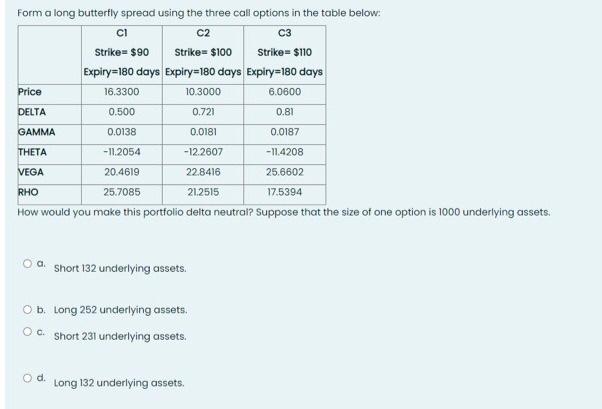

Question: Form a long butterfly spread using the three call options in the table below: CI C2 C3 Strike= $90 Strike= $100 Strike= $110 Expiry=180 days

Form a long butterfly spread using the three call options in the table below: CI C2 C3 Strike= $90 Strike= $100 Strike= $110 Expiry=180 days Expiry=180 days Expiry=180 days Price 16.3300 10.3000 6.0600 DELTA 0.500 0.721 0.81 GAMMA 0.0138 0.0181 0.0187 THETA - 11.2054 -12.2607 -11.4208 VEGA 20.4619 22.8416 25.6602 RHO 25.7085 21.2515 17.5394 How would you make this portfolio delta neutral Suppose that the size of one option is 1000 underlying assets. Short 132 underlying assets. Ob. Long 252 underlying assets. OC Short 231 underlying assets. Od. Long 132 underlying assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts