Question: Answer in type written please. - Q. No. 3 - X Ltd. owns all of the shares of Y Ltd. The shares of Y have

Answer in type written please.

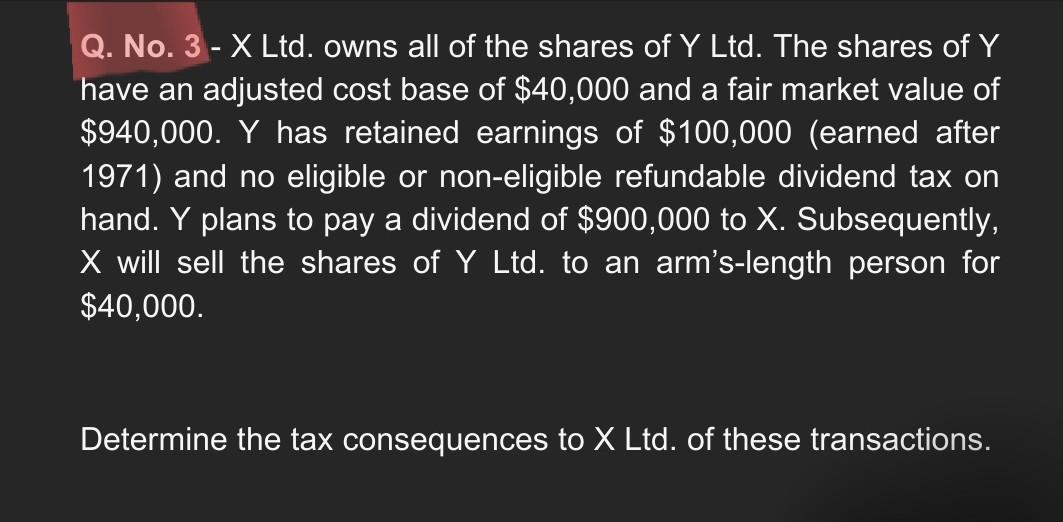

- Q. No. 3 - X Ltd. owns all of the shares of Y Ltd. The shares of Y have an adjusted cost base of $40,000 and a fair market value of $940,000. Y has retained earnings of $100,000 (earned after 1971) and no eligible or non-eligible refundable dividend tax on hand. Y plans to pay a dividend of $900,000 to X. Subsequently, X will sell the shares of Y Ltd. to an arm's-length person for $40,000. Determine the tax consequences to X Ltd. of these transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts